What does Inclusive Fintech Look Like in Ghana?

Introducing FIBR Partners, Farmerline, IT Consortium and Nomanini

FIBR, or Financial Inclusion on Business Runways is a new project of BFA in partnership with The MasterCard Foundation. FIBR rethinks financial inclusion by working with a broader set of partners, such as fintech companies and small businesses in addition to traditional banks and microfinance institutions (MFIs), to provide data-driven ways to bring financial services to unbanked and underserved populations.

Historically, financial service providers (FSPs) interested in serving these populations have sought to acquire customers directly by offering them bank accounts. This approach has proven challenging for several reasons, particularly the high costs (relative to revenue streams) of acquiring and servicing low-income customers; FSPs’ lack of familiarity with effective marketing approaches to these segments; and, owing in part to these two challenges, difficulty in keeping low-income customers engaged with their products, resulting in high account dormancy rates. Thus even where initial uptake of financial services by low-income customers has been strong, it has not necessarily led to sustained, meaningful usage.

FIBR examines the indirect relationship that an FSP could have with a low-income customer through intermediaries in their local communities. By leveraging trusted relationships of small businesses, such as a shopkeeper, with their customers and by capturing the increasing amount of user data now available on smartphones, financial inclusion can explore financial services that are designed around how the customer engages in business. Imagine, an employer-managed savings feature on top of electronic payroll, digitization of an agriculture ledger book to extend more credit to smallholder farmers or a billing platform to help parents make regular school tuition payments or access loans so their children can stay in school. These are just some FIBR-like linkages to financial services that address the financial challenges and moments that low-income individuals face in their lives, and unpack more meaningful ways to get these customers to climb up the financial ladder.

FIBR supports technology, business and financial partners in Ghana and Tanzania with technical assistance and funding, to design and develop new ways to link savings, credit and insurance products to the underserved. Ever since FIBR formally launched in February in 2016, the team has been on the ground in Ghana working on what FIBR refers to as a nanoproject with potential project partners. This pre-approval engagement is a collaborative and clearly scoped design sprint, which serves as a partner selection process and also lays the groundwork for a full-on FIBR engagement with the approved partner. The nanoproject design sprint also helps inform the product-market fit for the app that is built and tested during the FIBR engagement.

Today, FIBR is pleased to announce the first three project partners in Ghana.

Farmerline, a mobile technology and information software company, works with Ghana’s farmers to deliver valuable information on weather conditions, Agric tips and market prices (among other areas) directly onto their mobile phones. Farmerline has a strong presence in Ghana’s growing regions, which financial service providers typically have had difficulty serving due to their remote locations and relatively high service costs. With FIBR, Farmerline will develop a solution to use data on individual farmers to extend financial services to them. This solution has the potential to make formal credit and savings products available to the farmers for the first time.

