How embedding financial health may transform targeting and access for gig workers

India’s digital gig economy workforce is projected to reach 23.5 million by 2029-30. How financially secure are these workers who drive our cabs, deliver our meals, and freelance across platforms? To answer these questions, BFA Global, with support from MetLife Foundation, engaged with Entitled Solutions, a financial services provider for blue-collar and gig workers, in an active research project to understand their financial health and well-being as part of the Charge II program.

The Charge II program aimed to improve the financial health of low-income gig workers through project activities in China and India. A key achievement has been integrating financial health assessment into Entitled Solutions’ onboarding procedures.

Financial health is a composite measure that involves the ability to manage daily finances, withstand economic shocks, seize opportunities, and feel control over one’s financial life, directly influencing the stability and productivity of gig workers. For providers like Entitled Solutions, understanding financial health allows them to tailor products and services precisely to individual needs, enhancing targeting and intended impact. For gig workers, it translates into improved financial well-being. Operationalizing this involves embedding simple yet comprehensive financial health questions into existing onboarding and monitoring workflows, enabling real-time client segmentation and personalized support. In this blog, we share our experience of bringing this to life—how we measured financial health, the profiles that emerged, and how these insights can be used to deliver more targeted financial solutions.

Measuring financial health of gig workers

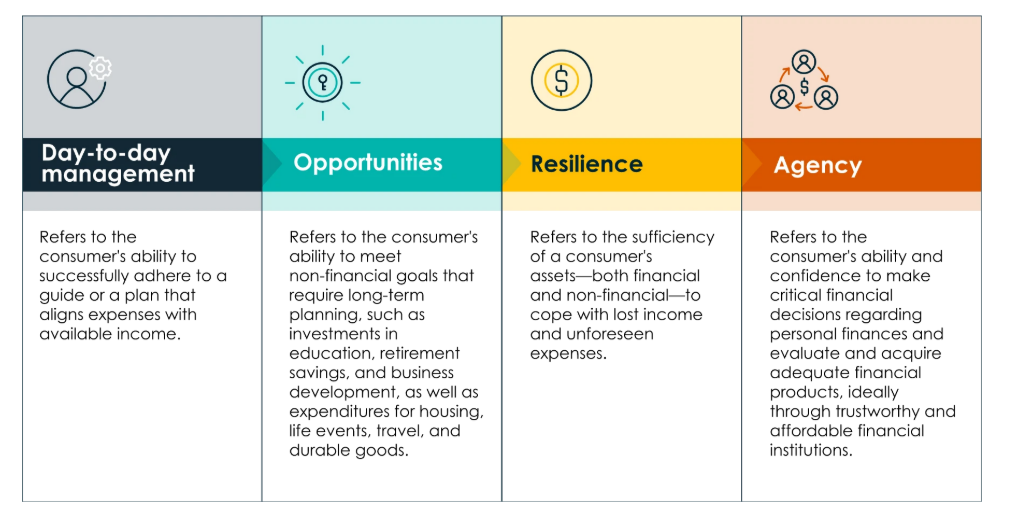

We surveyed around 2300 gig workers across India using Entitled Solutions’ bustling WhatsApp-based community, Sarvam, and administered four questions to assess their financial health. The questions were mapped to DORA, BFA Global’s financial health and wellbeing measurement framework. It examines four dimensions: Day-to-Day (money) management, Opportunities (ability to invest or save for goals), Resilience (ability to handle financial shocks), and Agency (sense of control over finances).

While comprehensive financial health frameworks often use a longer set of questions to capture the full spectrum of financial well-being, we recognized early on that integrating such a tool at the onboarding stage could create friction, particularly for gig workers accessing services via mobile platforms. Lengthy questionnaires risk drop-offs, delayed sign-ups, and lower response quality. To balance depth with usability, we opted for a shorter, four-question version of the DORA framework that could be embedded seamlessly into digital workflows like WhatsApp or mobile app onboarding. Despite its brevity, this streamlined approach still captures the core dimensions of financial health.

