Can inclusive fintech be the answer to climate resilience for underserved populations?

Climate change has already had a negative impact on the lives and livelihoods of billions of vulnerable, low-income, and marginalized communities in emerging markets — those who have contributed to climate change the least. In the short-run, these populations are the most exposed to climate risks because they are more likely to rely on the physical environment for their livelihoods and domestic food consumption, are more likely to live in climate disaster-prone areas, and have more of their wealth in physical assets prone to destruction during climate disasters. Moreover, these populations are also the most likely to be excluded from formal financial services and likely do not have access to social or financial safety nets.

Globally, innovators are working to build solutions designed to decrease the rate and severity of negative climate change impacts, and enable communities to bounce back from climate shocks. These solutions include technical fixes like more sustainable materials and inputs, methodological solutions like irrigation and leveling, as well as new financial instruments like climate-related insurance. However, many are not yet accessible to the populations most at risk. Digital finance innovations hold the potential to overcome several barriers to uptake and usage for these solutions, and at BFA Global we are particularly excited about what we see as significant opportunities at the nexus of fintech and climate resilience.

Available solutions can be mapped to three functions, according to the way they help users:

1. Understand risks

One group of solutions is designed to help vulnerable people better understand the risks they face, and take advantage of better, more precise predictive systems. These can include warning systems, weather forecasts, hazard mapping, and remote sensing. All of these solutions can help people understand what is on the horizon, where their vulnerabilities lie, and what to expect when climate change impacts occur.

2. Adapt to risks

The second group of solutions is designed to help people adapt their dwellings, livelihoods, and assets to these risks so that they can become more resilient, flexible, and durable. Such solutions can include improved, more sustainable building materials and architecture, irrigation and water management systems, climate-resilient seed and other inputs, and other land and home improvements.

3. Protect against risks

A third group of solutions seeks to protect households and small businesses against the economic impact of such risks, namely by enabling them to improve their financial health and resilience via products like savings, credit, and insurance. Such financial services can help families manage downside shocks, preventing them from falling into poverty due to illness, natural disaster, or another event.

