Learnings from our WhatsApp chatbot survey platform – A lightweight, digital research tool that meets the customers where they are

WhatsApp is one of the most popular social media applications in Africa. Majority of the internet users use WhatsApp for daily activities. In South Africa, 95% of internet users use WhatsApp followed by Kenya at 93%, Nigeria at 91% and Ghana at 89%. The high level of penetration showcases the significance and impact of WhatsApp on the continent. The reason for WhatsApp’s high penetration in Africa is due to it being cost-effective, easily accessible on devices and user friendly.

Given the high penetration rates of WhatsApp and the popularity of the app, the platform can be used as an easy way for companies to conduct surveys to gather information, and feedback and understand their impact. Over the years many companies have opted to use WhatsApp as a survey tool for the following reasons;

- Low costs – WhatsApp does not consume high data and therefore, it is cheaper for respondents to take a survey. Additionally, there are no mobile charges to the implementer when deploying the survey making it cost-effective

- Higher response rate – With high penetration rates and easy accessibility, WhatsApp has higher user engagement and therefore response rates tend to be higher than online surveys.

- Less time-consuming – When sending out a survey, WhatsApp enables the survey implementor to send the survey in bulk

- Design Customisation – Surveys to an extent can be customized and there are no restrictions on the characters and number of questions.

Based on the above research and findings on the ease of WhatsApp as a tool for delivering surveys, we decided to use the platform to measure the impact of our work carried out under the Inclusive Digital Commerce (IDC) program in Ghana.

Our digital experiment

Micro and small enterprises (MSEs) in Ghana play a crucial role in driving economic growth, providing employment opportunities and creating wealth. However, these MSEs often face several challenges, including limited access to finance, inadequate skills, and limited resilience to shocks.

To gain a better understanding of how digital tools can enable MSEs to become financially resilient, the Inclusive Digital Commerce (IDC) program worked with six digital commerce companies that build solutions designed to improve the livelihoods of MSEs in Ghana.

To measure the impact of the program, BFA Global conducted a series of WhatsApp chatbot-based surveys. This blog shares key findings and insights from the survey.

Survey Process

Between May and December 2022, BFA Global launched a WhatsApp Chatbot survey to understand the financial resilience of MSEs that used the IDC portfolio companies’ platforms in Ghana. The survey was conducted in three waves, with intervals of 5-6 weeks to be able to understand the change in income over periods of time. Prior to the kick-off, we had a pilot wave to test how the survey questions were interpreted by the end users and factors like the day of the week/time of the survey, compensation etc were determined to improve the survey uptake. Five IDC companies participated in the survey and were instrumental in making this process viable: KudiGo, OZE, Shopa, Boost and Swoove. These companies supported BFA Global by providing the list of contacts, feedback on the questionnaire, reaching out to their users to notify them about the survey, and in some cases, following up with them to respond.

Each survey collected information regarding business owners’ demographics, business basics, platform services, overall income, and several explorations on the impact of the platform services such as the recent rise in inflation. Based on these metrics we were able to assess whether MSEs in Ghana have become more resilient after using our portfolio companies’ platforms.

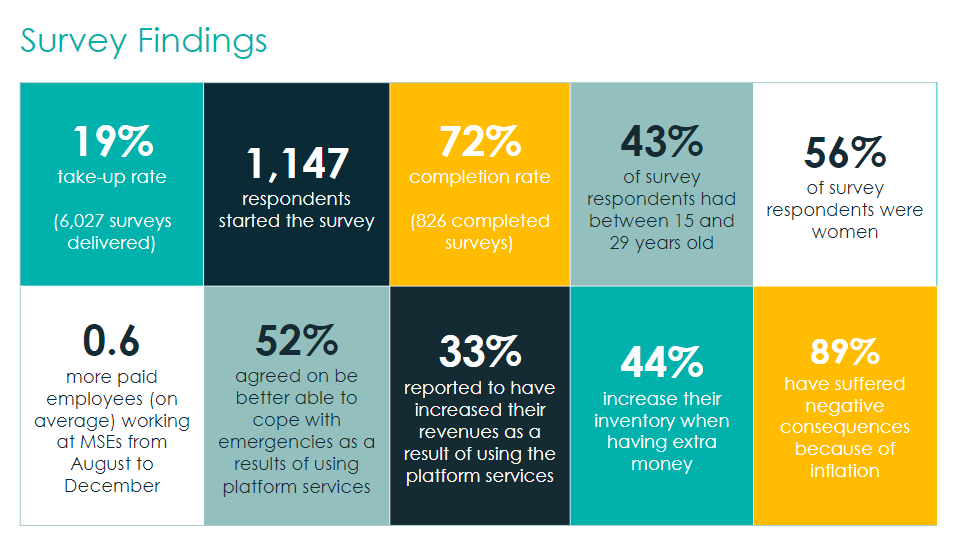

The overall take-up rate was 19%, with 1,147 people starting the survey out of 6,097 surveys delivered and a completion rate of 72%.

