Blog 6 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 5 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 3 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 4 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 1 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 2 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

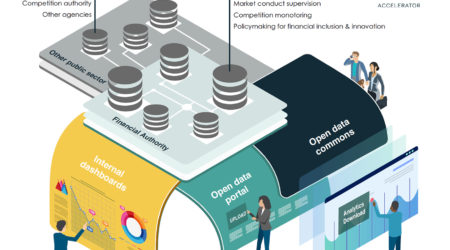

The DataStack, introduced below and elaborated on in our more detailed report, is both (a) a map...

“SupTech” is a word you’re likely to hear more about in the coming years. The term is a newfangled...

Financial service providers are quickly adopting regulatory technology (RegTech) to ease the burden of compliance. This white paper shows...

The Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, or CNBV) requested a partnership to...