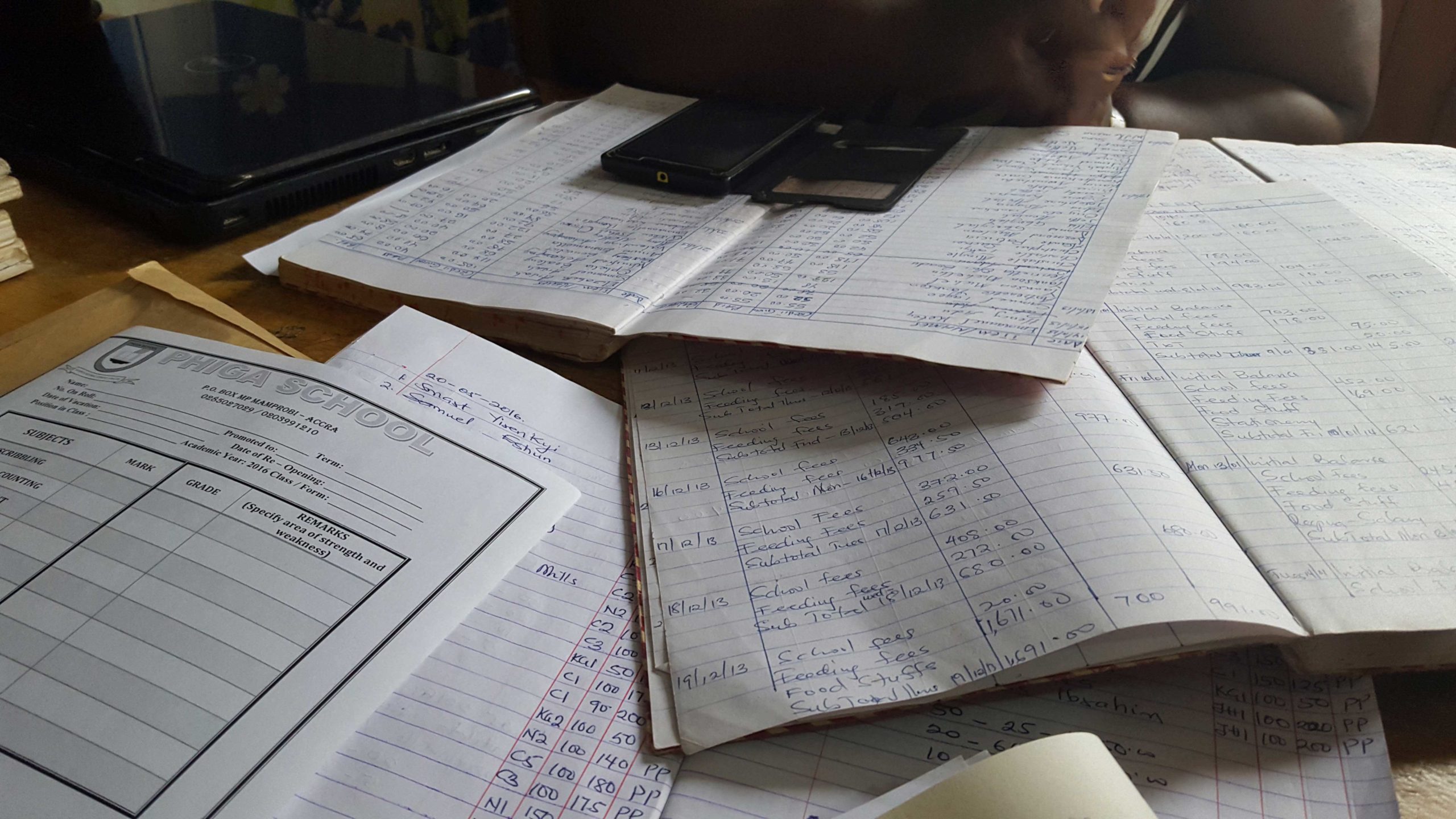

IT Consortium (ITC), a technology company specializing in payments and student information systems, has strong presence in Ghana’s education sector. It works with about 200 schools currently to help manage enrollment information, academic data and process parents’ tuition payments, which are a main source of funding for schools in Ghana. ITC is well-positioned to help manage a key issue for parents and schools alike: challenges paying school fees on time. Lack of funds is one of the biggest challenges that schools in Ghana and many other markets in Africa grapple with. When parents are unable to pay school fees, often the school’s recourse is to send children home as without these fees, there is no way to fund the school’s operations. With FIBR, ITC will develop an app for school administrators that would give parents more financing options when they are unable to pay school fees at the start of each term. While still early to say, the app could provide both savings and credit-related options — an exciting and important issue to work on.

Nomanini is working on a very different issue facing low-income customers in Ghana. Namely, how can small merchants use electronic payments to grow their businesses? Nomanini provides software and hardware to informal merchants that allows them to execute and track a range of electronic purchases from the same device, including airtime purchases, mobile money transactions and bill payments. With FIBR, Nomanini will use data on the merchants to generate a credit scoring algorithm that would top up the float whenever the merchants require additional working capital. Right now, these small merchants have a difficult time accessing credit for their business needs. FIBR could help change this by partnering merchants with Nomanini.

FIBR’s main objective is to learn how FIBR partners and their data can improve the lives of their customers and employees by being vehicles to financial services. We have three main learning questions that we hope to address across this first set of FIBR partners:

- Digitization: What are the most effective ways for local businesses to digitize their operations? What are the benefits of doing so?

- Tech companies as conduits for financial services: To what extent can tech companies offer their customers and employees financial services?

- Tech companies as the matchmaker: Can tech companies help forge connections between their customers and employees and financial service providers in their markets?

Each partner will uncover to some extent the answers to these questions. Documenting the benefits of generating digital data will be insightful to farmers (Farmerline), schools (ITC) and informal merchants (Nomanini) alike. Farmerline’s potential as a matchmaker between hard-to-reach farmers and FSPs is especially exciting and has not been done before. And for the first time, the ITC app will let school administrators offer financial services to parents. These are emerging examples of how FIBR seeks to make a transformative contribution to the financial service sector, and it is hoped, how a low-income individual or household better manages money, to be able to focus on their life goals.