How SAJIDA Foundation Practically Doubled Customer Uptake of Savings Accounts Using Evidence-Based Redesign

Afsana works at a garment factory in Dhaka and has two young daughters. She recently opened an Astha term deposit account with SAJIDA Foundation for 10,000 Bangladeshi Taka ($120) after learning about its benefits from a loan officer. For Afsana, Astha has allowed her to lock away a lump sum which is difficult to do on her limited salary and pressing needs. She explains, “My children are studying. I want to invest money for their higher education. I would also like to save up to build a house in the village one day.”

Astha, a term deposit account, allows SAJIDA Foundation members to save toward a purchase or financial goal. Members can deposit small amounts for a specified length of time while earning at-market interest. Astha, meaning “reliance and dependability” in Bengali, is a product of SAJIDA Foundation, an NGO which offers a microfinance program and various health and other development initiatives throughout Bangladesh, including long-term savings options for unbanked or underbanked individuals like Afsana.

Uptake of the Astha savings product was good, but through the OPTIX project, BFA conducted data analytics and client research revealing that most of the accounts had lower balances than anticipated, with a median of around BDT 2,000 ($24).

By redesigning and rolling out new features to increase adoption of the Astha accounts, SAJIDA Foundation saw a 97 percent increase in accounts opened and 59 percent more mobilization of savings, comparing the Astha savings profile from July to November 2016 to the same period the year before.

The Astha term deposit illustrates how financial institutions can optimize cross-sell to better serve the needs of their low-income customers. By focusing on clients’ needs and improving the existing suite of product and services, cross-sell enables an institution to further its impact by offering more relevant services to underserved customers. The different cross-sell strategies explored through SAJIDA Foundation serve to help other OPTIX partners and financial institutions to learn from this work. Since 2016, OPTIX has also partnered with three other financial institutions in Mexico, Colombia and Vietnam to advance cross-sell and germinate these strategies around the world.

THE REDESIGN: NEW FLOOR AND FLEXIBILITY IN ASTHA

With the guidance of BFA’s business and customer insights experts, SAJIDA Foundation made the following changes to the design of the term deposit:

- Minimum balance set to BDT 5,000: Costing this product, we realized that the break-even balance was closer to BDT 10,000 ($120). Existing users were saving less than half that amount. As a compromise, we chose the minimum balance of BDT 5,000 ($60).

- Multiple term lengths allowed: The previous product had a single term of six and a half years based on the assumption that members would find the notion of “doubling their money” enticing. The offer worked well as a selling point, but when a pressing need arose, the prospect of future versus present value was not enticing enough to prevent liquidation. Now, eight terms between six months and five years are offered to accommodate the varying needs for flexibility.

- Tiered interest rates introduced: Interest rates were recalibrated into tiers based on investment period, market rates and business case impact.

- Conversations oriented to goals: Field officers engaged in structured conversations around a specific goal that the member would save toward, instead of a generic income generation sales pitch.

- No account openings within one week of loan disbursement: Originally, many Astha accounts were opened when members visited the office during loan disbursements, as a matter of convenience. The simultaneous offering resulted in members opening term deposit accounts with low starting balances (i.e., by reassignment of some funds from the disbursed loans or from funds out of pocket). By separating the two transactions, the act of saving toward a goal by opening a term deposit account became more deliberate.

FROM EVIDENCED-BASED REDESIGN TO IMPACT

- Increase in number of Astha accounts opened: Five hundred and eighty-three accounts with a balance of at least BDT 5,000 ($60) were opened in the five-month period in 2015, while 1,148 were opened during the corresponding period in 2016, resulting in a 97 percent increase. Staff offered a couple of reasons for this increase.

- By focusing on quality instead of quantity (i.e. fewer larger-balance accounts), staff could dedicate more time educating members on the utility of Astha accounts.

- Members with more than BDT 10,000 ($120) in their Voluntary Savings Account and that had not drawn funds over one year were prompted to consider transferring that balance to an Astha account. This resulted in more interest income for the member and helped SAJIDA Foundation in asset-liability matching due to Astha’s longer term.

