Operationalizing financial health: Experiences from Vietnam

A leading microfinance institution (MFI) in Vietnam, Capital Aid for Employment of the Poor (CEP), is at the forefront of providing financial services to low-income individuals and communities to improve their financial well-being. CEP has a respected brand, an experienced staff and a growing presence outside of Ho Chi Minh City, and serves over 340,000 customers through 36 branches. In this first blog post of a three-part series, we share some of the key lessons from our recent engagement with CEP, which set out to measure and improve their customers’ financial health.

Financial health focuses on the efficacy of the access and usage made possible through financial inclusion. Yet, measuring that efficacy is not always easy. Consider two client composites created about a year ago, who we shall call Ánh and Bao:

- Ánh is the head of her household. Since the pandemic, her household income significantly decreased because she lost her job. She was not saving much before the pandemic and as a result, does not have sufficient emergency funds to pay for essentials for more than a few weeks. She does not have any assets that she can sell for emergency cash and does not have any insurance cover. She is currently receiving financial support from the Vietnamese government.

- Bao is also the head of her household. Her income decreased somewhat when market activity declined as a result of the pandemic. She has set aside some emergency funds to see her and her family through difficult times. She would be able to pay for essentials for a few months if she lost all income. She has gold she can sell for emergency cash. She has outstanding loans – she has been late in loan repayment in the past and anticipates being late on some future payments. She has health insurance.

