How fintech startups should pursue B2B partnerships

For many fintech startups, particularly those in the insurtech space where high levels of trust are essential, business-to-business (B2B)...

Press Release: Announcing the $4.3M Catalyst Fund Inclusive Digital Commerce Accelerator in Ghana to improve the financial resilience of informal MSEs

ACCRA, Ghana, 19th October, 2020 – Catalyst Fund, managed by BFA Global, in partnership with the Mastercard Foundation and...

Are we there yet? The evolution of fintech regulation in Nigeria

Nigeria is a hotspot for fintech innovation in Africa as investors and startups respond to Nigeria’s positive environment for...

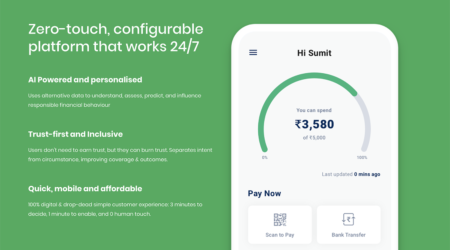

Meet KarmaLife, bringing financial services to gig workers in India

Digital platforms in India will employ 15 million people by 2021. While these gig-workers are not formally employed by...

Meet Flex Finance, the solution to digitize Nigerian SMEs

Flex Finance provides SMEs in Nigeria with a simple mobile app to track, optimize, and gain insights from...

Every action counts: Making financial services available to refugees

In a time of global uncertainty, it has become crucial to continue to raise awareness about the plight of...

When hustling fails: The impact of coronavirus mitigation efforts on ordinary people’s livelihoods

Originally posted on the FSD Kenya Website, April 6, 2020 Unlike many Kenyans, Esther in rural Makueni is not...

New lives, new tools: The financial lives of refugee communities

Observations by BFA Global based on initial field research Access to financial services and a steady source of income...

Refugees and their money – understanding the enablers of the camp economy in Rwanda

In Rwanda, financial inclusion allows low-income households to build assets, mitigate shocks and make productive investments. It also stimulates...

From Ideas to Field Tests in 4 Days: A Design Sprint for Refugee-Centered Financial Services

In June 2018, BFA Global, a global consulting firm led a four-day design sprint for financial service providers (FSPs)...