How is Client Centricity Shaping Financial Services for the Low-Income Consumer?

In the current financial services industry, customer experience has become a key differentiator across brands. Today’s customer has more access to information and expects better services. The ability of institutions to deliver services that are convenient, efficient and accessible distinguishes leaders from the laggards.

Since 2013, The MasterCard Foundation has hosted a Symposium on Financial Inclusion (SOFI) with a thematic focus on clients. BFA has long attended SOFI, with David Porteous, BFA’s CEO and Daryl Collins, BFA’s Managing Director providing insights on BFA’s work in client engagement at each of the Symposiums. This year, Daryl Collins and several members of our staff attended the Symposium in Kigali.

BFA had the opportunity to facilitate an alternative delivery channels (ADC) roundtable on behalf of The Foundation. The Roundtable brought together 50 financial service provider (FSP) practitioners to discuss challenges, opportunities, results and solutions related to the development and rollout of ADCs, such as mobile and agency banking. The Roundtable discussions examined client centric issues around building client trust and confidence in ADCs. There was also a candid analysis of returns on investment in ADCs and a lively debate on the optimal approach to managing Agent Networks. BFA has expertise in engaging FSPs globally to answer questions on improving the business case for savings, especially the deployment of ADCs and facilitating a workshop on trust and the customer journey during SOCAP16.

The Roundtable was a result of BFA’s collaboration with The Foundation in 2016 as a learning partner focused on consolidating learnings across six networks or “aggregators” and thirty FSPs that are deploying ADCs, including UNCDF and its MicroLead partners. In addition to working closely with the networks and local FSPs themselves, BFA is working directly with key industry and Foundation stakeholders such as MiX Market to further test the value proposition of a set of ADC tools, including a performance monitoring dashboard and costing methodology. The 2016 learning process will allow BFA, The Foundation, and MiX to identify further areas for testing and intentional learning, sharing of best practices, and dissemination. For customers, ADCs are likely to improve access to financial services by reducing costs, saving time and improving convenience and proximity.

Building on that theme, other key takeaways from the Symposium include:

● Digital finance can be a driving force for financial inclusion and growth

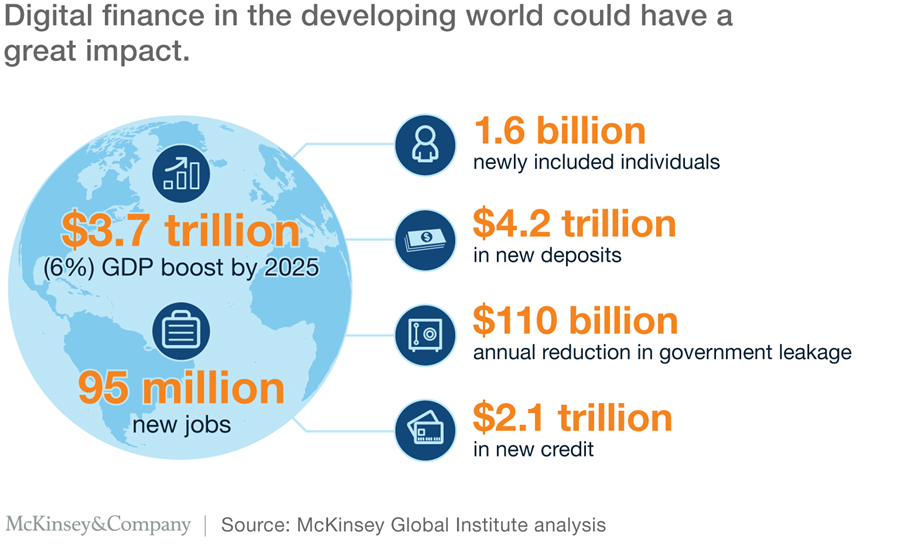

Digital finance has the potential to enable billions of people to access financial services, and thus drive economic growth. But this can only be achieved through the joint collaboration of financial services players working together and using digital products and channels to reach low-income customers. Ann Miles, Director, Financial Inclusion and Youth Livelihoods at The MasterCard Foundation and a few of the other speakers referenced statistics from the Digital finance for all: Powering inclusive growth in emerging economies report by Mckinsey Global Institute illustrated in the infographic below.

As an example, Hello Paisa, a low cost international money transfer solution for remittances showcased its work at the Symposium and was awarded the second Clients at the Centre Prize for its role in promoting financial inclusion by facilitating money transfers for foreign workers.

● Data analytics are essential to understanding today’s customers

Data analytics enables institutions to harness their data and derive value from it. Data analytics provides FSPs with actionable insights into customers, markets, channels and products. FSPs have an opportunity to stay ahead of their competition by using data analytics to understand their customers, develop the right products for different segments and at the same time maintain regulatory compliance.

CEOs of our FIBR partners, ITC & Nomanini who employ data analytics techniques in their work also attended SoFi. There were, however, very few regulators at the Symposium, who are key stakeholders in the ecosystem. Given the current prominence of Regtech, the Symposium is equally relevant to the work of regulators. We hope to see future events where regulators help shape the narrative.

● The adoption of fintech is changing financial services

Innovation and technology have brought about change in the financial services sector. Fintech startups are redesigning financial services processes making them faster and easier to use. To keep up, traditional FSPs have to refresh their thinking and adopt fintech solutions that will meet customer demands, improve customer experience and build customer trust. This can only be done by forming partnerships and creating alliances with fintech startups to enable FSPs to deliver financial products that meet the needs of customers.

SoFi examined different approaches on how FSPs can offer client centric services from the use of ADCs, digital finance, data analytics to the adoption of fintech. To succeed, it is now up to FSPs to embrace the provided models and redefine their customer relationships. The importance of client centricity, fintech and the disruptive nature of digital finance in the financial services sector are very much along the lines of BFA’s thinking in financial services for the low income consumer. For example, our FIBR project with The MasterCard Foundation seeks to learn how to transform emerging data about low income individuals and link them to financial services by working with technology partners that touch the lives of underserved customers. Through the Catalyst Fund, we have created the Customer Trust workshop for inclusive fintech startups, which focuses on building trust by identifying how to build trust and maintain it along the customer journey. Finally, the African Fintech Unconference we are planning for March 2017 in partnership with Nomanini, will explore the regional fintech ecosystem. Set in Accra, two of the tracks will focus on customer engagement and partnership building for digital financial services players.

Learn more by following @BFAGlobal on Twitter.