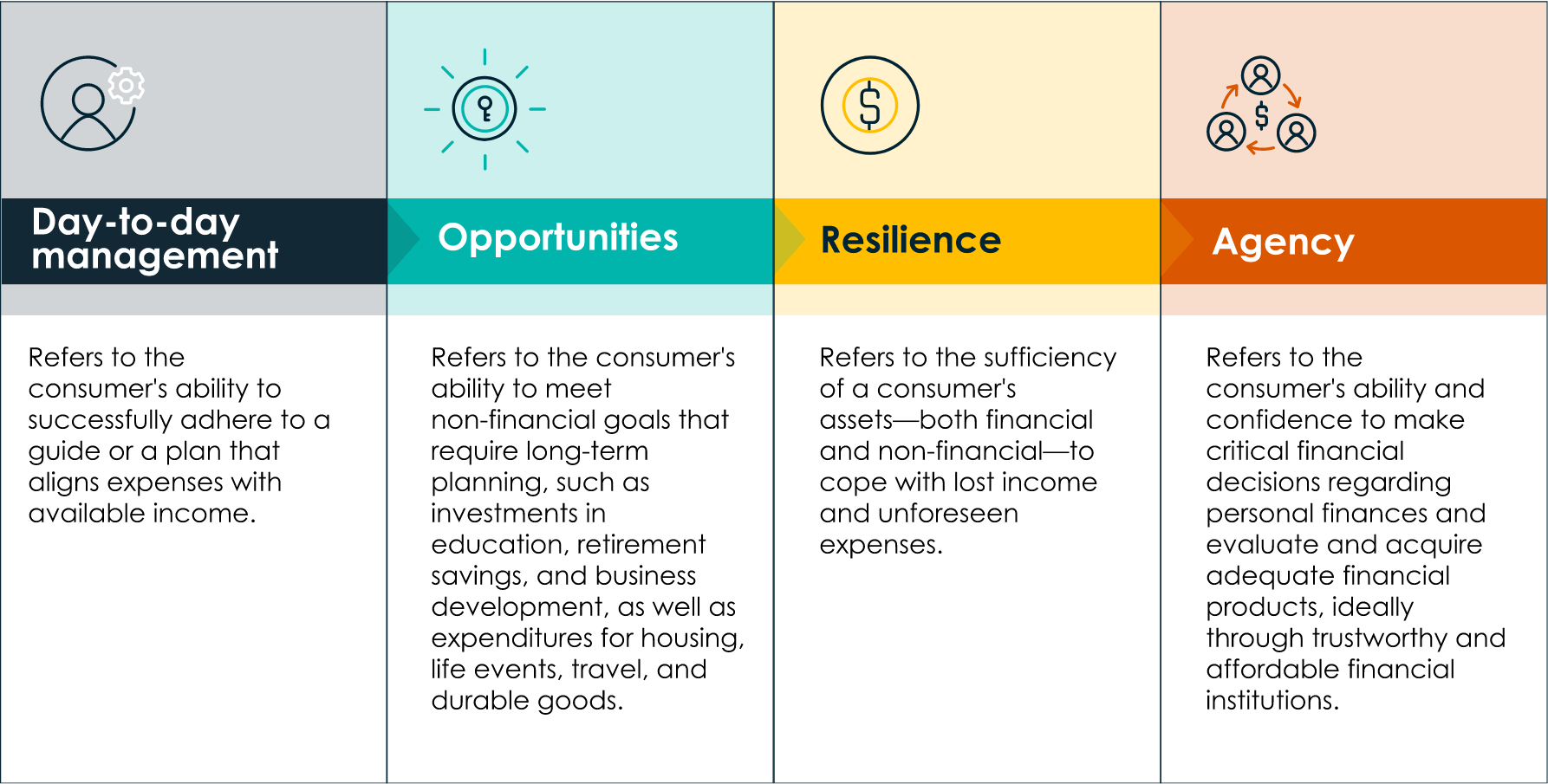

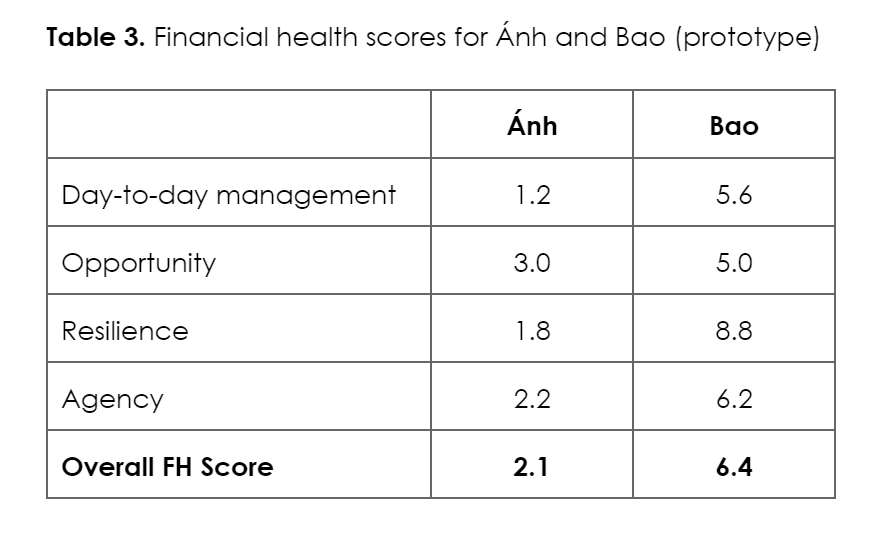

We can infer that Bao’s financial health is better than Ánh’s, but also that Bao’s could be better. CEP and BFA Global embarked on a journey to create and deploy a financial health measure that would assist CEP in serving customers with a combination of appropriate products/services and guidance. At the core of the measure is a financial health index that is composed of four interlocking dimensions: Day-to-day management, Opportunities, Resilience, and Agency. Or DORA (Table 1).

Table 1. DORA, our approach to financial health.

