Who are the Small Merchants Who Make a Real Living Instead of Just Making Some Extra Money?

Certain Behaviors Can Help Providers Unmask a Business’ Readiness for Financing

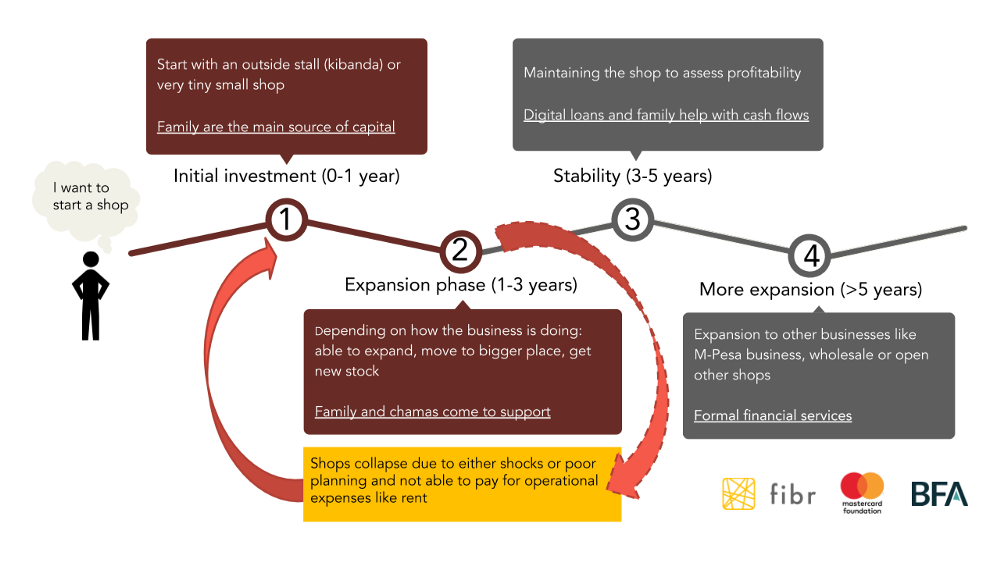

We previously explored the life cycle of a shop to help Financial Service Providers (FSPs) recognize when a merchant may want to expand her business. Beyond life stages, there are also two types of businesses to recognize when considering what type of financial services to offer: livelihoods and side-hustles. While livelihoods serve as the primary income for the business owner, side-hustles serve a different function.

A business is a side-hustle when it provides only supplemental income to the business owner. These businesses provide extra non-essential income and serve to pass free time.

A side-hustle is a common practice to make extra cash in one’s spare time, sometimes seasonally or outside a regular day job. In Kenya, typical side-hustles include running a shop, selling food & clothing, or providing services such as hair styling, make-up, photography, event management, sales, or marketing.

It is important for Financial Service Providers (FSPs) to recognize side-hustles because their owners are not likely to grow their businesses. On the other hand, when the business is a primary livelihood, owners will be more motivated to move into the secondary expansion phase of the shop life cycle we observed in our research. FSPs may be tempted to use the level of inventory to evaluate a shop, but inventory is not a good indicator of what is going on behind the scenes. Instead, to distinguish a side-hustle from a livelihood, FSPs instead should look for:

1. Evidence of Operational Tools

Merchants who treat the business as their primary source of income are more likely to keep some type of records, especially with regard to credit given to customers as well as accounts payable to suppliers. These records are not always clear and detailed — for example, they may include only category inventory and not list sales — but they are a good indicator that the merchant understands she needs to keep records to track the revenue/profitability of the shop. These merchants also understand the importance of keeping their shops open at regular hours, and are more likely to have up-to-date permits.

On the other hand, merchants with side-hustles are less likely to keep records and may use estimates to evaluate their revenue/profits. More likely than not, they have expired permits or no permits at all.

2. Independent Decision Making

Who makes the decision in the business? When the owner makes decisions independently, it is likely that the shop is a primary livelihood. In this case, the owner will decide what to do with the profits, whether to have employees, and whether to expand the business or stock a new product on her own.

However, merchants who treat the shop as a side-hustle are rarely the key decision makers. Husbands or other family members ultimately make decisions about how the business should be run. We saw merchants call their husbands to confirm if they should take a new product and observed family members pass by in the evening to see how the day went to identify any issues that warranted the family’s attention.

3. Use of Formal Financial Instruments

Merchants with livelihoods are more likely to use formal financial services such as a bank or an microfinance institution (MFI) to save or for business finances. They understand the need to separate personal money from business money; they may not do it diligently but they understand the importance. They are also more likely to use digital loans like M-Shwari or KCB M-Pesa to store and borrow money. Their loan limits on both platforms are more likely to be above USD $100. They use the loans to ease cash flow problems and are working to increase their limits for times of need.

Those with side-hustles do not separate their business finances from their personal finances. Even when they have formal financial services, they do not use them and instead rely on informal financial instruments — e.g., savings groups and family and friends — to help with cash flow. They rarely use digital loans and, even when they do, have low loan limits (less than USD $10).

4. Low Resiliency

Unfortunately, even though people rely on them more, livelihoods are less resilient to shocks. These businesses tend to collapse after a health scare or a family crisis since they do not have additional sources of support. Last year, because of the general elections, we saw that many shops were not able to recover from the upheaval and owners had to start all over again.

By comparison, shops that are side-hustles are better able to handle shocks as they do not have to rely on only one source of income. In most cases, other family members have a stable or regular income that can provide support during shocks or if the business is not doing well.

What does this mean for FSPs?

FSPs should tailor their services based on the needs of the shopkeepers, recognizing their type and the life stage of the shop. Those with side-hustles will want to stay in the stabilization phase and will need insurance products and inventory credit. Owners of livelihoods will want to enter the secondary expansion and should be targeted for digitization and bigger loans. These merchants can benefit from a wider range of services to help them with shocks as well as advice to grow and improve their operations.

Learn more about our ongoing MSME research by signing up for our “Hitting the Sweet Spot: What do small merchants need to survive and grow their business?” webinar and follow us on Twitter @FIBR_BFA.