Adopting SupTech for anti-money laundering: A diagnostic toolkit

The success of anti-money laundering and combating of financing of terrorism (AML/ CFT) measures is deeply dependent on the...

The Emergence of ‘SupTech’ — And How it Can Move Past the Experimentation Stage

“SupTech” is a word you’re likely to hear more about in the coming years. The term is a newfangled...

The suptech generations

Financial authorities’ use of technology has evolved over the years, leading to different generations of technology that culminate in...

Financial Authorities in the Era of Data Abundance: RegTech for Regulators and SupTech Solutions

Financial service providers are quickly adopting regulatory technology (RegTech) to ease the burden of compliance. This white paper shows...

R2A API Solution Creates a Faster, Direct Data Delivery Channel between Philippine Banks and the Central Bank

THE CHALLENGE: The Bangko Sentral ng Pilipinas (the Philippines Central Bank, or BSP) Supervisory Data Center (SDC) was receiving...

The RegTech for Regulators (R²A) process

The purpose of this working paper is to share the RegTech for Regulators Accelerator’s (R2A) approach, process, and tools...

R²A CASE STUDY: API AND VISUALIZATION APPLICATION PROTOTYPE

The Bangko Sentral ng Pilipinas (the Philippines Central Bank, or BSP) Supervisory Data Center (SDC) was receiving incomplete, late, and...

R2A Trials Data Warehouse For Mexico’s CNBV to Boost the Fight Against Money Laundering

R2A teamed up with local tech vendor Gestell to create a data warehousing platform, fed by application programming interfaces...

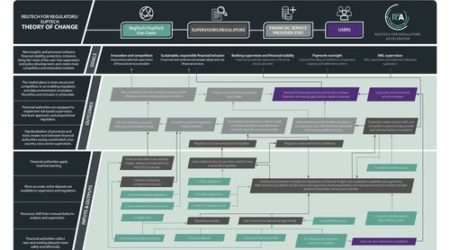

R²A Theory of Change – Infographic

This set of infographic resources cites the potential benefits of RegTech for regulators. Limited capacity to analyze data, inadequate...

The State of RegTech: The Rising Demand for “Superpowers”

Most financial authorities collect data monthly or quarterly or as needed. The infrequent nature of data collection is a...