How micro- and small enterprises (MSEs) leveraged informal financing and digital technology during the COVID-19 pandemic in Zambia

Introduction

The COVID-19 pandemic has resulted in drastic declines in revenue for micro- and small enterprises (MSEs) in Zambia. BFA Global and FSD Zambia surveyed business owners in the MSE sector to identify the driving forces behind the changes in revenue they experienced, and determined the role informal financing and digital financial services played in their road toward recovery. The interview occurred between June 2020, two months into the pandemic, and November 2020.

In this blog post, we share three insights into Zambian MSEs based on the surveys. First, Zambians were more likely to raise money informally — through friends and family — than through banks or the public sector. Second, the businesses that managed to succeed during the pandemic became more and more concentrated in the service sector over time. Third, Zambia’s micro- and small businesses did not make the leap into digital sales or payments to address shortfalls in revenue.

We know that in Zambia, many businesses have been devastated by COVID-19, and some fear that they will be unable to continue in 2021, with businesses in the transport sector particularly pessimistic. BFA Global and FSD Zambia have recently shared insights previously about how the pandemic has affected Zambian SMEs, based on our own survey data.

The story of declining revenues among MSEs in Zambia shares many features with other countries around the world. Official policies limited mobility and impeded access to marketplaces in efforts to prevent the spread of the virus. Customers sought to limit their exposure to the virus and consequently avoided markets, reducing foot traffic. This caused a drastic reduction in customers and revenues for MSEs, which remains a chief concern for many businesses. In addition, Zambia’s macroeconomic situation is dire. As November 2020 closed, the COVID-19 crisis was the tipping point that led Zambia to default on its debt obligations.

Methodology

Our survey was conducted through an online, web-based interview. The survey occurred in three waves, as part of a global research effort occasioned by the COVID-19 pandemic. The respondents were owners of micro- and small businesses, who were recruited through the Cint marketplace for market research panelists, with a total sample size of 560.

- Wave 1 included 170 business owners, collected from 11th to 17th June

- Wave 2 included another 202 business owners, collected from 15th to 30th September

- Wave 3 included 188 business owners, collected from 5th to 20th November

Male and urban respondents represent a majority of the sample, due to the demographics of respondents from online market research panels. Respondents were 67 percent male in wave 1, 66 percent male in wave 2, and 61 percent male in wave 3. The sample was 64 percent urban in wave 1, 71 percent urban in wave 2, and 73 percent urban in wave 3. The rural percentage of respondents was constant at 8 percent in all three waves, and the remainder was peri-urban. The geographic representation of panelists by regions within Zambia is not specified as it would be for other countries in the Cint marketplace, due to the dearth of available respondents. Consequently, the study should not be interpreted as representative of the national population, nor of the national population of micro- and small enterprises, but rather as a specialized survey sample that remained feasible during the global COVID-19 pandemic.

Context

According to Google’s mobility data (Figure 1), Zambians have responded to COVID-19 like many others around the world by largely staying away from public spaces and occupying private spaces (1). Immediately after Zambia recorded its first case of COVID-19 on March 18th, 2020, Zambians largely stayed at home and avoided public spaces.

Beginning in June 2020, Zambians began to move back into public spaces, and by July 2020, Zambians were grocery and retail zones had regained a similar level of traffic and time spent as they had before the crisis. The same mobility data show that Zambia’s transit locations also reached pre-pandemic levels of presence by mid-December, yet workplaces remained nearly ten percentage points below baseline. (Because Google Mobility data are not seasonally adjusted, we do not report data after December 21.) The abandonment of workplaces has far-reaching implications for micro-entrepreneurs and the small businesses who depend on them. As demand shifts away from business districts, MSEs must pivot to new business models and new service models. This requires time, new information on client behaviour changes, and capital.

Google Community Mobility reports are provided Google to the public as a measure of how individuals’ geolocation has changed during the global pandemic (see documentation here). The data represent these patterns as a measure of time spent in certain types of locations: residences, workplaces, parks, retail, grocery, and transit. For an individual, the data might represent hours spent at home, at an office, in transit, at a park, buying food, and running an errand. These times are then aggregated for the population and compared to a baseline day. When the percentage of time in the residence exceeds the baseline, the percentage increase is reported as a positive value in the mobility report. When the percentage is below the baseline, the percentage decrease is reported as a negative value in the mobility report. Thus, over time, the mobility reports, measure the aggregate time spent by the population in six types of locations. Of these types, we have focused on grocery, retail, and workplaces as most relevant to MSEs.

