Quantifying the benefits of a transition to digital payments for frontline healthcare workers

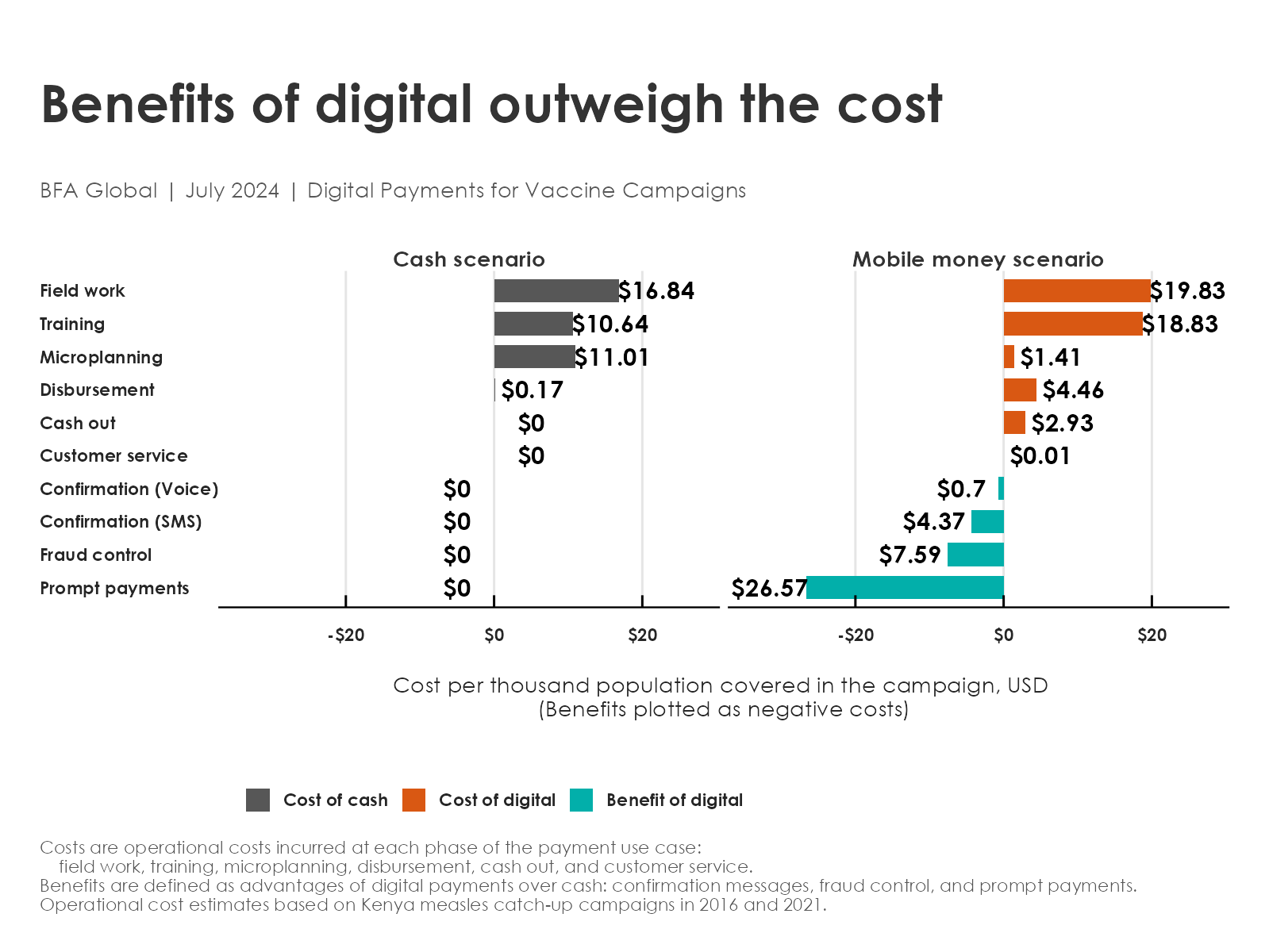

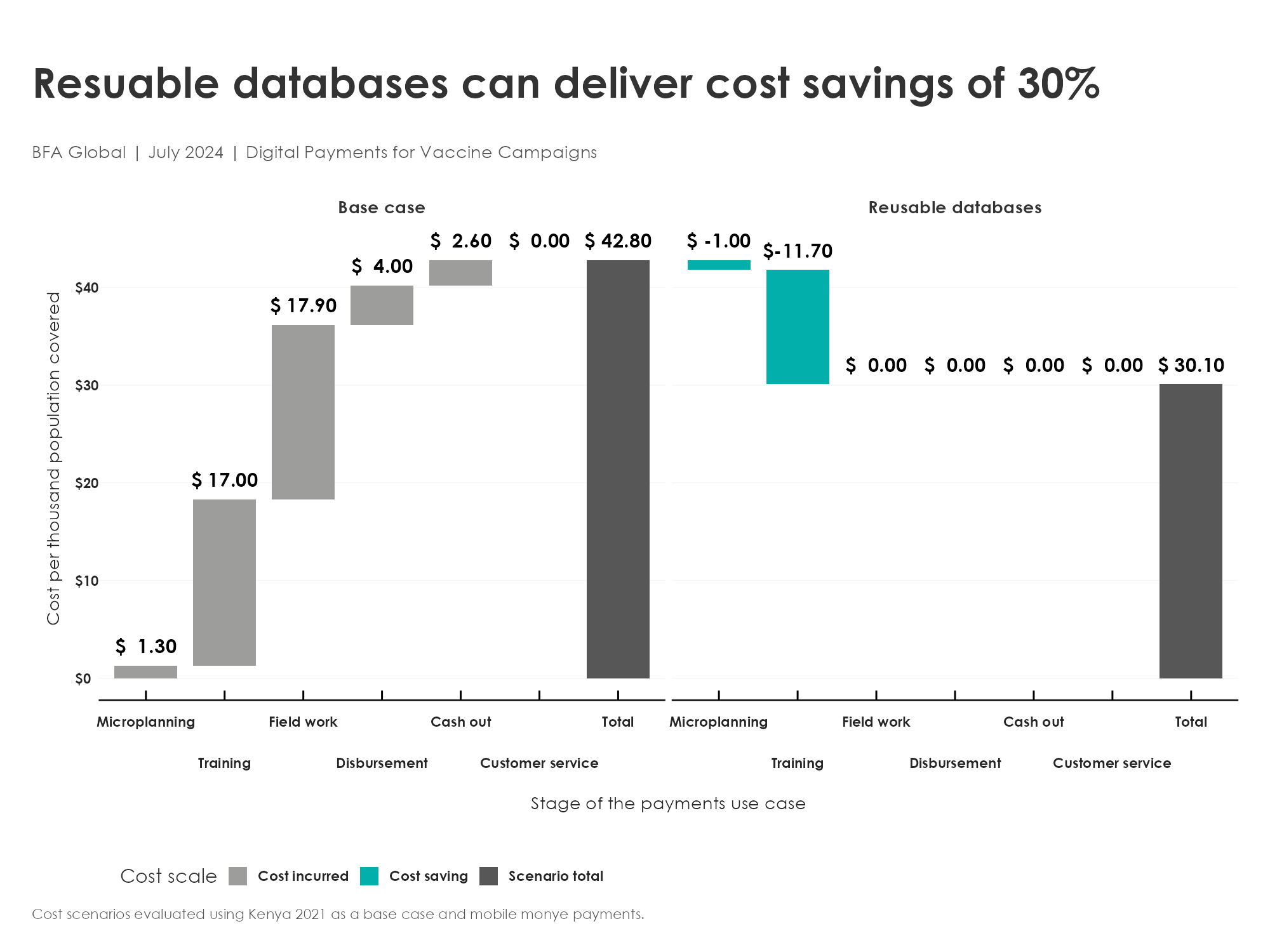

The benefits of digital payments vis-à-vis cash are well known: timely disbursement, payment confirmations, and risk controls for both payer and recipient. Using a combination of research methods, we modeled the benefits of a transition to digital payments. Our financial model covered every phase of the campaign (planning, training, field work, disbursement, cash-out). We estimated the operational costs associated with payments: all staff time and fees-related payments, such as budgeting, approving payments, managing funds, cash logistics, disbursement, accounting, and payment fees. We also estimated the benefits commonly associated with digital payments: prompt and accurate disbursement with confirmations. The digital transition incurs a modest increase in the cost of payments beyond what cash costs (20%), but yields much greater benefits (87%), over half of which accrue to workers. Although the reduction in expenditures on cash logistics alone is not sufficient to offset the cost of payments, the benefits realized are far greater than the associated costs.