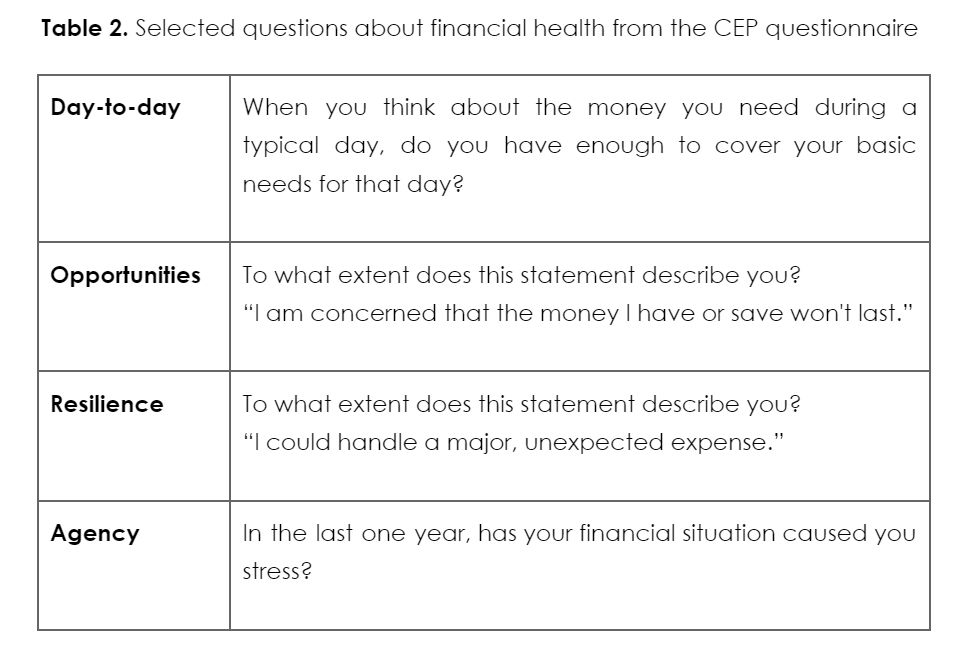

The financial health index is derived from a brief questionnaire. Customers answer 14 simple, multiple-choice questions that were pilot tested with CEP customers. It does not require any financial disclosures about what customers earn, how much money they have saved, or their credit scores. Those sorts of questions are unreliable for vulnerable populations, who may have volatile and unpredictable income, thin credit files, and incomplete financial recordkeeping.

The questions are designed to measure the four aspects of financial health (DORA). Based on their responses, an individual gets a financial health score that rolls up all of that information into a single number between 0 and 10. The index leverages a statistical technique, “factor analysis,” to generate a scoring algorithm that reflects the underlying aspects of financial health (see Blog Post 2). At a glance, the customer and CEP get actionable information about the customer’s financial well-being.

This framework allows for individual interventions. Ánh and Bao score 2.1 and 6.4 points, respectively (Table 2). CEP staff members can use the diagnostic to probe for the drivers of Ánh’s lower financial health score. They may learn from Ánh that her highly variable income can lead to shortages of cash for day-to-day expenditures. There are some months when she is not able to pay her bills on time; but the shortfalls are not entirely predictable or seasonal. On occasion, she has difficulty making ends meet — reportedly because she does not plan how she will spend her money when a lump sum arrives. Based on this conversation, they can start with two achievable goals: laying out a budget on paper and building resilience by setting aside some money for emergencies.

Financial health measurement is a substantially new capability for CEP. Serving the poor has always been a core tenet of CEP’s mission. Previously, CEP’s financial metrics contained information about its customers’ account balances, transactions, and loan performance (but only for accounts at CEP). When onboarding new customers, CEP also surveyed them about their living standards and household structure. That data supported two poverty metrics, one based on the national poverty line and another metric preferred by CEP. Together, these data gave CEP visibility into financial behavior and poverty status.

Today, financial health adds both a measurement tool and a diagnostic. As a measurement tool, the index is specific to financial obligations and goals. Financial goals may be predictable, such as setting aside money for monthly bills or red envelopes at the new year. They may be long-term, such as buying assets that provide an income in old age or, they may be unpredictable, such as hospitalization. The burden of hospitalization is substantial in Vietnam, where financial distress affects up to two-thirds of patients living outside their home district. Insurance can reduce the risk of financial distress by more than 10 percentage points1Pekerti, Andre, Quan Hoang Vuong, Tung Manh Ho, and Thu Trang Vuong. 2017. “Health Care Payments in Vietnam: Patients’ Quagmire of Caring for Health versus Economic Destitution.” International Journal of Environmental Research and Public Health 14 (10). https://doi.org/10.3390/ijerph14101118.. With a financial health score, CEP can focus on how well its services are supporting customers.

The diagnostic capability of financial health offers a way to customize financial advice. The components of the financial health index (DORA) are tied to specific questions. We can break out sub-scores for day-to-day management, opportunity, resilience, and agency. With that, the customer service team can recommend products, services, and supports that are focused on each customer’s needs.

CEP is deploying this tool in two ways. First, it incorporated the financial health survey into its onboarding process for new customers. Second, CEP is making a self-assessment version available through the digital app that was also developed with support from the VietFHI project. The app offers detailed content that informs customers on how they could improve their financial health, and currently boasts 50,000 active weekly users.

Financial health has already had important impacts on CEP’s work. Financial health is measured consistently and reliably across branches and customer segments. Second, it allows CEP to expand its impact assessments. The app allows CEP to reach its customers in a much more cost-effective manner compared to group meetings. Third, beginning with the app, CEP can offer users content that will improve their financial health: learning to track spending, to make a household budget, to set aside money for predictable expenses, to create an emergency fund, and how CEP products and services can help them realize their goals.

CEP has embarked on a journey to measure the financial health of all new customers. The result of the engagement has been a new capability to measure financial health at the individual level, which in turn can drive strategy, product development, customized financial advice, and ultimately, impact. We are excited to see how this focus on financial health evolves over time, and continues to impact the hundreds and thousands of CEP customers.

This work was conducted through the VietFHI project and was made possible through generous funding and support from MetLife Foundation and Rockefeller Philanthropy Advisors.