The pandemic in Zambia began in April. Zambia recorded its 100th official case on 30 April 2020 (see Our World in Data). Its first death was recorded on 2 April, and the 100th death on 17 July 2020. Zambia’s fortunes in the pandemic have been mixed. It has seen lower case totals and lower prevalence of the virus than larger and harder-hit economies, including the United States, Brazil, and South Africa. Yet, despite a gradual decline in cases from July to the end of November (the time when the bulk of our data collection occurred), a tragic acceleration of the pandemic is now underway. New cases per day accelerated from single digits in December to more than 70 in January, and the test positivity rate rose from under 1 percent to as high as 14 percent. The best news in the public health data has been a steady decline in the case fatality rate, which dipped below 2 percent since mid-December.

Accessing financing: funding has been inadequate for SMEs during the pandemic

Liquidity constraints are key in understanding how businesses in Zambia have been affected by COVID-19.

Businesses face severe liquidity constraints, as shown by survey data that documents how they tried unsuccessfully to raise funds in order to ride out the downturn. Most businesses remain in need of capital, with 70 percent of those we surveyed reporting that they were unsuccessful in obtaining funds for their businesses at all. Only 9 percent said they had no need for capital or had been able to raise adequate funds. Just half of those, or 5 percent, had succeeded in raising funds for the business.

From June to November, the proportion of businesses with access to any loans in our sample fell from 35 to 27 percent (Figure 2). The dearth of working capital prevents businesses from buying inventory, placing advertisements, and hiring workers. Consequently, MSEs in Zambia will be less able to make the necessary investments to get back to work as soon as public health conditions allow. Nonetheless, the collapse in foreign exchange rates, inflation nearing 20 percent, and border closeures will make these measures all the more difficult to undertake.

Business owners draw on business funds to cover personal expenses

Businesses were not only starved of new capital, they also suffered cash outflows because owners required funds for personal use. Zambian business owners reported having to withdraw cash out of their business for personal use to cope with the pandemic (Figure 3). This suggests that the liquidity constraint became binding as the pandemic progressed across the three waves. Moreover, there are interesting patterns in the proportion of business owners who took cash from the business, and how much they withdrew for personal reasons.

Business owners who described their work as taking a salary from the business that they own were among the least likely to have tapped business funds for personal expenses in 2020. For microenterprises, it is common to commingle personal and business funds; but larger businesses may pay owners a fixed salary. We ask all business owners if they have withdrawn funds from the business, which could construe either a microenterprise diverting funds from investment to consumption, or a small business making special payments to owners for personal use.

We divided the MSEs in our sample on a spectrum of maturity, for lack of a better word, based on how the owners described themselves. One category consists of those who identify themselves as self-employed or owning their own business, when we asked their occupation. These we refer to as “self-employed.” In the second category, we include those who describe their livelihood as either a “salary or steady job,” or working in the farm sector. These individuals were screened out of the interview if they simply held a job for pay. They were retained if they described their income as the earnings of their own business, or a salary from their own business. This second category we refer to as, “salary and farm.” And the third category was made up of students and job seekers who were engaged in self-employment although it is not their main occupation. Casual laborers and self-identified gig workers were screened out of the interview and their responses were not counted.

The lens of maturity shows one aspect of which micro- and small businesses withdrew funds for personal use. The “salary and farm” entrepreneurs were less likely (62 percent) than the other categories (85 percent and 82 percent) to have taken funds from the business. It is tempting to think that this correlation is because of how agriculture and livestock businesses tie up capital. Once funds are invested in crops or livestock, they are not easily converted into cash. Yet the timeline of investment in farm businesses does not account for the whole story. The proportion of businesses in the agriculture sector that withdrew cash was only 10 percentage points less than in other sectors. Due to small sample size and the online interview format, we are reluctant to speculate further about the cause of this pattern.

SMEs turn to informal lenders to fill capital requirements

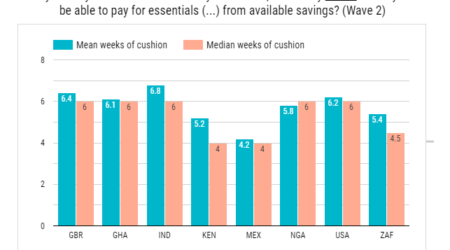

Informal lenders played a role in partially relieving constraints on bank lending, as businesses tried to relax these liquidity constraints. More than half of respondents in our survey said that they had invested their own money in the business. After that, the next most important sources of capital are friends and family or moneylenders. Bank lending is very rare, available to only 7 percent of our respondents in Wave 3. Friends and family have provided loans to more than one-third of the sample, and moneylenders are a source of funds for 14 percent. Government loans are not only rare, they have been farther out of reach for respondents in Waves 2 and 3 than in wave 1.

