Changing Internal Culture to Smooth the Transition from Pure Lending to Savings

Changing staff culture in order to effectively promote new products at a microfinance institution (MFI) can be nearly as challenging as getting customers to embrace the products but the OPTIX project helped one MFI in Vietnam address its marketing problems by connecting it with a peer in Bangladesh that had overcome this hurdle.

The Capital Aid Fund for Employment of the Poor (CEP) was founded in Vietnam in 1991 as an unregulated nonprofit organization to offer credit to people on low incomes in the Mekong region of Vietnam. Over 27 years of operations, CEP had established a strong, credit-focused identity, which drove admirable results for its clients and for the institution.

CEP realized, however, that its clients had financial goals beyond credit and it undertook a decade-long transformation to become a regulated MFI, expecting that term deposits would be a good and stable source of funding while meeting client needs. In October 2016, CEP launched a term deposit product but quickly learned that its solid foundation as a lender was now an obstacle to convincing clients that term deposits should be an important product in their portfolios.

In rolling out the term deposit, CEP discovered that its strong MFI identity and culture meant that many loan officers found it difficult to convince clients of the merits of the new savings option. From the client’s perspective, CEP had always been a lender; they had never asked whether CEP was a safe place to store their money. The key to overcoming this problem of perception was in the hands of the loan officers, who needed to become true financial product agents. CEP realized the problem and today has made real strides in building a savings base.

Since October 2017, CEP has opened 2,291 accounts with average balance of US$3,396 per individual account. In the first three months, there were more institutional accounts than individual ones but that trend has shifted. As of April 2018, there were 311 newly opened individual accounts.

In making this progress, CEP took action on three key areas: improving loan officer appreciation of the new product; providing clearer lines of responsibility; and improving customer targeting.

Changing the staff mindset

CEP began to transform its image and culture by addressing simple marketing problems. They sent their top employees to marketing courses, hired a marketing consultant, and hosted multiple trainings to teach their staff how to promote term deposits. Simultaneously, CEP formed an internal marketing team to change CEP’s branding to be recognized as a serious microfinance bank worthy of managing clients’ deposits.

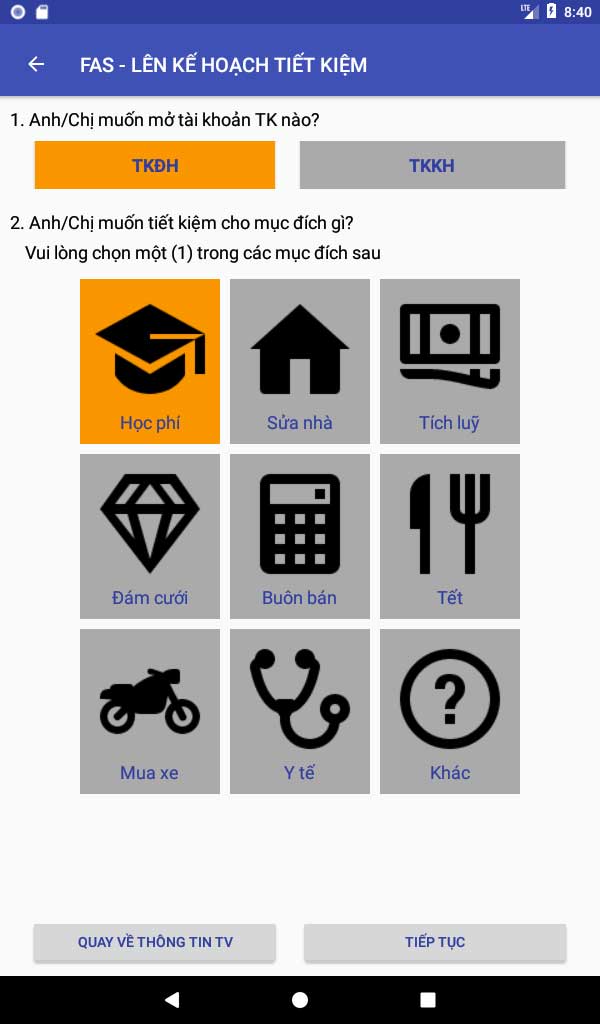

Even with this attention, the team still found that loan officers struggled to explain the product to clients. Turning to the OPTIX project, CEP representatives visited SAJIDA in Bangladesh to learn more about SAJIDA’s term deposit product and its Financial Service Advisory (FAS) app they developed to support loan officers also making the switch from a credit-only institution to one that promoted the benefits of savings. The app aids officers in explaining the product and helps clients set goals and by displaying expected interest earned. CEP realized the utility of this tool and it launched its own FAS app (figure 1). CEP added a new feature that allows loan officers to create term deposit plans (i.e., deposit amount, deposit date, and goal for savings) with clients, monitor the plans, and set up future reminders. The FAS app has now rolled out to all branches.

Re-assign responsibilities to manage the new term deposit product

Additionally, to help transform the identity of CEP, the management team appointed three employees at each branch to take responsibility for the term deposit process. While all loan officers are responsible for introducing the product to current clients and attract new customers, only three term deposit specialists are directly involved in the transaction process at the branch. One person is assigned to help with registration, one acts as a controller, and one serves as an accountant. These appointments mean that all CEP branches have at least one staff member present at the branch to serve customers exclusively on deposits. CEP is monitoring and evaluating the effects of three-person model, particularly on productivity and operation efficiency.

Targeting customers appropriately

Changing the perception of CEP as a credit-only institution is not only applicable to new clients but also to CEP’s existing clients. The CEP term deposit is designed to reach the low-income (specifically moderate poor level and above) households that might be saving in the form of gold or that have term deposits at another bank. Using the OPTIX methodology of data-driven decision making, CEP was able to identify target customers as those who have more than VND10 million (US$434) in their voluntary savings accounts (approximately 16 percent of their current portfolio). Based on this finding, loan officers have been able to focus on targeting customers that are able and have the means to save within their current customer base.

CEP’s experience has shown that identity lies at the heart of cross-selling and that any shift from familiar territory into the unknown requires steps that address internal culture and attitudes as a first step toward effectively promoting new products. OPTIX helped CEP confront the culture issue by connecting it to SAJIDA’s knowledge and expertise, helping perhaps shorten the pains associated with a major shift in identity and business focus.

BFA and MetLife Foundation created OPTIX to support financial institutions in building better portfolios of products for their low-income customers. Starting in 2016, OPTIX has partnered with four financial institutions in Mexico, Colombia, Vietnam and Bangladesh to better understand the benefits of cross-sell strategies for the businesses and their clients.