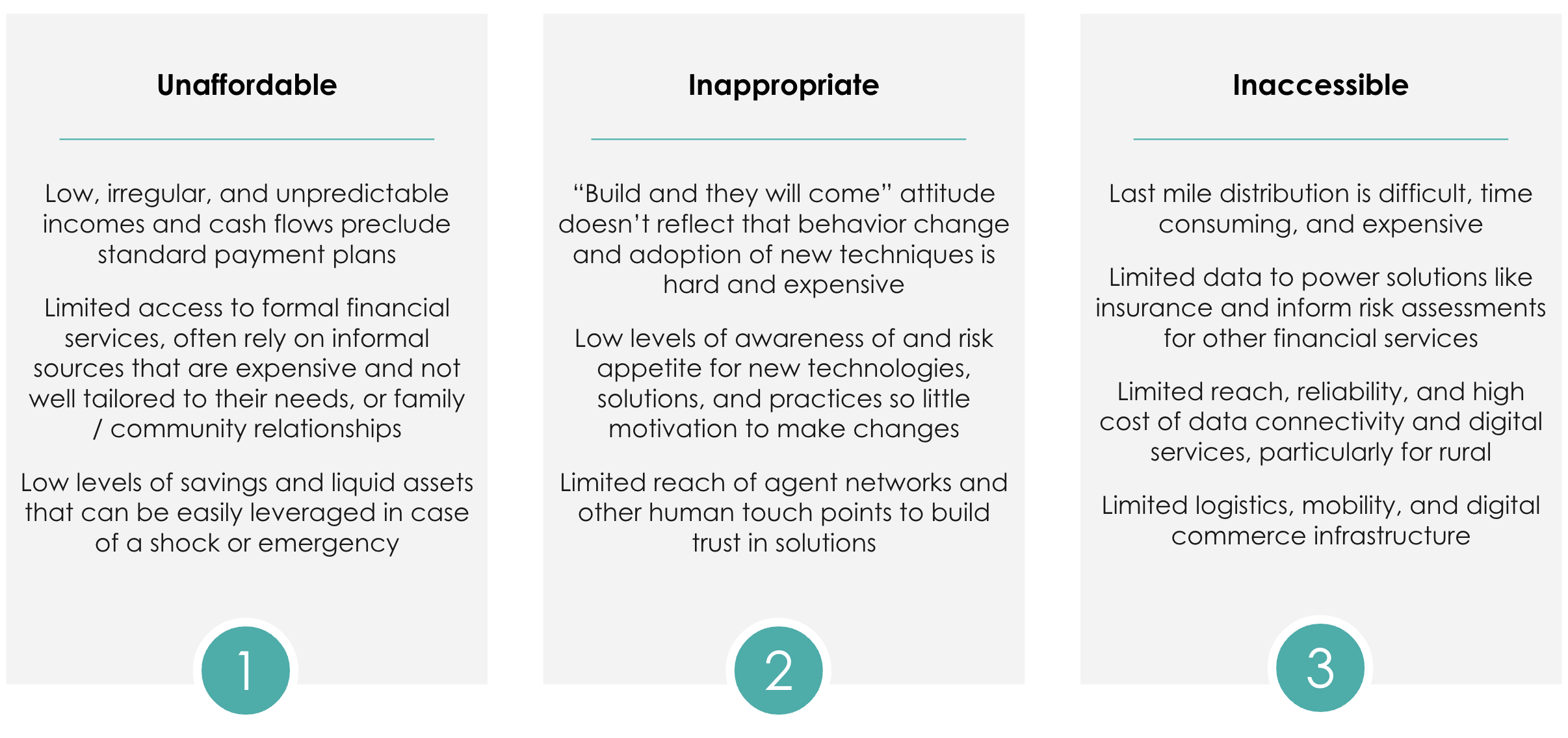

Unfortunately, for the vast majority of climate vulnerable populations, these solutions are not particularly inclusive, given barriers to cost and access. Catalyst Fund defines inclusive solutions as those that are AAA – affordable, accessible and appropriate – for low-income individuals and small businesses.

Many climate resilience solutions, particularly those focused on innovations in materials and improvements to existing structures or farming practices, are expensive and specialized; they remain out of reach for most rural, vulnerable households. Furthermore, most are designed with a “build it and they will come” attitude that does not account for low awareness and literacy, or the difficulty of changing embedded routines. For example, scaling the uptake of drip irrigation has required extensive education in the form of demonstration plots, support for installation and maintenance, and other extension services, even though the benefits from the solution are undeniable.

Finally, even when solutions are affordable and tailored to remote, low-income, or rural households, they may not always be accessible. Last mile access and logistics are difficult in these areas, and getting solutions to these households may imply huge mark-ups or may not even be possible if adequate communication and logistics infrastructure is not in place.

