The impact of COVID-19 on financial lives in eight countries, over two weeks

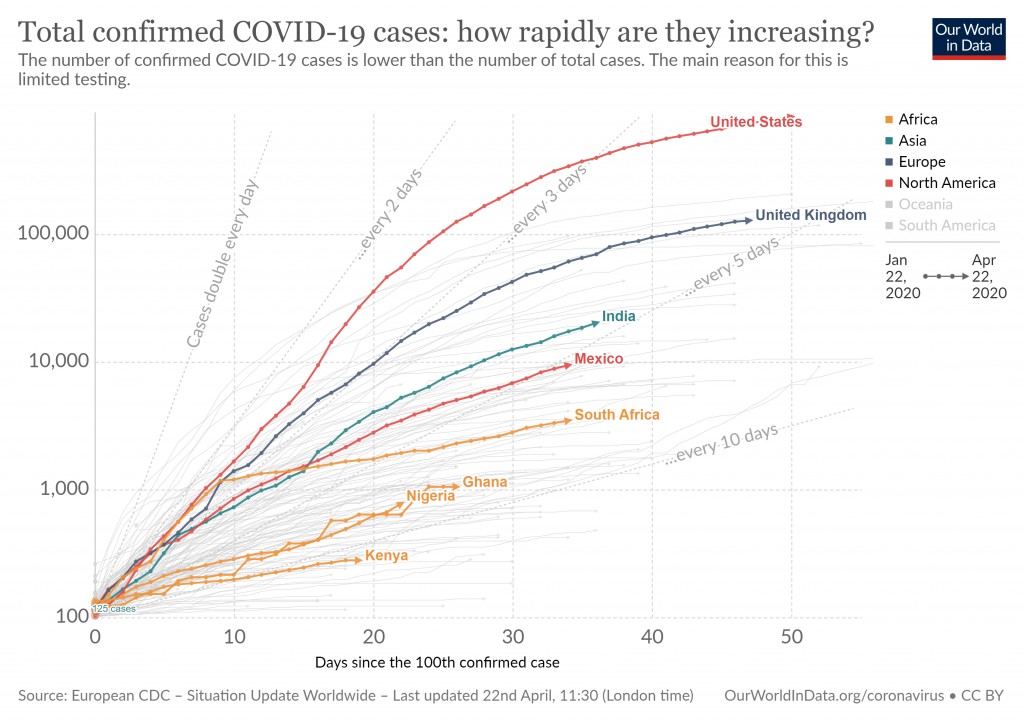

Protracted battles continue to rage across the world against the invisible enemy of COVID-19, as countries enforce restrictions on movement and business to “flatten the curve”, with various degrees of success (Figure 1). At the same time, concern is growing around the ability to sustain such restrictions in the face of increased desperation as livelihoods are destroyed, and the prerogatives of social distancing necessitate significant changes in how we lead life.

It is in this context that we conducted the second wave of our rapid online “dipstick” surveys in eight countries on April 11 and 12. In Wave 2, we polled 1,646 low and lower-middle-income respondents in Ghana, India, Kenya, Mexico, Nigeria, South Africa, the UK, and the US. The samples were balanced by age and gender. We summarize the findings from Wave 2, as well as make comparisons with the first wave, Wave 1 (conducted between Mar 25 and 26, two weeks prior to Wave 2).

Wave 2 was carried out just before stringent restrictions were imposed in India, Kenya, Mexico, Nigeria, and South Africa. You can explore these results in more detail by visiting the Wave 2 dashboard.

A global decline in financial well-being

Downward pressure on income, savings, and business

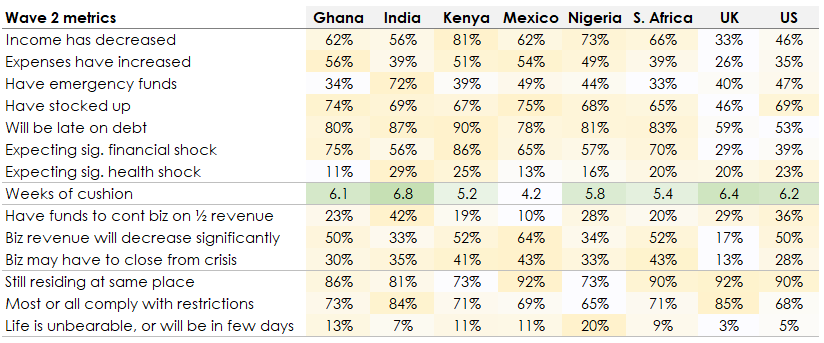

There continue to be pervasive negative effects of COVID-19 on lives across all eight countries (Table 1). Income decreased for over half the respondents in most countries. Expenses increased for up to half of the respondents. About only a third to a half of respondents had emergency funds they could tap into for essentials, in the event that most or all of their income were lost.

