How to design PAYGo operational models to improve repayment

There has been a lot of work exploring why some pay-as-you-go (PAYGo) solar customers stop paying after they are initially granted a loan, most of which has focused on the customer and challenges they encounter, for example, short-term cash flow issues, and challenges with payment logistics, etc. Our goal with this blog is to examine the other side of repayment — what can PAYGo operators do internally with their products, systems, and processes to set customers up for repayment success (or failure)?

A core value proposition of PAYGo is the payment flexibility offered to end-customers. It is intuitive, it matches the precarious nature of the target customer’s income, and mimics how an off-grid individual would otherwise purchase energy on a per-use basis to meet their needs. But flexibility can be complex for PAYGo operators to manage and requires a new approach to customer service. There is no regularly scheduled repayment due date for your customers, no two individuals will pay at the same speed, and it is rare to find a customer who consistently pays in the same denomination (though there are patterns that emerge) — all of which make portfolio management more complicated. While customer requirements and operator business models can vary widely across markets, our experience has shown that PAYGo operators should be thinking about product and operational model design as levers for repayment, and not just as a way to cut costs.

Over the last three years BFA’s FIBR team have identified four areas that PAYGo companies should consider to improve repayment among customers and broke them down into fifteen actionable points:

- Customer education, onboarding and support

- Payments structure

- Agent incentives

- Information and communication technology infrastructure

In order, operators should focus on:

Customer education, onboarding and support

- Explain what is meant by “pay-as-you-go”. The industry has more or less defaulted to using “PAYGo” or “PAYG” as an acronym to describe an offering that is closer to a hire-purchase agreement than a true “pay-as-you-go” model. Customers are familiar with the latter through prepaid mobile airtime and data plans. We have found that the way the offering is communicated is a key first point in which you can set a customer up to succeed or have challenges. In order to avoid misinterpretation, avoid describing it as “pay-as-you-go, just like mobile”. This will most likely set incorrect expectations that the client can, well, pay whenever they can (and not pay whenever they don’t have the ability, are traveling, or simply don’t want to use the product). Depending on what is possible in your market, consider lease-to-own, rent-to-own, or pay-to-own language, with a key focus on this as a financial obligation and not a fee-for-service (unless that is your model!).

- Deploy reminders, incentives, and behavioral interventions to nudge repayment behavior. Operators should embrace a culture of lean experimentation to test and identify the right tools that can help customers make a mental model and plan to pay, set an expectation for the time to ownership, and encourage consistent payment behavior. The same experimentation model can be applied to identifying the right mode, frequency, messaging, and timing of payment reminders and other forms of communication with customers.

- Invest in customer communications. Build-in redundancy in communicating critical information to new clients to minimize risks that agents over-sell/over-exaggerate or the customer makes an impulse purchase, and audit these processes regularly to identify low-hanging fruit for improvement. Spend time thinking about what information needs to be delivered to the customer at what point in their life, and create specialized tools, processes, or roles to deliver it.

- Support product maintenance requests. PAYGo customers will not pay if the product is not working, and we have seen many companies face issues with payment if even one appliance is not working. So companies need a clear, consistent, and timely after-sales service model. Providers should think through the entire chain of the customer getting service on their system: (1) customer knows they have a problem, (2) customer knows how to get help, (3) customer executes on asking for help, (4) PAYGo company helps. Steps 1 and 2 actually happen during onboarding and can be best addressed with improved sales processes and communication. Supporting the customer — Step 3 — could involve improving call center reachability, creating digital chat support, and call back functionality.

- Prioritize referrals. We have also seen that customers who first experience a PAYGo offering in their own community by talking to a family member or neighbor have a better sense of the product capabilities and financial commitment, whereas clients who sign up at major marketing events can have lower repayment because there is not a lot of space for the same conversation which can lead to disconnected product expectations. Referrals can be not just a key to cracking scale in the industry, but also help with repayment.

- Design for simplicity. Terms and conditions should be as short and simple as possible — complicated rules in most PAYGo markets are as good as not having them at all. Provide written contracts in local languages, go through the terms and financial commitment on a welcome call with the client, and follow up regularly with person-to-person phone support. And where possible, extend your new client onboarding to more than 30 days where clients continue to receive bits of information about the offering and their obligation.

- Don’t skimp on agent recruitment, vetting, and training. The personality profile, motivation, onboarding, and ongoing training of the salesperson plays a critical role in the lifetime of the PAYGo customer. This person is often where the customer first learns about the technical capability of the product, the financial obligation, the digital payment options, and the service guarantee, and in many cases also plays a role in encouraging ongoing repayment after installation. If the customer does not understand key aspects of the product, PAYGo operators should ask themselves — does my sales agent understand these key aspects? Have I given them the tools and training to effectively deliver this content to the customer?

Payments structure

- Require a deposit or down payment. This financial hurdle, either in the form of a deposit or down payment as well as some prepayment of energy usage time, is a critical initial way to forecast a client’s capacity and willingness-to-pay. We have seen that deposits of 15% or more of the total cost of ownership are correlated with stronger repayment.

- Keep a relatively short repayment term. In most markets, the ongoing weekly or monthly payment level is the most visible and important pricing model component to end-consumers. We are seeing that heavy competition in multiple markets is leading PAYGo operators to extend the repayment term to arrive at an ongoing price point that is attractive — either below what an average user would pay without solar, or to undercut other PAYGo operators. While this might lead to a near-term uptick in sales, in our experience it can also set the company up for significant future repayment challenges. We have found that terms longer than two years are riskier as clients tend to experience payment fatigue, and, in more competitive markets, become more willing to switch mid-lease if alternative and attractively-priced solar products are available.