Inclusive fintech innovation can help solutions reach the most vulnerable

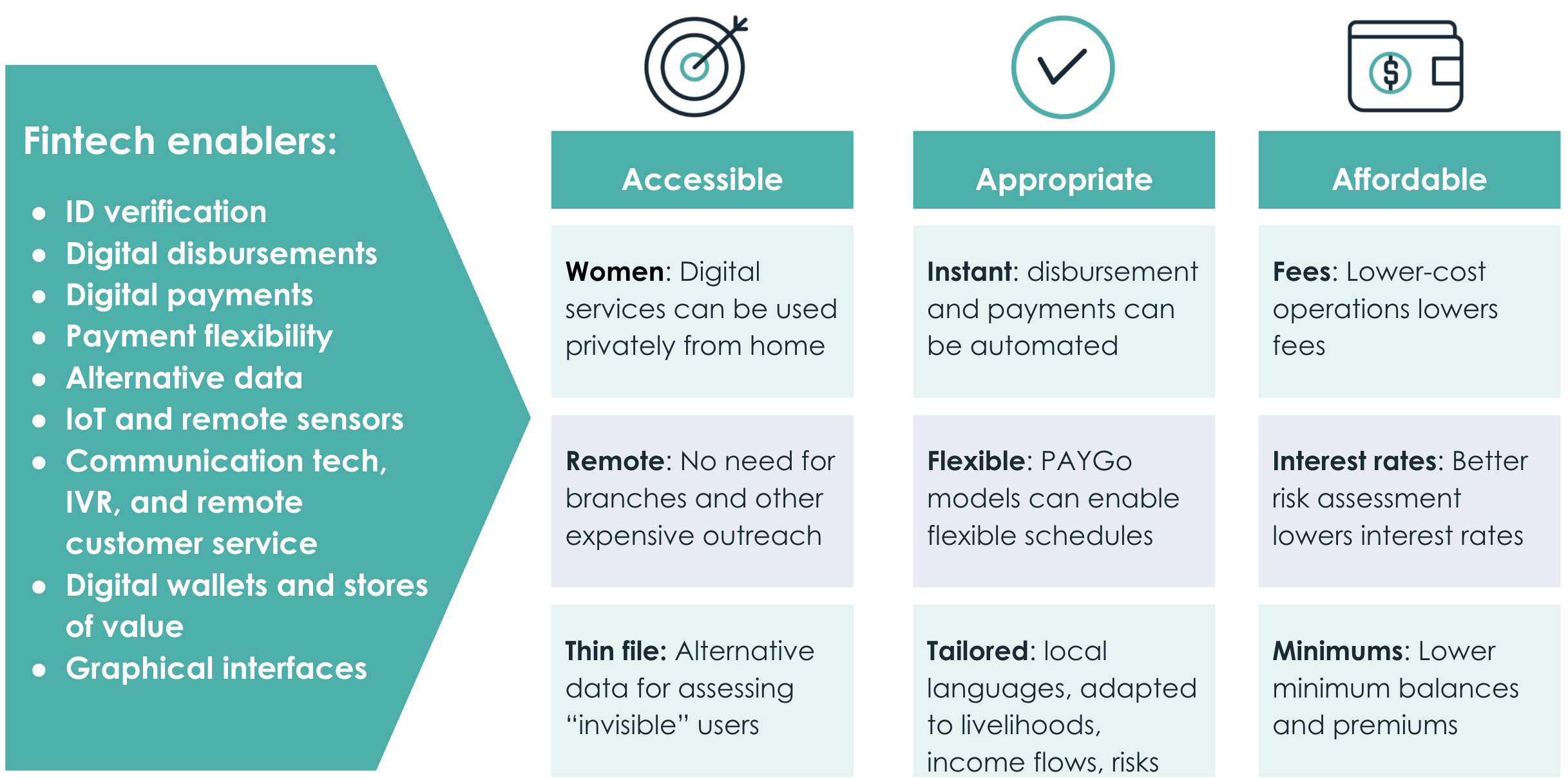

Fortunately, rapidly-growing, fast-moving inclusive fintech innovations present an opportunity to address some of these barriers among vulnerable populations – particularly the rural, coastal, and urban poor – who are also the most likely to be excluded from financial services. The barriers that have prevented them from accessing climate resilience solutions are precisely the barriers that inclusive fintech solutions have sought to resolve via a diverse set of enablers like digital payment rails, digital ID, and alternative data.

Fintech enablers can help make financial services – and other, adjacent products and services – more accessible, appropriate, and affordable by enabling them to reach remote or thin-file populations, allowing for more tailored, flexible offers that suit the needs and behaviors of these populations, and by bringing down operational and transactional costs to make products more affordable.

For example, fintech innovations in the mobile money ecosystem – from software innovation, to use of agent channels to improve reach, to innovative regulation, to new business models – have resulted in significantly improved digital financial inclusion, in the form of 1.2 billion mobile money accounts, 300 million of which are active each month. Almost half of these accounts are in sub-Saharan Africa, suggesting that many account holders were previously excluded from formal financial services. When fintech enablers like digital payments are coupled with products and services that enable access to energy, education, and healthcare, these too can become more accessible, appropriate, and affordable for underserved populations.

