Toolkit assists government agencies to design AML/CFT SupTech roadmaps

The capacity to adopt Supervisory technology (SupTech) solutions varies widely. Anti-money laundering and combating of financing of terrorism (AML/CFT) supervisory authorities, and Financial Intelligence Units (FIUs) all have different capacities, leaving vulnerabilities in the international AML/CFT framework.

Some agencies like AUSTRAC, the Australian AML/CFT regulator and FIU, develop their own SupTech and incorporate AI solutions. Other agencies use solutions like the United Nation’s GoAML suite, while others prefer outsourcing the development of new applications to tech vendors. A survey by the RegTech for Regulators Accelerator (R2A) has identified authorities that are still receiving data from reporting institutions by courier, mail, or email or via insecure data portals.

The lack of consistency in supervisory capabilities adds to the vulnerability of the global AML/CFT framework. An estimated $2.4 trillion in proceeds from criminal activities are laundered through the world’s financial markets and banking systems every year – and globally less than 1% is detected and confiscated.

In order to achieve greater success, authorities and agencies need to leverage advances in technology and data science to collect and analyze comprehensive datasets accurately and speedily. SupTech provides important tools that enable these agencies to enhance their intelligence and supervisory capabilities without undue cost burdens for government, regulated entities, and customers.

R2A AML Working Group

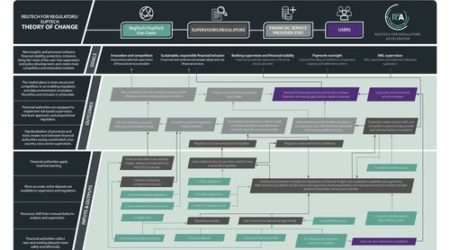

R2A assists AML/CFT supervisory authorities in the analysis of their data architectures and tech stack, and the identification of potential upgrades. R2A established a Working Group to advise on the future development of SupTech, and to promote further adoption of AML/CFT-focused RegTech and SupTech solutions by financial authorities in emerging and frontier markets. Participants include financial authorities responsible for AML/CFT regulation and supervision from a variety of high-income, middle-income, and low-income countries.

An outcome of the Working Group is the publication of an AML SupTech toolkit for agencies. Adopting SupTech for Anti-Money Laundering: A Diagnostic Toolkit, authored by Rochelle Momberg and Louis de Koker, and prepared with input from the R2A team and Working Group members, was published in April 2020.

SupTech set to gain traction in 2020

Increased reliance on innovative, digital financial services (DFS) means significantly more data is generated. These trends sharpened lately as COVID-19 measures like physical distancing led customers and governments to rely on DFS solutions in substitution for cash, while disrupting non-digital data collection and analysis by agencies and limiting on-site supervision.

In his COVID-19 statement in April 2020, the president of the Financial Action Task Force, the international standard-setter for AML/CFT, “encouraged the use of technology, including Fintech, RegTech and SupTech to the fullest extent possible,” within the task force’s official standards.

R2A – together with API Exchange and the Monetary Authority of Singapore – also supports the G20 TechSprint Initiative. This is a hackathon-style competition recently launched by the Saudi G20 Presidency and the Bank for International Settlements Innovation Hub. The Saudi Arabian Monetary Authority Governor, Ahmed Alkholifey, said that “the initiative will support the efforts of supervisors and regulators in reaping the benefits of technology to ensure that the global financial system continues to support households and businesses.”

It is within this backdrop that R2A hopes the toolkit will be widely used and shared between authorities and agencies in emerging and frontier markets, to accelerate the adoption of SupTech practices.

The AML toolkit

The diagnostic toolkit will assist with asking the appropriate questions to drive the creation of a strategy with customizable steps for execution that can facilitate improved data management and enhanced data analytics.

The toolkit enables a financial authority to assess its capabilities by examining the supervisory and intelligence lifecycles, creating a roadmap towards improving its SupTech at a pace reflective of its capacity, contexts and objectives. It also provides a conceptual overview of SupTech, briefly setting out the technologies available to financial authorities and provide guidance through the use of examples.

The toolkit is specifically designed to be “low tech” to be accessible to agencies emerging and frontier markets that are starting their SupTech journey. We would welcome comments and feedback from AML and policy experts, and in particular from the officers in government agencies and financial authorities. Your feedback will allow us to work towards creating a living document that can stay up to date with developing technologies and practical examples and reflect the impact the toolkit generates for its users. If you have suggestions, opinions, or opportunities after reviewing the report, we’d love to hear them. Please comment below, reach out to the authors directly, or contact us on LinkedIn and Twitter, where you can also see the latest on the RegTech for Regulators Accelerator (R2A).