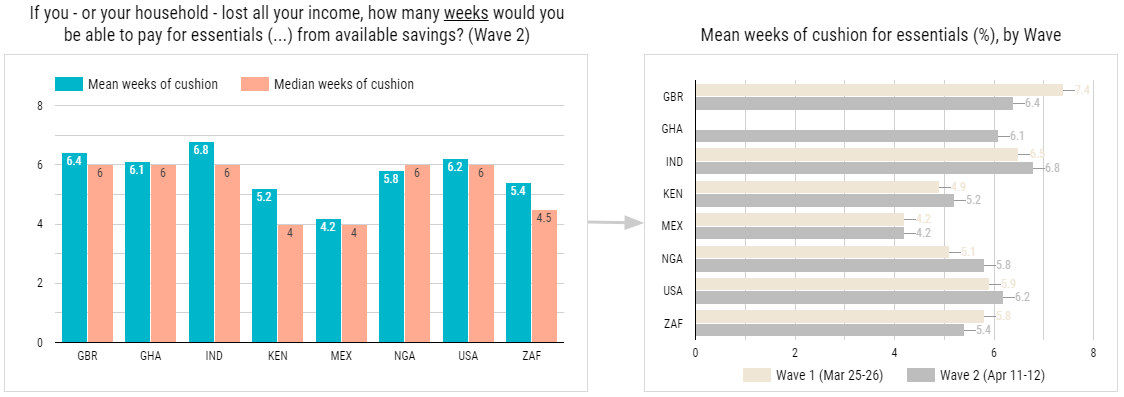

On average, respondents reported being able to pay for essentials for between four to seven weeks from their savings, if sources of income were lost. Most stocked up in response to the crisis, and did not expect to be able to make payments to pay down debt during this time. Overall, most respondents expected significant adverse effects to their financial well-being, although far fewer were concerned about significant health effects from the crisis

Self-employed individuals make up 30% of the response pool. About a third to a half of them expected revenue to decrease significantly. Another third expected to have to close their businesses as a result of the crisis, or had already done so! Were revenue fall by half, then less than a quarter had funds to continue their businesses.

Significant country-level differences

Over 80% of respondents in Kenya reported decreased incomes and the expectation of significant adverse effects on financial well-being. Weeks of cushion (Figure 2) for essentials was lowest in Mexico at 4.2 weeks, while it was about 60% higher in India, at 6.8 weeks. Similarly, only 10% of businesses in Mexico noted that they could continue if revenue falls by half, while over 40% were able to in India. India also had the highest portion with emergency funds, at over 70%, while Ghana and South Africa were at around half that level. The UK, and to a lesser extent, the US, displayed lower levels of distress compared to the other six emerging economies.

The externalities on society are also not uniform across countries. Kenya and Nigeria had about three times as many respondents noting they were no longer at their preferred place of residence as a result of the crisis – they had either moved or were unable to leave their current location. There is still a large degree of compliance with the restrictions, with Nigeria reporting the lowest levels of compliance. This is perhaps influenced by the much higher proportion of Nigerians feeling that life is already unbearable or will be so in a few days. The UK is an outlier here too, showing the highest degree of compliance, and lowest levels of dissatisfaction.

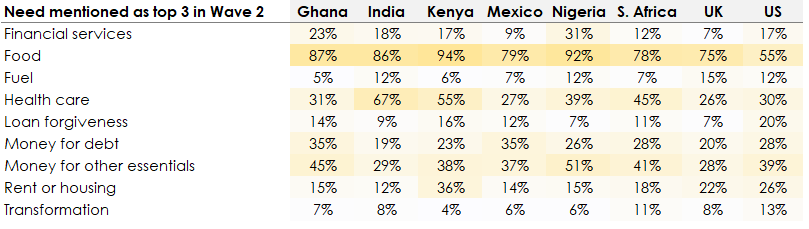

Reduced income, restrictions on movement, and disrupted supply chains are increasing the needs of items compared to what is available (Table 2). The need for food was almost universal; the need for healthcare, money for other essentials, and money for debt payment also showed up at heightened levels.

After two weeks: same boat, different storm

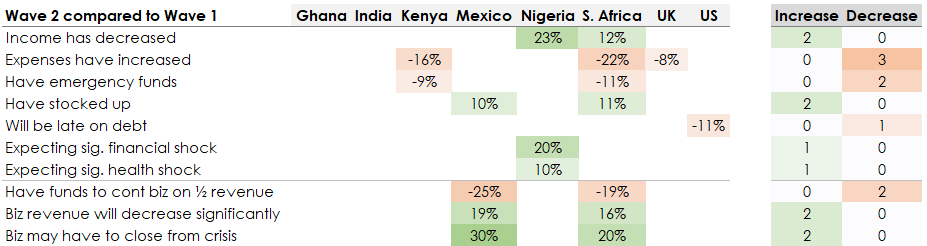

In Table 3 below, the “Positive” and “Negative” columns summarize how many such changes are seen for any given metric across all eight countries, allowing us to easily identify which metrics experience the most changes.

