Robbing Peter to lend to Paul

Our friends at MicroSave Consulting recently published a detailed, timely study on the state of digital credit in Kenya. It is chock full of great information, including lots of data, and we encourage you to dig into it in detail.

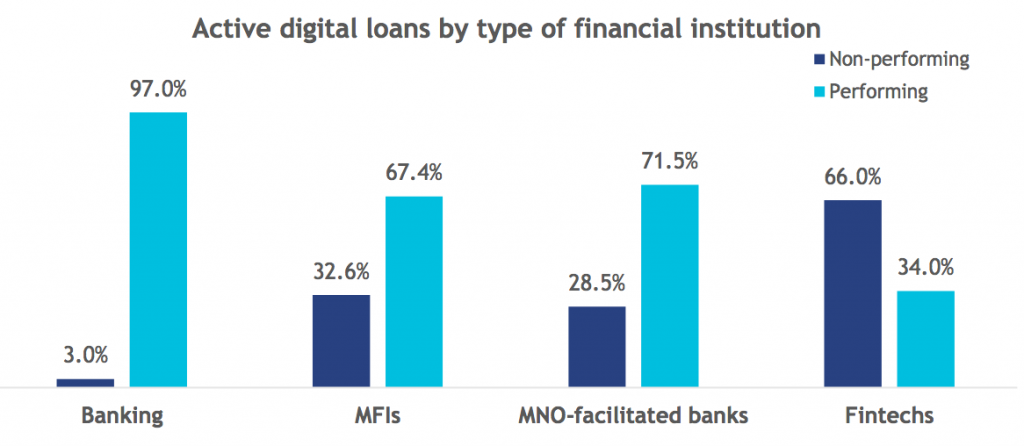

One particular theme caught our eye — the relative portfolio-level performance of the various types of digital credit providers — banks, MFIs, bank-MNO hybrids, and fintechs. We note the following:

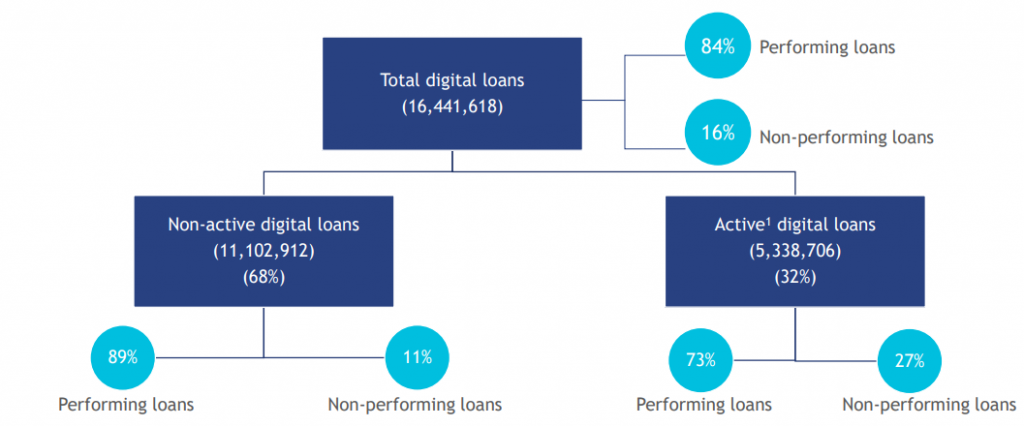

- Non-performing loans (NPLs) for active digital credit is 27%. 16% of all digital credit given out between 2016 and 2018 are non-performing. This includes active and non-active loans, and all four types of providers. That figure is 27% for active loans only! Having worked extensively with financial service providers (FSPs) serving mass markets around the world, we know that those at the helm get quite worried when NPL inches toward 10%, and the relevant regulatory authorities start considering major interventions if it gets close to 20%. NPLs of 27%, in comparison, seems seems shockingly high.

- NPLs for active digital credit from Fintechs is 66%. That’s correct — for every digital credit given out by fintechs that is not non-performing (as opposed to “current”), there are two that are! (Hence the title of this post…) These astronomical levels of non-performance truly boggle the mind. In comparison, NPL levels at MFIs and bank-MNO hybrids are half as bad at around 30%, and banks come in at 3%.