Survey Results

- The results of the survey showed that the majority of the respondents were youth and women (ages 15-35) running their businesses in Greater Accra in the Fashion accessories, beauty and cosmetics industries. We also saw that most of the MSEs use the IDC platforms to track their sales.

- We found that the IDC companies are positively impacting MSE in terms of income. Over the seven months of the survey, we saw a reduction in the proportion of MSEs with a weekly income of fewer than 300 GHc and increase in revenue because of the services provided by the companies.

- Young female entrepreneurs in Ghana often face cultural and societal barriers that limit their ability to succeed in business. The survey found that women-led MSEs start at a disadvantage in terms of income and the number of paid employees.

A more in depth explanation of the survey results can be found in our WhatsApp Chatbot Brief, “Breaking Barriers: Women Entrepreneurs in Ghana Navigate the Digital Landscape,” which examines the challenges and opportunities for young women and their livelihoods through digital commerce.

A more in depth explanation of the survey results can be found in our WhatsApp Chatbot Brief, “Breaking Barriers: Women Entrepreneurs in Ghana Navigate the Digital Landscape,” which examines the challenges and opportunities for young women and their livelihoods through digital commerce.

Lessons learned from data collection

Chatbot surveys can be a cost-effective way to get qualitative data about platform clients

Building out the WhatsApp chatbot had initial startup costs – both monetary and human capital. Initial costs for building the chatbot were as follows;

- It took our software developer 2 months to build the survey platform

- A monthly hosting fee for the platform

However, once the chatbot was built and ready to be deployed, the cost of implementation was negligible and the chatbot can now be used for various other programs. The only cost associated with deployment was the cost of acquiring a WhatsApp for Business phone number and the cost of sending out the questionnaire.

Take-up rates are dependent on various factors

From our survey, we saw that several reasons affected the take-up rates:

- Many MSEs are busy in the mornings and early afternoons therefore sending the surveys at those times did not get high response rates. Therefore, we opted to send the survey between Friday and Sunday in the late evenings when MSE owners had time to respond to the survey.

- Incorrect phone numbers and ignoring invitation messages were major reasons for low take-up rates. As we went along the process of deploying the surveys, we were able to filter out incorrect phone numbers. To help reduce the number of messages being ignored, we would send reminders to the MSEs through the portfolio companies prior to the survey launch and then during the timeframe the survey was open for.

- Economic compensation may increase the completion rate but couldn’t counter survey fatigue. We found that the MSEs had survey fatigue as we were sending them a WhatsApp survey over short periods of time and simultaneously, the portfolio companies would send surveys to get platform feedback. This caused the survey uptake rate to reduce with each progressive survey wave even though compensation increased. Completion rates were much higher than take-up rates, which suggests that the survey had a fair number of questions which were concise and straightforward.

- Sample size and reliable data messaging are crucial in promoting take-up. When deploying the survey, the first message was found to be crucial in reducing resistance (including the compensation), and the help of platforms sending reminders is key in increasing take-up amongst the respondents. Furthermore, we found that capturing data especially income-related from a multiple-choice question reduced inconsistencies and refusals. Finally, larger sample sizes drive more reliable data, especially for more granular analysis (e.g., good weeks/employees and gender).

WhatsApp has several restrictions when launching business surveys thereby making implementation complicated

While WhatsApp has a large client base due to its high penetration, they have several restrictions set in place when it comes to sending bulk messages and deploying business surveys. Firstly, each template for the survey needs to be approved and verified by WhatsApp which can either take a few hours or a few days. Furthermore, WhatsApp has various business registration approvals based on which only a certain number of messages can be sent in one go. When we deployed our surveys, two companies were only able to send out a max of 50 surveys in one go which made it difficult to deploy the survey in one go to over 300+ MSE users.

WhatsApp also controls the content that can be shared, therefore, we had to be very careful in the wording of the initial messages where it showcased the survey as a form of feedback for the portfolio companies rather than an advertisement.

In conclusion, it is important to consider that while digital tools such as WhatsApp have clear benefits such as cost-effectiveness, efficiency, high penetration rates and easy accessibility in deploying a survey, it needs to be tailor-made for the respondents for it to be effective. Not only do factors such as differences between rural and urban respondents, internet connectivity, and language barriers need to be efficiently incorporated in the survey design, the tool also needs to clearly communicate to the respondent that it would be beneficial to them as well as the company deploying the survey to encourage increased take-up and completion. We continue to experiment with the survey tool and approach. The channel is promising for collecting fresh user data, tracking metrics over time, and for determining how we can improve measurement of impact to MSE customers.