Fintech forests: classifying and comparing fintech ecosystems

Blog 2 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

A creative approach to startup financing: Graviti combines grant, debt and equity investment, linked to impact outcomes

It took Catalyst Fund portfolio company Graviti only two months to raise a debt round that will finance 600+...

Press Release: Announcing the $4.3M Catalyst Fund Inclusive Digital Commerce Accelerator in Ghana to improve the financial resilience of informal MSEs

ACCRA, Ghana, 19th October, 2020 – Catalyst Fund, managed by BFA Global, in partnership with the Mastercard Foundation and...

Inclusive fintech startups are pioneering products for the digital generation

The digital generation (aka netizens, digital natives, generation Z, millennials) is a rapidly-growing customer segment that has exacting user...

Women and youth may be weathering COVID better than others, but the most vulnerable are getting left behind

As the COVID-19 crisis continues to ransack economies across developed and emerging markets, expectations are that low-income people –...

Press release: Catalyst Fund and Greenhouse Capital announce Fintech in Focus event to discuss strategies for Africa’s tech sector to rebuild in a post-pandemic climate

LAGOS, Nigeria, August 25, 2020 – Catalyst Fund, the global inclusive fintech accelerator managed by BFA Global, supported by...

Are we there yet? The evolution of fintech regulation in Nigeria

Nigeria is a hotspot for fintech innovation in Africa as investors and startups respond to Nigeria’s positive environment for...

Rapid tech due diligence: How Catalyst Fund assesses a startup’s tech

Alongside product-market fit and adequate control of data, underlying tech quality is a key determinant of whether a startup...

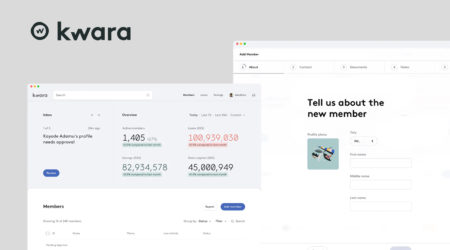

SaaS startup Kwara is helping SACCOs deliver during COVID-19

Savings and Credit Co-operatives (SACCOs) are the financial service backbone of the unbanked population in Kenya. While SACCOs increasingly...

Meet Paymenow, a financial wellness app helping South Africans escape debt cycles via access to liquidity

Paymenow gives low-income South Africans early access to the wages they have already earned, to smooth their income while...