Turbulence in South Africa, Mexico, and Nigeria

Quite a bit has changed in two weeks during the pandemic, especially if you are in South Africa. In South Africa, seven of the ten metrics registered change even within just two weeks. More respondents noted that income has decreased, and more noted that expenses have stayed the same or decreased. Fewer respondents had emergency funds, and more reported stocking up. Business sentiment had decreased drastically, with many more anticipating significant decreases in revenue, or having to close shop.

Likewise, the impact on businesses is perceptible in Mexico, where more respondents expected significant reductions in revenue and having to close their business. In Nigeria, there was a marked rise in respondents noting a decrease in income and expectations of adverse financial and health effects.

Calm waters in India so far

Whereas if you are in India, there evidently hasn’t been much of a change. There was no significant change in India, and on one metric only in the UK and the US, suggesting that people’s perceptions and responses to the crisis did not change much in these two weeks. Ghana was not part of Wave 1, and so has no data for comparison here.

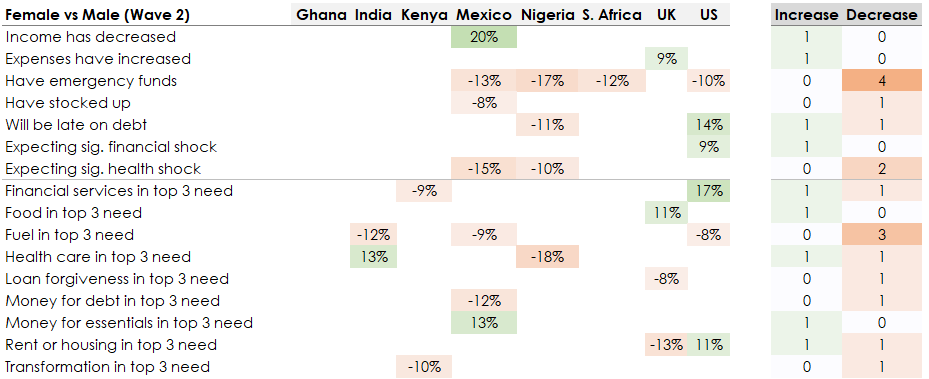

The gender effect

The gendered fault lines and inequities of the pandemic also show through in our analysis of the survey data. In the event that most or all income is lost, fewer women reported having emergency funds they can tap into for essentials in four countries (Table 4): Mexico, Nigeria, South Africa, and the US. In particular, Mexico has the highest number of gender differences in their responses: more women reported a decrease in income, fewer stocked up, and fewer were expecting a significant health shock. More women viewed “additional funds for essentials” as one of their top three needs, while fewer considered “fuel” and “funds to repay debt” in their top three. In Nigeria, fewer women had emergency funds put aside, but fewer also expected to be late on debt payments or expected a significant health shock. Most other effects were idiosyncratic to the countries.

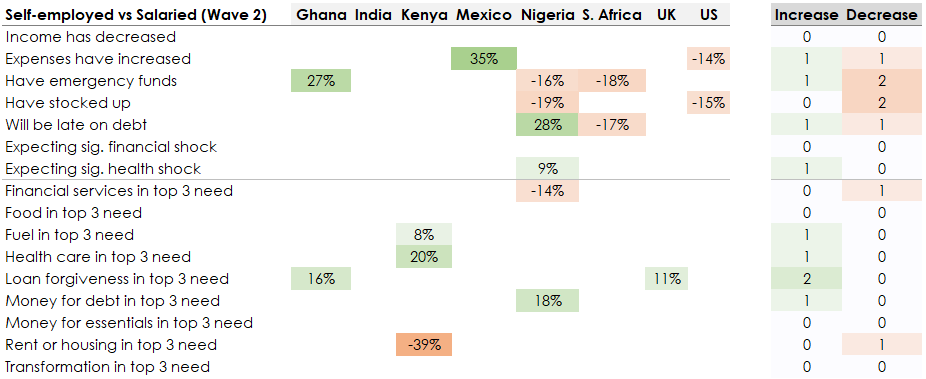

The plight of the self-employed

The differences between those who are self-employed and those who have jobs are not numerous, other than for Nigeria (Table 5). This may very well be because job-holders may no longer be getting paid, or may even have lost their jobs, adding to their own distress from income-shock. Note that we excluded retirees, students, and homemakers from this comparison.

