Toolkit assists government agencies to design AML/CFT SupTech roadmaps

The capacity to adopt Supervisory technology (SupTech) solutions varies widely. Anti-money laundering and combating of financing of terrorism (AML/CFT)...

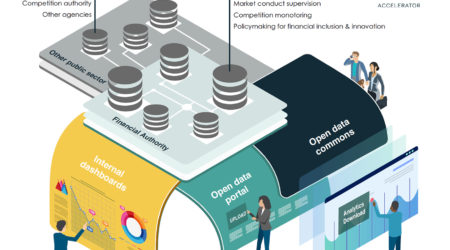

The DataStack blueprint

The DataStack, introduced below and elaborated on in our more detailed report, is both (a) a map...

The “DataStack”: A data and tech blueprint for financial supervision, innovation, and the Data Commons

Digital transformation of the financial sector has been driving financial inclusion and innovation . Better connectivity, cheaper mobile technology,...

R²A Podcast: Bringing New Technologies to Financial Authorities

Simone di Castri, R²A Managing Director, spoke with Sean Creehan and Paul Tierno of the Federal Reserve Bank of San...

The RegTech for Regulators (R²A) process

The purpose of this working paper is to share the RegTech for Regulators Accelerator’s (R2A) approach, process, and tools...

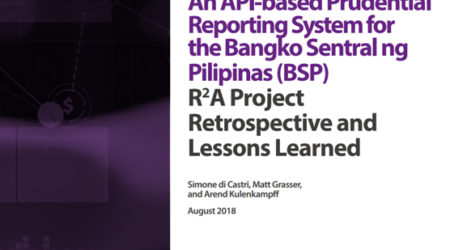

R²A CASE STUDY: API AND VISUALIZATION APPLICATION PROTOTYPE

The Bangko Sentral ng Pilipinas (the Philippines Central Bank, or BSP) Supervisory Data Center (SDC) was receiving incomplete, late, and...

R2A Trials Data Warehouse For Mexico’s CNBV to Boost the Fight Against Money Laundering

R2A teamed up with local tech vendor Gestell to create a data warehousing platform, fed by application programming interfaces...

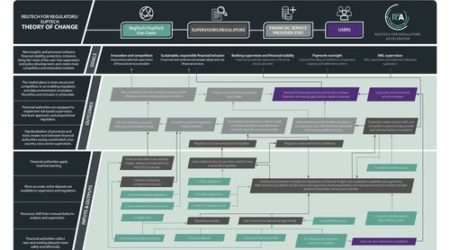

R²A Theory of Change – Infographic

This set of infographic resources cites the potential benefits of RegTech for regulators. Limited capacity to analyze data, inadequate...

The State of RegTech: The Rising Demand for “Superpowers”

Most financial authorities collect data monthly or quarterly or as needed. The infrequent nature of data collection is a...