Inclusive fintech for climate resilience

Inclusive fintech can address many of the barriers preventing wider adoption of climate resilience solutions because we’ve seen innovations in financial inclusion and financial health, as well as PAYGo solar, successfully serve the same vulnerable populations.

Inclusive climate resilience innovators can use digital technology and a deep understanding of the needs and behaviors of low-income populations to provide accessible, appropriate, and affordable climate resilience solutions for these underserved populations in one of two ways:

1) Applying fintech solutions to climate challenges faced by vulnerable populations

In this case, inclusive fintech solutions that are already reaching low-income populations, in some cases at significant scale, can be leveraged to help improve the reach of climate resilience solutions. Here, fintech can be used as a vertical layer, whereby a financial service or product — like savings, credit, or insurance — can be designed specifically to cater to a climate risk.

Parametric insurance is a well-known example of a financial solution tailored to climate risks. These providers leverage data to automatically make payouts to a policyholder digitally when a specific, pre-defined climate event occurs, such as a flood or hurricane. Innovators like Pula are able to offer these solutions to smallholder farmers in Africa, for example, by using remote data collection methods, advanced data analytics, and machine learning to assess a farmer’s risks and exposure and tailor the policy features to their needs.

These insurance providers use data from a wide range of sources, such as satellites, weather stations, and soil sensors, to monitor and measure weather changes and other risks, and in many markets can send payouts directly to a rural smallholder’s mobile money account in the event a covered event occurs. Thanks to fintech enablers, Pula and similar providers can offer affordable parametric micro-crop insurance to vulnerable populations, at scale.

Another example is myAgro, which enables farmers to purchase quality, climate-resilient agricultural inputs and extension services on ‘mobile layaway’ – by saving toward a larger purchase in small increments, over time. Farmers contribute to their savings digitally by purchasing scratch cards – the same way they top up their mobile phones with airtime – which they can access via the same mobile money agents. They buy scratch cards throughout the year, and when they reach their savings goals they will automatically be delivered a set of quality inputs before the first rains.

Scratch-card savings is an example of an inclusive fintech solution, designed specifically for low-income users that have a lumpy and uneven income distribution throughout the year and may find saving through other means difficult as other unexpected expenses arise. This savings product leverages the mental model of buying scratch cards for phone credit, allowing users to easily understand and start using it, and saves the money digitally.

2) Embedding fintech solutions into climate products and services

In the second case, there may be existing climate resilience solutions that can transform the lives of the underserved, but they are not yet reaching the people who need them most. Fintech can be embedded in these solutions as a horizontal layer, acting as an enabler to improve their access or affordability.

For example, companies providing solar home systems, such as M-KOPA, have leveraged fintech innovations like mobile money and remote sensors via PAYGo models to provide improved energy access to 83.7 million people globally, 8 million of whom were previously underserved and offgrid. The success of PAYGo solar and other embedded inclusive fintech models suggests that this could also be a powerful mechanism for expanding access to climate resilience solutions.

Another climate resilience solution that has extremely low penetration but potential for high impact on climate resilience is irrigation for smallholder farmers. However, smallholders often lack access to the financial services needed to purchase water pumps and irrigation equipment on credit, given the high cost for traditional financial institutions to extend their reach into rural areas. Or, if there is credit available, they are unlikely to have financial data and a credit history to access it or may be charged exorbitant interest rates due to high perceived risk.

By combining inclusive fintech innovations like digital payments, remote sensing and lockout technology with innovations in farming equipment, companies like SunCulture, for instance, are able to offer flexible financing to unbanked, smallholder farmers in Kenya to purchase a high quality solar water pump and micro-irrigation kit.

Looking ahead

Climate resilience solutions will require a combination of data, financing, and technology innovations in order to effectively scale and replicate. Looking ahead to the challenges of the next 5 years, we see the potential for inclusive fintech ventures and technologies to significantly impact one of the great challenges of our time – climate change.

In future blogs we will explore in more detail how the climate resilience ecosystem might learn from the development of the inclusive fintech sector, and announce BFA Global’s new work at the nexus of inclusive fintech and climate resilience.