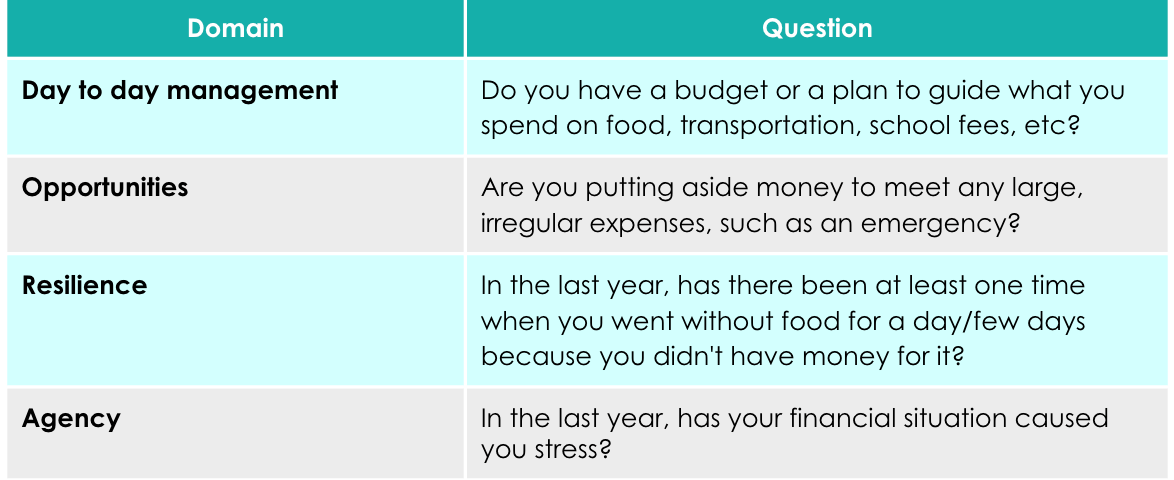

In practice, it meant asking gig workers targeted questions about their financial lives mapped to each dimension. For example, participants were asked if they keep a budget or spending plan to guide daily expenses and whether they set aside money for large or irregular expenses like emergencies. To probe Resilience, we asked if, in the past year, they had to go without food for a day or more because they couldn’t afford it, and to understand Agency, workers reported whether their financial situation caused them stress in the last year. By covering routine habits as well as shocks and stress, these questions paint a coherent picture of financial well-being.