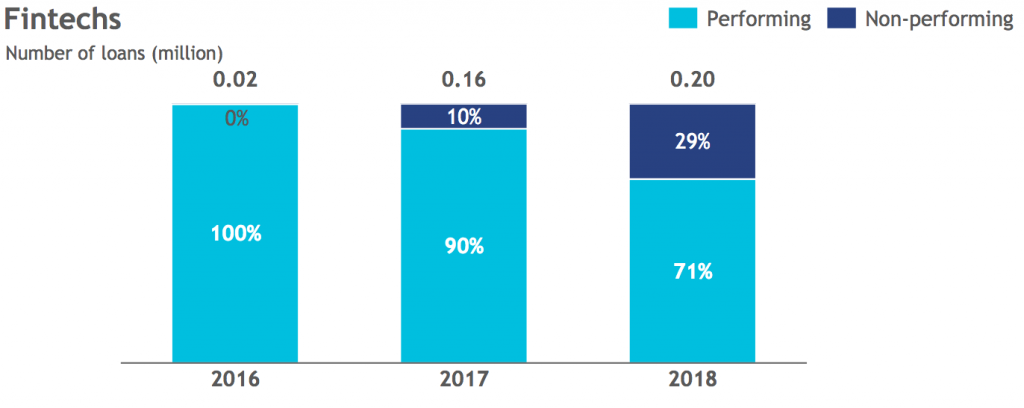

- It’s getting worse. NPL levels were at 0% in 2016, 10% in 2017, and 29% in 2018. This trend is largely due to the fact that fintech digital credit portfolios have only started out or expanded significantly in recent years, and it takes time for NPLs to show up on the books. Nevertheless, the trend is certainly worrisome, as our experience suggests that vintage analysis would show that the “steady-state” NPL would be quite a bit north of 29%.

How could a financial institution stay in business if 66% of the loans that are expected to be repaid within a month are actually more than 90 days late? Turns out, there are some redeeming characteristics of this Wild Wild West of digital credit.

First, 81% of borrowers pay back their balance eventually, while 19% remain non-performing (slide 25). With 19 out of every 100 short-term loans having outstanding balances, one can almost start sympathizing with a 15% monthly interest rate that the likes of Tala must charge to stay in business…

Second, the balance on non-performing credit is lower than the portfolio average — about two-thirds of the 27% active NPLs have an outstanding balance of US$2 or less (slide 27). For comparison, digital credit is usually in the KES 1–500 range. This certainly dilutes the impact of the number of NPLs on the overall portfolio.

Finally, a lot of the smaller loans are taken by first-time clients who are testing out the product and don’t bother paying back if they don’t like the service (slide 27). Though it does have the effect of getting millions stuck in Credit Bureau purgatory.

While these factors mitigate some of the severity conveyed by the figures above, the fact remains that the health of the digital credit portfolios of fintechs is quite sub-par compared to those of other digital lenders.

With that in mind, we offer three thoughts.

Whither the fintech creditworthiness secret sauce? Weren’t the client’s smartphone usage patterns and associated alternative credit data supposed to provide some special juju that would allow providers to quantify uncertainty around creditworthiness for thin-file clients, and thereby provide sustainable risk-adjusted credit to them?

NPL levels an order of magnitude higher than traditional FSPs makes one wonder if the additional 10% of digital credit footprint (slide 15) is worth it. Allowing for borrowing from multiple types of digital lenders, the actual increase in footprint is probably quite smaller than 10% also.

Socializing costs at Internet speeds? With one out of three clients paying back within 90 days in the short-term, and four out of five clients paying back eventually, this is a clear instance of cross-subsidization where those who are making regular repayments on these short-long loans are making up for the non-payment by others and keeping the digital lenders afloat. A charge of up to 15% a month is not a trivial amount by any stretch of the imagination. Do the quality of life improvements associated with making immediate small-ticket credit available to the digitally connected justify the significant degree of cross-subsidization that the fintech-led digital lending business case seems to require?

And irrespective of the positive externalities, is it even fair to spread out the risk of one bad Paul on only four good Peters, when banks serving the low-income or mass-market typically have NPLs in the single digits, and rotating savings and credit associations (ROSCAs) spread out the risk of one amongst twenty to forty of his or her peers?

A pop in time saves nine? Granted, the number and size of digital loans are not large enough to be of systemic risk to the Kenyan inclusive credit market, but fintechs focused on digital lending continue to raise significant amounts of venture funds, and these hype-y things have a way of getting carried away with themselves and becoming a bona fide bubble.

The microcredit sector responded too late. The PayGo sector is going through a period of soul-searching, and will hopefully be able to “right-size” itself. Perhaps it would be wise for fintechs in particular, and all digital credit suppliers in general, to take note, pop the baby bubble that we fear is emerging, and bring discipline to digital credit operations. After all, borrowers will readily queue up to take on easy credit, and venture capital cannot but help to fuel fires in the face of potentially astronomical returns. And nothing suggests that this time will be different.

Given the increasingly digital nature of the globe, fintechs have been a major driving force behind innovation in the inclusive finance space. We hope fintechs involved with digital credit in Kenya are able to get their houses in order before there is large-scale negative impact to the consumer, the credit marketplace is significantly distorted, and regulators engage in reactive responses that mess up the sandbox for everyone.