Fewer self-employed in Nigeria had emergency funds and stocked up compared to salaried respondents, while more noted that they would be late in making debt payments, and expected a significant health shock. In Kenya, those who are self-employed noted “healthcare” and “fuel” in their top three needs more often than the salaried. The rest of the effects were idiosyncratic to the countries.

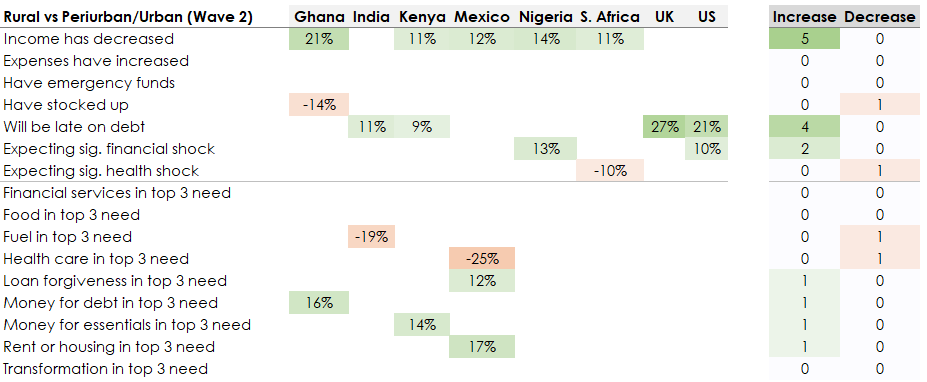

Rural areas may have it worse

Urbanicity is correlated with COVID-19-related outcomes (Table 6). Income decreased significantly more in rural areas in five out of eight countries, compared to their peri-urban and urban counterparts. Rural respondents in four out of eight countries also noted that they would be late in making debt payments.

Key takeaways for action

From these data points we draw the following observations apply across the board, based off of Wave 2 data:

- While COVID-19 is a public health crisis, the primary effect on most people is in the form of financial distress. The adverse effects of COVID-19 on financial lives, business, and ways of life is tangible and sizable across all countries. This continues to underscore the fact that this is an economic crisis, as much as it is a public health one.

- The situation is evolving rapidly enough to register worsening effects even within a two-week window. This implies that the situation will get worse before it gets better, and do so fairly fast. People are preparing for the crisis by stocking up and delaying debt payments, but they have only a few weeks of runway to pay for essentials if income is lost.

- Even though COVID-19 is progressing at very different paces across these countries, the adverse financial effects, particularly for those with large low-income populations, are quite uniform in magnitude. Within each country, population segments are responding differently to the crisis, with gender, urbanicity, and livelihoods modulating impact significantly. Interventions will need to heed these dynamics.

On that last point, Mexico is showing the most amount of dynamism in reported effects. It has registered significant change between waves, women are being affected differently compared to men, and rural areas seem to be under more pressure than urban areas. Kenya, South Africa, and Ghana also display some degree of internal heterogeneity on three dimensions – gender, type of livelihood, and urbanicity.

With an ear to the ground

It is worth noting that the effects we shared quite possibly have a negative bias when compared to the overall low and low-income population, i.e. we are underestimating the true impact on the population. This is because our respondents are taking an online survey on a computer or smartphone, and therefore are presumably better off than others in the low(er) income groups. Also, the relatively small sample size (N=200-240) makes this study underpowered – we are quite certain a fair few sizable estimates would show up as significant in larger studies but chose not to share them as they do not pass statistical tests. In other words, a larger, more representative survey would probably find effects that are more pronounced, and more effective overall. Under the global public health restrictions, the rapid dipstick survey is an especially useful and appropriate, albeit, directional tool in our toolkit for COVID-19 response. As the pandemic response evolves, we will supplement our rapid dipstick surveys with more comprehensive quantitative surveys and qualitative interviews, in the future and under the appropriate circumstances.

In the meantime, we will continue to diligently collect just-in-time information of sufficient quality to stay abreast of the rapidly evolving situation that is the COVID-19 pandemic. We seek to generate critical insights to inform thoughtful programmatic and policy actions and highlight the cornerstones of financial health in an inclusive recovery. We thank MetLife Foundation for their steadfast support in enabling us to produce this analysis and public resources, such as the survey instrument and the results dashboard.

[1] We ran logistic regressions on each of the metrics listed on the left (e.g. “Income has decreased”), controlling for which wave the data was from, gender, age, whether head of household, income level, employment type, and urbanicity. The marginal effects were calculated for each of these variables, and are displayed only if they are significant at the 0.01 level.