Digital payments have expanded rapidly in the past decade. Yet some vaccine campaigns continue to distribute wages and stipends in cash, despite the cost and risk associated with cash logistics. Public sector organizations should have an opportunity to lead the digital transition in payments. They have centralized finance offices and large workforces, with thousands of clinical officers, nurses, physicians, and administrative personnel. Vaccine campaigns (or supplemental immunization activities) require salaries for permanent staff and stipends so that staff can afford expenditures for temporary operations.

Over time, the uptake of digital payments has expanded, and so has the acceptance of digital payments at the point of sale. Consider the four countries that we studied for the vaccine campaigns project: Burkina Faso, Ethiopia, Kenya, and Nigeria. Whereas 10 years ago, only in Kenya had a majority of adults made and received digital wage payments, by 2021, we see much progress. Less than half of wage earners reported earning wages exclusively in cash. This points to a sea change in the use of bank accounts, mobile money, and other financial institutions.

The benefits of digital payments vis-à-vis cash are well known.

- Timely disbursement

- Confirmation of disbursement

- Improved risk controls — for both sender and recipient, while balances are in transit and after they are received.

Each of these aspects (timeliness, record keeping, and risk controls) can be assessed from the perspective of the campaign and the recipient. The value of timeliness to the recipient is important and often overlooked. Workers generally prefer to have their stipends paid into an account, rather than in cash. In our survey of healthcare workers in Ethiopia, 77% preferred bank payments or mobile money to cash.

We used a multi-country study of polio workers to estimate the value of prompt payments. That study found that workers in Liberia and Republic of Congo not only prefer digital payments (80% of respondents), but also showed that timeliness is a key reason why. The study asked whether each worker would accept a lower payment than what they were due, if the payment came sooner. About half of workers would prefer to have a payment that is 40% less than what they were owed, if it would only come sooner (within ten days, rather than 30 days). For the median worker, a timely payment is worth 40% more — in dollar terms. This matches what economic theory tells us about high discount rates for the poor: they can’t afford to wait.

The second benefit, payment confirmations, effectively come for free with most digital payment methods. Digital payments provide independent confirmation of clearing, with messages to both parties and often with accounting reports for senders. Cash payments do not. Instead, cash controls frequently consist of a simple signature for receipt, which cannot be independently verified.

To measure the value of these payment confirmations, we replicated the confirmation process manually in Ethiopia. We paid local health posts to contact their frontline healthcare workers using a combination of SMS messages and telephone calls. This confirmation process was ineffective (success rate of 68%) and costly (14 days of staff effort per 1,000 payments). The payment confirmation messages that we take for granted with digital payments are valuable.

Finally, we needed some information about the risks associated with cash logistics. Key informant interviews corroborate that finance and administration staff prefer digital disbursement. One business lead in East Africa was extremely proud that their team could provide daily reporting on the status of disbursement rather than semimonthly. Generally, staff are held accountable for cash entrusted to them, and this can be stressful in environments with security challenges.

Quantifying the risks associated with disbursement of cash was not possible as informants were not authorized to disclose to us any internal estimates of the rate of cash losses due to fraud or theft. Although preventing cash losses is an important source of value in our model, it is both highly uncertain (it isn’t possible to measure with the tools available) and also not the largest source of embedded value.

Putting it all together, we were able to estimate the costs and benefits of a transition to digital payments that accounted for operations at each phase of the campaign (planning, training, field work, disbursement, cash-out) and also the main benefits of digital payments as compared to cash (payment confirmations, fraud control, and prompt payments). Seen in that light, digital payments represent a modest outlay in terms of cost incurred (20%) in exchange for much greater benefits to both payer and recipient (87%).

Return to the executive summary

This material was prepared for the Bill & Melinda Gates Foundation. The findings and conclusions contained within are those of the authors and do not necessarily reflect the positions or policies of the Bill & Melinda Gates Foundation.