Bank lending did not ramp up to meet the capital requirements of small businesses. Instead, rotating savings and credit associations (ROSCAs), or chilimbas, provided an increasing share of this funding over time (Figure 4). ROSCAs go by many names around the globe, such as chama in Kenya or stokfel in South Africa (2).

Most other sources of funding remained constant through the three waves of the study, in the proportion of respondents that used them. The reverse trend was evident in MSE use of government loans. The Zambian government’s efforts, through the Bank of Zambia, to inject much-needed liquidity into the economy is helping businesses access much-needed credit; but with bilateral or intergovernmental support, these efforts could yet be deepened.

Key drivers for changes in SME revenue

Not all businesses faced a revenue decline

The fates of businesses in Zambia vary greatly. As of September, 74 percent of respondents experienced declines in revenue, and 22 percent had considered closing at least until the pandemic was over. Yet a few firms had found opportunities to thrive. From June to September, the fraction of respondents with any increase in revenues stayed roughly constant at 14 percent. Two trends that may indicate the cause of this increase bear some reflection.

Early in the pandemic, those businesses that provided essential goods to the market saw greater success. We asked businesses whose revenues had increased what sector they were in, providing a menu of responses including healthcare, home delivery services, and security. Although we thought that these responses would be the most interesting, it turned out that solid growth occurred in one of the other categories on the menu: essential services. Among businesses that did well, one in five (21 percent) were selling essential goods (see Figure 5 below). As public health restrictions limited movement and commerce, prices for goods increased. Those who were already in possession of inventory, therefore, could still sell their goods until their inventories were depleted, possibly even at higher prices. These advantages, however, did not persist.

By November 2020, just seven percent of businesses who saw increasing revenues reported that they were providing essential goods. Traffic to retail and grocery businesses had largely returned to normal (see Figure 1 above), so essential goods were no longer in high demand. Instead, it was those businesses that were able to provide essential services, rather than goods or security, that saw success. Essential services — other than home delivery, security, and healthcare — accounted for 52 percent of those who reported increased revenues in November. Because the pandemic necessitated new daily routines and new ways of doing business, the market for services has grown.

Figure 5. Essential services were responsible for an increasing share of rising revenues, while security and essential goods declined.Transport challenges contributed to layoffs, decline in revenue

The reasons for declining revenue, as reported by respondents, also evolved over time. But the proportion of respondents touched by these claims doesn’t tell us much about the economy as a whole. In June, there were more businesses who said their staff could not reach work (seven percent) than that transportation problems impeded their operations (2 percent). These other transportation problems could affect supply chains and customers’ access to markets alike.

By November, the fractions were inverted, with 7 percent citing transportation problems interfering with business and only 2 percent complaining that workers could not get to work. These views could be correlated with an overall pattern of layoffs common to small businesses in the BFA Global research series. The only period for which we have data on Zambia and other countries is June (Wave 1), when we conducted research in Zambia, Mexico, and Vietnam. At that time, we found that our sample included much larger businesses in Vietnam than in the other countries, with a median of 10 employees. Thus we don’t have a good comparative guide to employment trends around the world. Our samples in Mexico and Zambia both included small businesses with a median of 2 employees and a range from 0 to 50. Among businesses in Mexico and Zambia with employees prior to the crisis, the median percentage of employees laid off was very high: 50 percent in Zambia and 80 percent in Mexico.

The same underlying issue — originally expressed as the inability of employees to get to work — was not alleviated when businesses restructured to make due with fewer employees. Instead, transit problems found their way back to respondents through other channels.

The declining role of digitization and technology

Perhaps surprisingly, digital adoption was not a factor that contributed to the success of businesses that saw an increase in revenue from June to November. Digital adoption did not increase among all respondents; and it was not responsible for improvement in revenues. To the contrary, digital payments use by micro- and small businesses declined from 68 to 60 percent between June and November (Figure 6).

Large majorities of respondents use digital marketing and payments. In Wave 3, digital marketing was used by 72 percent of respondents, digital payments by 59 percent, and digital sales by 52 percent. The other choices of technology were rarer, with operations at 42 percent and credit at 15 percent.

Notably, digital credit remains more common than bank lending among Zambia MSEs. Above, we saw that banks and moneylenders serve just 7 percent and 14 percent of respondents in Wave 3. This suggests that digital credit could become more important for small businesses’ recovery than bank lending, nonbank lenders, and government lenders together. If the products are transparent and fairly priced, this will expand access to badly needed credit. If not, MSEs could fall into default en masse.

