How Flexible Financing, Solar Panels and Data Could Be Key to Financial Inclusion

Pay-as-you-go (PAYGo or PAYG) is emerging as a solution that addresses both end-customer affordability and provides sufficient margins to fuel operational models that can scale the deployment of off-grid solar solutions to the 1.2 billion people in the world who do not have access to electricity.

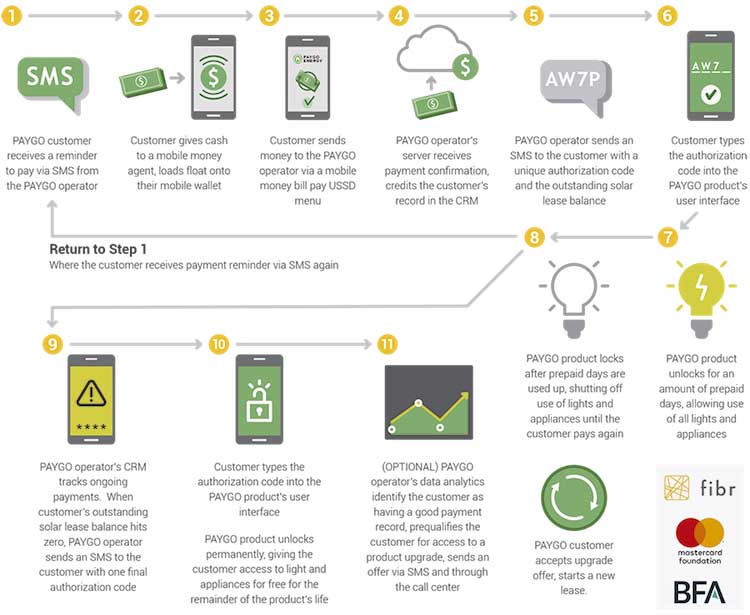

Under a PAYGo model, a low-income household can take home a high-quality home solar energy system by paying a deposit — typically 10–20 percent of the total cost of ownership — and committing to a certain number of ongoing payments by signing a solar lease with a PAYGo operator. The end customer makes payments in daily, weekly or monthly increments through a mobile money account, with each payment typically paying down a portion of the principal. Proprietary hardware in the solar device regulates usage, disabling the energy services when the customer’s prepaid usage is used up or expires. Under most PAYGo models, the device permanently unlocks at the end of the lease period and ownership is transferred to the end customer. With over 1 million units installed in the past four years and over 40,000 units installed each month, the PAYGo technology and financing model is already responsible for unlocking significant growth for the off-grid solar industry.

PAYGo operators are flush with data generated daily through products, mobile payment transactions and customer touch points that are increasingly captured by a commission-based agent equipped with a smartphone. At FIBR, a project by global consulting firm BFA, in partnership with Mastercard Foundation, we see significant opportunities to improve how PAYGo operators leverage these data sets to make better point-of-sale decisions, customize the product offerings, engage and retain agent networks, inform future follow-on product and financial services offered, and ultimately build linkages with banks and other local financial service providers.

FIBR brings together fintechs and banks to partner on using networks of small businesses to deliver digital financial services to low-income customers. Small and medium enterprises such as PAYGo solar operators can act as an “indirect” channel for financial inclusion. Through the solar lease and agent touch points, low-income consumers can access a high-value asset without prior access to formal finance. Predictive analytics and machine learning enable PAYGo operators to customize the product offerings to fit market segments with unpredictable income and expenditure patterns. PAYGo solar also provides a tangible reason for low-income consumers to sign up for and use mobile money services. By generating payment and credit histories, this data can be leveraged to provide additional services in the form of product upgrades, financing appliances and other livelihood-improving devices and even financial products.

But the PAYGo solar sector also faces formidable challenges. There is a growing tension between the current rates of sales growth and portfolio quality, particularly in markets where competition is forcing operators to lower the financial hurdles to become a new PAYGo customer. As PAYGo operators scale, figuring out the right agent engagement and compensation model becomes critical to drive sustainable growth and customer satisfaction, while lowering high agent network churn and management costs.

Many PAYGo operators are also finding that a large portion of the off-grid solar market is new to mobile money in general and bill pay options in particular, forcing companies to play an active role in reducing frictions in the customer payment experience to minimize payment delays and customer churn. The PAYGo model is inherently capital intensive, requiring financing at a scale that will necessitate new approaches to unlock capital from local financial institutions.

A new FIBR Briefing Note, “PAYGo Solar: Lighting the way for flexible financing and services” examines four key industry challenges from a financial inclusion perspective that serve as the foundation for FIBR’s PAYGo solar learning agenda: 1) unlocking local capital; 2) building data-driven financial operations; 3) tackling customer payment frictions; and 4) driving smarter agent network management. FIBR expects to conduct research and make project investments aligned with these four industry challenges in the sector. FIBR is currently working with CGAP to explore how PAYGo solar fits into the financial lives of low-income consumers across Africa, also published a case study on Lendable, an alternative lending platform that is pioneering asset-backed lending for PAYGo solar and other leasing companies in Africa.

Learn more by following @BFAGlobal on Twitter.