The success of anti-money laundering and combating of financing of terrorism (AML/ CFT) measures is deeply dependent on the...

The RegTech for Regulators Accelerator (R2A) partnered with leading financial sector authorities to pioneer SupTech applications for financial sector...

Financial authorities’ use of technology has evolved over the years, leading to different generations of technology that culminate in...

The Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, or CNBV) requested a partnership to...

THE CHALLENGE: The Bangko Sentral ng Pilipinas (the Philippines Central Bank, or BSP) Supervisory Data Center (SDC) was receiving...

Wednesday, April 18, 2018 9:00 AM 10:00 AM Google Calendar ICS In this webinar, Bart Van Liebergen presented the findings from...

The Bangko Sentral ng Pilipinas (the Philippines Central Bank, or BSP) Supervisory Data Center (SDC) was receiving incomplete, late, and...

During this RegTech for Regulators (or SupTech) webinar, we had presenters from the National Bank of Rwanda (BNR) sharing...

Teaming with fintech vendor Sinitic, BFA Global’s RegTech for Regulators Accelerator program trialed a chatbot solution for BSP’s complaints...

R2A teamed up with local tech vendor Gestell to create a data warehousing platform, fed by application programming interfaces...

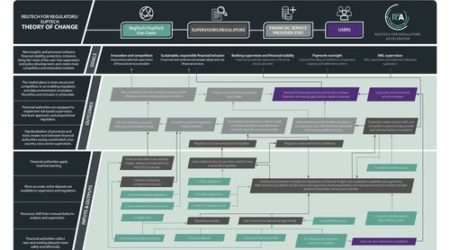

This set of infographic resources cites the potential benefits of RegTech for regulators. Limited capacity to analyze data, inadequate...

Most financial authorities collect data monthly or quarterly or as needed. The infrequent nature of data collection is a...

Towards Evidence-Based Policy Making in Financial Inclusion Continue reading →