We also asked businesses to report on the reach of digital technologies: what percentage of their businesses occurred through digital channels. Our measures of digital reach included five areas: payments, marketing, sales, operations, and delivery. Both adoption of digital payments (the fraction of businesses that accepted them) and the share of payments among adopters (the fraction of payments, considering only those who accept digital payments) declined over the course of the study. The median percentage of digital payments declined from 30 to 20 percent between June and November, and the average declined from 39 percent to 32 percent over the same period. The same declining trend is observed for businesses’ proclivity to use digital technology in their business.

Part of the story is a sharp decline in the volume of mobile money payments in Zambia. Mobile money payments declined by 37 percent from May to September 2020 (3). Although the value of those payments increased by 19 percent over the same period, the decrease in payments volume suggests that point-of-sale payments were on the decline. Instead, mobile money may have been used for peer transfers and larger payments. Plainly, this is not the whole story. Further study of Zambian MSEs using in-depth interviews and detailed financial analysis is warranted.

Zambia has undergone a decline in digital marketing and sales where other markets saw an increase. In the COVID-19 era where one’s customers may be unlikely to patronize one’s business in person, the digital space may offer a lucrative alternative for businesses to reach their customers. However, we found that businesses surveyed in later waves were more likely to cite costs as the most significant barrier to their digital adoption (Figure 7). This sensitivity to costs suggests that as the recession makes cash increasingly scarce, businesses become increasingly sensitive to costs.

Conclusions

The findings from our survey of MSEs in Zambia during the COVID-19 pandemic do not tell a unified story about the sector and how it can recover. One theme is that MSEs in Zambia face a serious and prolonged funding gap. The financing gap is partially filled by informal financing: friends and family, ROSCAs, and moneylenders. A growing solution to the dearth of funding is digital credit, which is today nowhere near as prevalent as mobile money but may be headed in that direction.

A second theme is that the composition of businesses that can grow in this environment is changing. Services account for a rising share of businesses with increased revenue. Overall, the proportion of businesses that have prospered since the onset of the crisis is stagnant. Pivoting to the service sector will require new skills and new investments for existing small businesses. Innovation in services will continue for the foreseeable future, as homes and businesses adjust to life in the pandemic.

Finally, digital technology alone cannot kickstart a recovery. Digital technologies for sales, marketing, and payments can facilitate economic activity. But first the economy must find its way back to growth. And although digital credit is far less common than these other digital services today, it is already on par with ROSCAs and moneylenders by the number of borrowers who say they use it — if not by value.

In closing, we offer a few thoughts for policymakers. First, small businesses require credit immediately. The availability of credit will relax liquidity constraints that have hobbled businesses in the face of mobility reductions and declining demand. Without this, the small businesses that have managed to hang on this far into the pandemic may yet fail.

The pandemic has greatly reduced the mobility of the population. That, in turn, has reduced demand from customers of goods and services and also made it harder for businesses to operate. There are multiple channels by which mobility restrictions can interfere with a business’ ability to obtain necessary materials or inventory; impede workers’ access to the workplace; limit the days and hours that marketplaces are open, or even shut them completely; or simply raise the cost of doing business to an extent that wipes out rather small profit margins of these tiny businesses. Customers and workers alike confront increased risk of infection every time they venture into the public square. Moreover, doing business during a pandemic is fraught with risk that public health measures will tighten in the near future, so that investments made might wither on the vine.

Second, access to additional funding through ROSCAs has filled a gap in credit from the financial services sector and government programs to date. A remedy to this gap is necessary if Zambian businesses are to recover from 2021 onward. There is a need for the government to foster an environment that allows these ROSCAs to thrive but also to ensure its credit programs are transparent and appropriately-targeted to the intended businesses.

Third, despite some businesses faring badly during the pandemic, there are pockets of expansion in essential services. What will happen to these businesses as their services become redundant in a post-COVID19 world? The answer to this question depends on how the government and other private sector stakeholders work to advance the MSE sector both in the COVID19 era but also beyond it.

Fourth, and finally, we have also learnt that Zambian SMEs facing liquidity constraints become more sensitive to costs to digital adoption and therefore participate less in digitization. This begs the question how the relevant stakeholders may relax this cost barrier to digital adoption either through greater transparency to businesses about the true cost of digital adoption, but also perhaps through subsidizing these costs.

Reference List

- Google LLC “Google COVID-19 Community Mobility Reports”. https://www.google.com/covid19/mobility/ [Internet] Accessed: December 1, 2020.

- Bouman FJ. ROSCA: On the Origin of the Species / ROSCA: Sur l’Origine du Phénomène. Savings and Development. 1995 Jan 1:117-48.

- Bank of Zambia. Payment Systems Statistics. Mobile Payments – 2020. [Internet] Accessed 08 January, 2021.