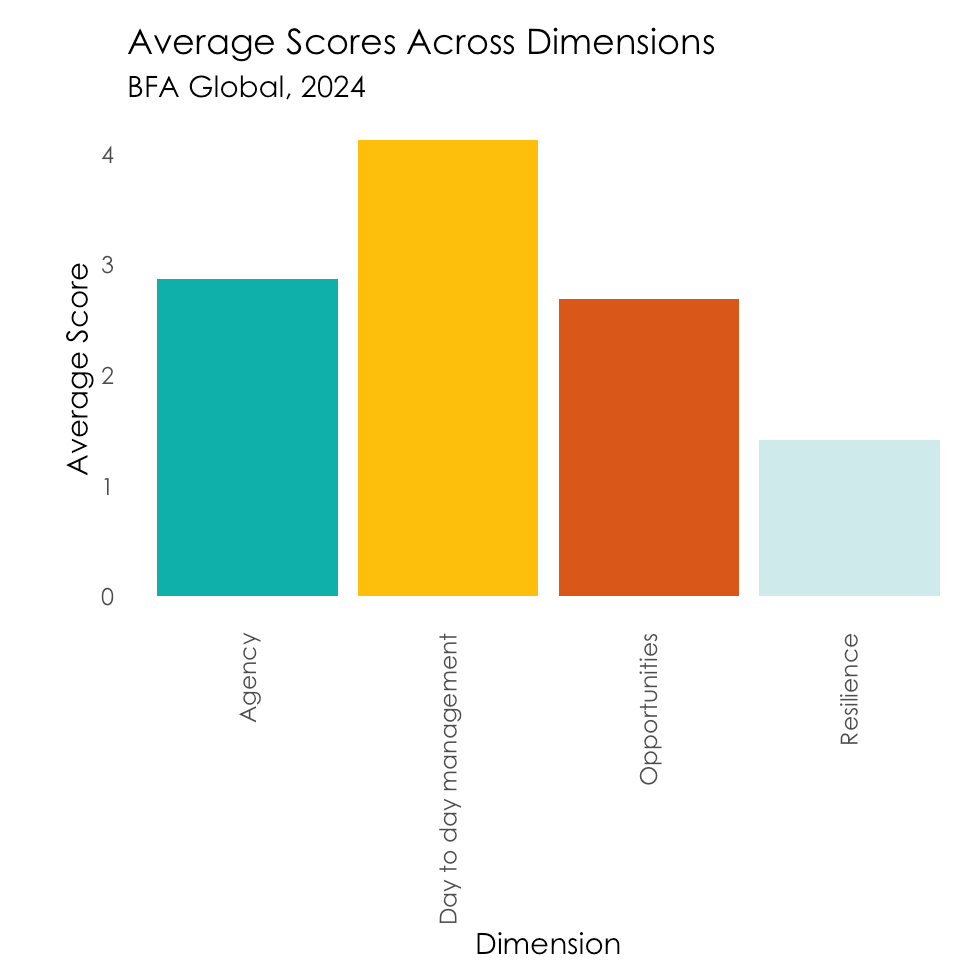

Our data revealed specific patterns: gig workers generally manage everyday expenses adeptly but struggle to build resilience, aka safety nets, and many experience financial stress. Day-to-day management consistently scored highest among the four dimensions. In contrast, Resilience scored the lowest, indicating that most gig workers can make ends meet daily but remain one crisis away from a financial shock.

Profiles that emerged

We identified three distinct profiles from our analysis:

- Budget balancers excel at day-to-day budgeting and often have a system to manage their income and expenses (for example, setting aside money for rent or fuel). However, Budget Balancers struggle to withstand financial shocks—their emergency savings or buffers are minimal, so an unexpected expense (e.g., a medical bill or a week of low earnings) could destabilize them.

- Financial floaters: This group is moderately managing – they can cover daily needs most of the time, but not as consistently or confidently as the Budget Balancers. Floaters often juggle expenses and may sometimes fall behind on bills. They remain vulnerable to stress and income shocks, as any disruption (sickness, vehicle breakdown, etc.) could push them into hardship. Floaters might have started saving a little or reduced some debt, but these gains are fragile and have not yet been sustained long-term.

- Financially fragile: These workers are in the most precarious position. A Financially Fragile gig worker cannot reliably manage daily expenses; running out of money for basic needs is a real and recent memory. They have almost no capacity to save or plan for large expenses, and their resilience to shocks is near zero – even a minor emergency can be catastrophic. In essence, they are constantly in crisis mode, often relying on borrowing or outside help to scrape by. This segment represents the most financially vulnerable tail of the gig workforce.

The fact that we see the same patterns repeat underscores that similar structural challenges persist across gig workers. They face obstacles like low-income stability and lack of safety nets, which produce these recurring profiles.

What we recommend

As part of our recommendations, we highlighted three key intervention areas:

- Integrating financial health assessments into Entitled Solutions’ onboarding and monitoring processes

- Developing a blueprint for inclusive and accessible motor vehicle insurance tailored specifically for delivery and cab drivers (you can read more about this in our next blog); and

- Revising their credit-scoring model to enable access to finance for their B2C client segment, which had been hitherto underserved

For embedding financial health as part of their core onboarding and measurement framework, we recommended integrating these four questions into every gig worker’s onboarding or initial financial health assessment – for example, as part of a mobile app sign-up or during the first client consultation:

These four questions are deliberately simple and non-intrusive, yet together, they cover the breadth of financial health. A yes/no or scaled response to each can quickly segment a worker into one of the three profiles above. Importantly, this low-burden questionnaire can be built into digital workflows (e.g., a WhatsApp onboarding form) so it doesn’t disrupt user experience.

By scoring each response and mapping it to DORA, providers can achieve several things:

- Real-time worker segmentation: Based on answer patterns, new clients can be classified into one of three profiles, allowing for more personalized service pathways.

- Enhanced product targeting: The platform or financial institution can immediately match clients with financial products and advice that fit their profile (for example, directing a fragile worker toward emergency assistance programs).

- Progress tracking: These same questions can be asked periodically (every 6 or 12 months) to track progress. Improvements in scores would signal better financial health, while stagnation or decline would flag a need for intervention. Over time, this creates a feedback loop to measure the impact of any support provided.

By implementing this measurement and targeting, firms like Entitled Solutions and other FSPs can actively improve the financial health of their gig-working clients. Using the DORA framework as a guide, service providers can move beyond one-size-fits-all offerings and instead deliver targeted, empathetic financial solutions at scale. By asking the right questions and segmenting workers into meaningful profiles, companies can craft interventions that help each gig worker not just survive but build financial resilience and agency over time.