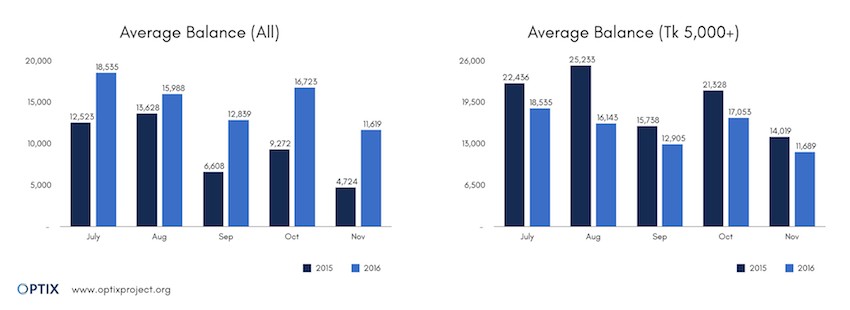

- A distribution shift toward a minimum balance of BDT 5,000 ($60). With a new account balance minimum of BDT 5,000 ($60) from no minimum previously, the average balance of the total number of accounts went up, as expected (Figure 1). However, if we considered accounts with balances of minimum BDT 5,000 ($60), the average balance went down (also Figure 1). Data also showed that more accounts were opened at the minimum balance levels in 2016 (66 percent) compared to 2015 (46 percent). Why? Although no minimum balance was usually indicated to customers, field officers would arbitrarily mention BDT 5,000 ($60) when describing the Astha account. It is very possible that this tendency “anchored” the staff, and thus, the member’s mind to save the minimum balance and depressed the average balance for the Astha portfolio. SAJIDA Foundation responded by instead encouraging field officers to use BDT 10,000 ($120) or BDT 20,000 ($240) when giving examples in discussions with customers.

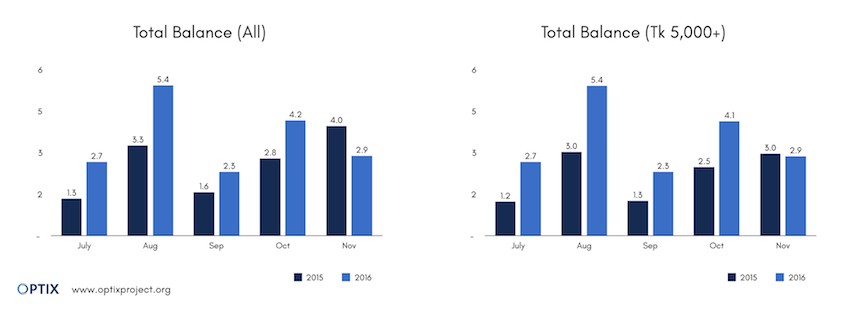

- Increase in total savings mobilized through Astha accounts. Total balances across all Astha accounts increased from BDT 12.9 million ($161,000) in 2015 to BDT 17.4 million ($218,000) in 2016. When only accounts with BDT 5,000 ($60) or more are considered, the 2015 balance levels were BDT 11.0 million ($137,000), resulting in a 59 percent increase of savings mobilized.

The total amount mobilized increased for all months except for November and doubled in value in July. There was a slight dip from 3.0 million in 2016 to 2.9 million in 2017 (Figure 2). We need to keep a close eye on data after November to see if this decrease is an anomaly or the beginning of a slowdown in savings mobilization in Astha accounts.

REFLECTIONS ON CROSS-SELL AND NEXT STEPS

The redesigns resulted in a discernible positive impact on account openings and savings mobilized. However, the shift in the average balance of accounts with minimums of BDT 5,000 ($60) was less obvious. The decrease is potentially the result of another possible cause — savers that typically maintain balances below BDT 5,000 ($60) are now saving at the threshold. If this is the case, then the outcome would be a positive one for SAJIDA Foundation. By monitoring the data after the staff started using different language on account balance minimums, it will reveal whether anchoring was the real cause of the shift.

In the spirit of peer-learning and cross-collaboration across OPTIX institutions, SAJIDA Foundation’s experiences will be very valuable to another project partner, the Capital Aid Fund for Employment of the Poor (CEP), in Vietnam, when deploying their own term deposit product. CEP will not only be able to leverage what we learned at SAJIDA Foundation but also benefit from lessons around packaging and marketing a long-term savings product, goal-oriented narratives for field officers to promote term deposits and best practices for appropriate analytics to track product performance.