Marco is a development economist with 20 years of experience. He is Director of Advisory LatAm at BFA Global, where he shapes program strategy, manages partner and donor relations, and leads research to advance financial health, MSE development, and inclusive finance.

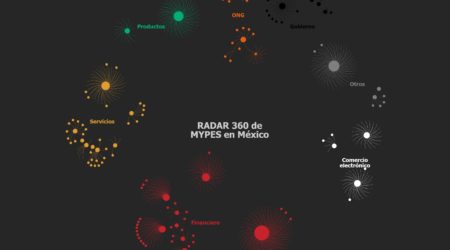

Currently, he directs FinnSalud 3.0, coordinating donor relations, institutional technical assistance, ecosystem building, and learning outputs. He led Strive Mexico to build evidence and practical tools on MSE resilience; co-led the CIFAR Alliance’s Measurement for Climate Resilience Working Group; and has overseen projects such as Santander-Tuiio Financial Health, impact research for the Inclusive Digital Commerce program in Ghana, and gender-intentional regulatory studies with CGAP.

Prior to joining BFA Global, he served as Managing Director for Financial Inclusion at Mexico’s financial regulator (CNBV), where he steered the National Strategy for Financial Inclusion and the National Survey of Financial Inclusion (ENIF); at Financiera Rural, he managed planning, research, and evaluation for programs within the rural-finance credit portfolio; and at the Ministry of Social Development he contributed to strategic planning and assessment of social programs.

Marco specializes in inclusive finance, financial health, MSE development, rural financing, social development, and gender-intentional approaches, with strengths in data analysis and survey design, monitoring and evaluation, impact-narrative and insight generation, financial regulation, multi-stakeholder leadership, ecosystem building, and public speaking. He holds an MSc in Public Policy (CIDE) and a BA in Economics (UAM), completed an exchange at Carnegie Mellon’s Heinz College, is pursuing an MITx MicroMasters in Data, Economics, and Policy Design, has executive certifications in Financial Inclusion from the Fletcher School (Tufts), Digital Finance from Fletcher School and the Digital Frontier Institute, and Leadership in Financial Inclusion and Gender from the Saïd Business School (Oxford). He holds diplomas in statistics and econometrics, social and rural development and sustainable finance.