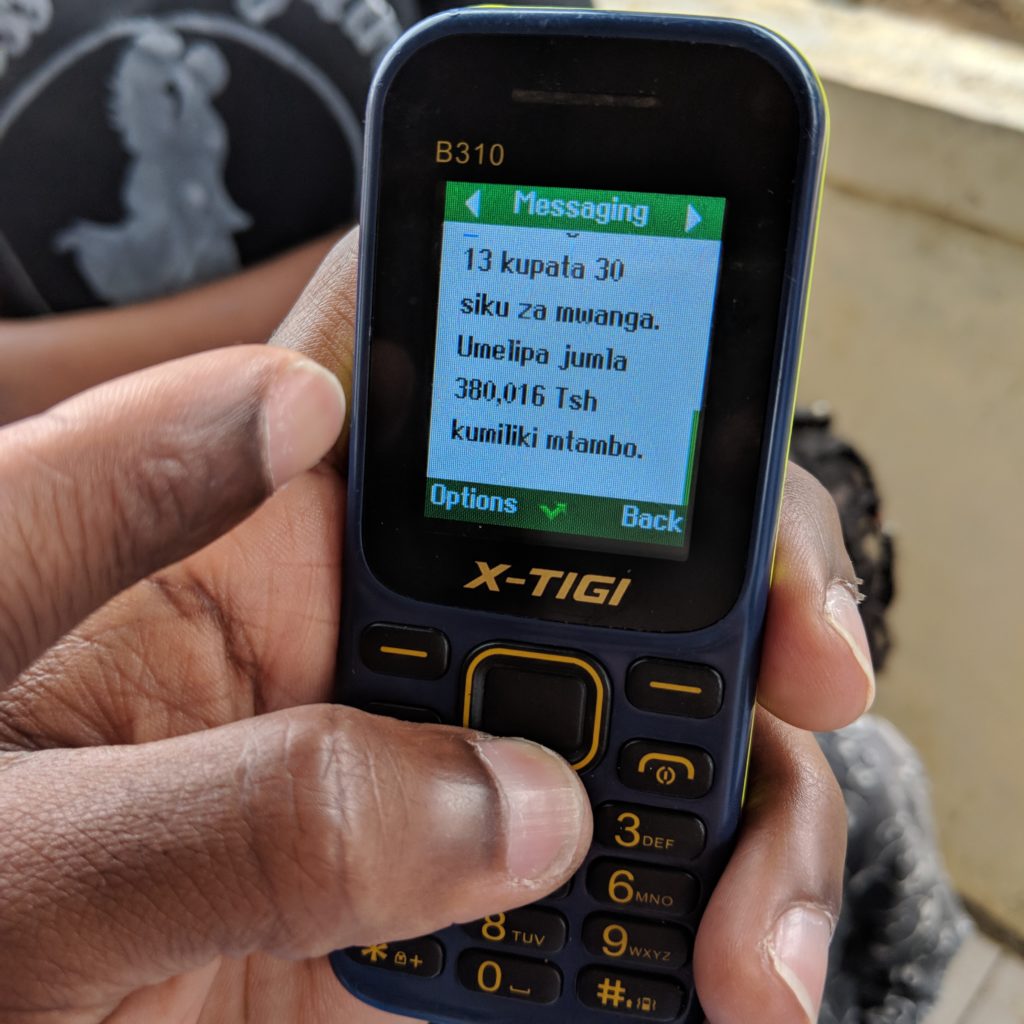

- Give people compelling reasons to pay consistently and complete the purchase above and beyond just keeping the lights on and ultimately owning the solar home system. This can be qualifying for product upgrades when you complete the purchase, follow-on financing of other assets, reporting positive repayment histories to credit bureaus, and supporting PAYGo solar customers in qualifying for products at formal financial institutions.

- Set limits for non-payment. As most PAYGo models do not apply interest accrual to clients who take longer than the contract term to complete the purchase, we have found that it is useful to set boundaries on the number of “grace” or “locked” days. At the very least, define the boundaries in terms of consecutive days, and ideally cumulative days locked upper limit — again, keeping these rules as simple as possible. While these rules might set some upper boundaries, it is also important to build in empathy and the ability to be flexible with customers with otherwise positive history with the company.

- Have clear and consistent non-payment escalation processes and consequences. Set standard dates for different types and modes of communication with delinquent clients, and (if required) execute repossessions on the same terms across geographies and over time.

Agent incentives

- Keep agent compensation simple and easy to understand, but also align incentives for selecting good clients. While there is no silver bullet single compensation model, we have found that tying some percentage of an agent’s commission for a sale to at least the first three customer payments can make a big difference.

- Consider sales limits for new agents. We have consistently seen that customers onboarded in the first 90 days of an agent’s tenure with a company perform more poorly. PAYGo operators should explore an onboarding process that slowly ramps up an agent’s opportunity over time, based on the full, or at least first 90 day repayment performance of clients signed up.

ICT infrastructure

- Avoid off-network areas. Mobile network connectivity is a critical enabler of the PAYGo industry: all providers send some form of payment reminder or confirmation via SMS; many send this confirmation directly to the product to turn the customer’s lights on after a payment; and most providers use call centers as a primary support channel for customer care. We have consistently seen a strong correlation between repayment behavior and connectivity, with phone reachability, in particular, playing a major role. If you cannot call your client, you simply cannot service the lease. PAYGo operators should avoid operating in poor network areas, require a minimum of two phone numbers at the application stage, and consider automated phone number validation prior to lease approval. If a customer can’t be reached, don’t complete the sale.

While not comprehensive, the hope is that these recommendations can help PAYGo operators unlock new opportunities to improve the customer journey and decrease default rates, and to help investors have a better and more comprehensive understanding of the potential drivers of customer repayment.