Is digital commerce the future for mobile money providers?

Mobile money providers working with digital commerce platforms can empower MSEs with much-needed digital tools while growing new sources of revenue

There are over one billion mobile money (MM) accounts in the world today, and the industry processes about $2 billion every day. This scale, together with the growing number of mobile money providers (MMPs) that have achieved profitability in recent years, have proven that financial services targeted at low-income populations can be financially viable – and even shockingly profitable.

However, mobile money providers risk becoming a victim of their own success if they do not seek new models. As mobile money usage rates grow, particularly in P2P transfers and merchant payments, users are keeping more of their money digital. This means that MMPs will find the cash in/cash out (CICO) transactions that have powered their account books to date begin to dry up.

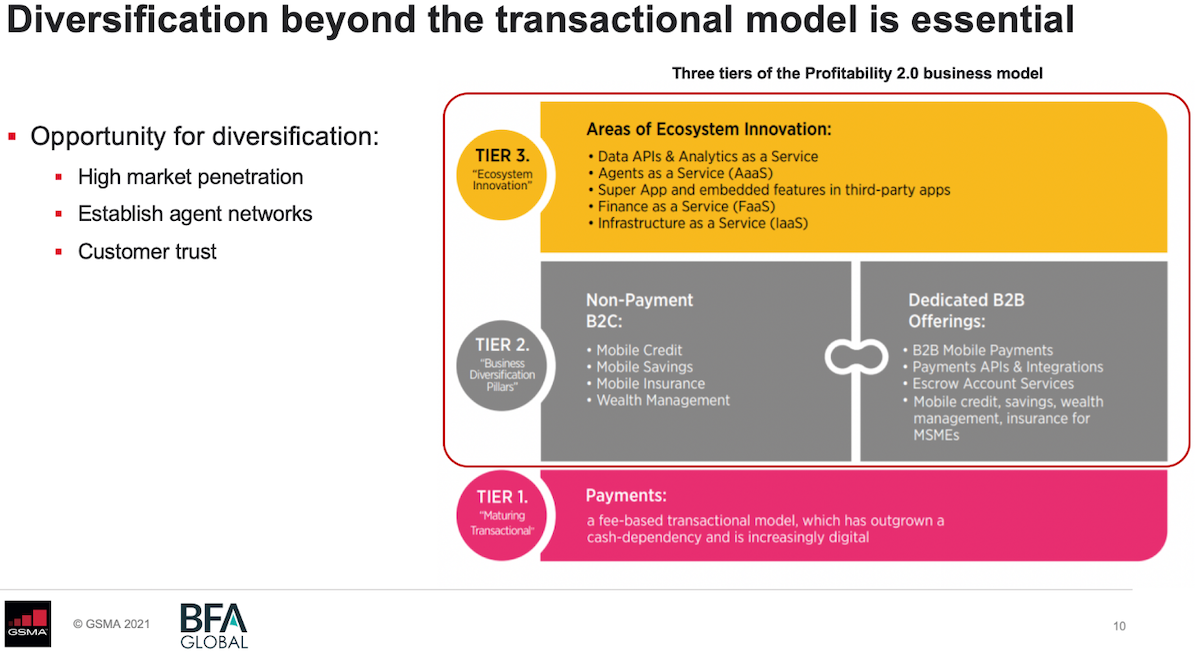

Moreover, MMPs are facing increased competition from platform competitors in e-commerce like WhatsApp Pay, and from fintech startups like Chipper Cash. As these pressures grow, as discussed in our recent Profitability 2.0 report co-authored with GSMA, MMPs in emerging markets need to grow beyond a purely transactional model to avoid stagnating in the face of rapid fintech innovation (to include, for example, the revenue sharing agreements for financial services, data and analytics licensing, ecosystem partnerships, and more, as described in the report).

One promising area of growth is digital commerce. In the Catalyst Fund Inclusive Digital Commerce program, we have found that the ecosystem of digital commerce startups in Ghana is growing, but to expand further, these companies require precisely the sort of enabling services that MMPs are imminently able to provide. To serve these startups and partake in the growing digital commerce sector, MMPs should think about leveraging mobile money agent infrastructure as a platform that can serve as a middle layer for tech-enabled businesses and ecosystems. This approach can power the rapid and inclusive growth of digital commerce, while also providing MMPs additional sources of revenue.

Payments opportunities in digital commerce

By shifting to an ecosystem view, or allowing others to leverage the networks MMPs have developed, mobile money services can enable other players, like aggregators, utility providers, financial service providers, competitors, and notably, MSMEs, to use digital payments, which MMPs can then monetize. In the GSMA Profitability 2.0 model displayed below, these opportunities sit in Tier 2 (Business Diversification Pillars) and Tier 3 (Ecosystem Innovation).

View “Mobile money profitability: Exploring current & future business models” (July 8) webinar

MMPs have long recognized the opportunity provided by digital commerce but have yet to approach it from their strength as ecosystem enablers. For example, when Safaricom entered the space, it attempted to build an entire e-commerce platform in the form of Masoko, which was ultimately deprioritized to retain focus on M-Pesa. Instead of building standalone ventures, MMPs should seek to empower digital commerce players via Tier 3 Ecosystem Innovations.

In the following table, we map a number of next-generation B2C, B2B, and ecosystem product features MMPs can offer today to specific use cases within the digital commerce ecosystem where they can be applied.

In the third column, we note specific examples of companies within the Catalyst Fund IDC portfolio (and portfolio-adjacent) companies that offer value propositions related to each use case. These businesses present clear opportunities as partners for MMPs, who can, for example, serve as the the digital payments rail or digital wallet partner to make sending and receiving payments easier for digital commerce businesses, offer APIs and integrations that can enable the MSE customers of these solutions to receive payments via digital storefronts, or leverage their existing agent network to increase the reach and penetration of digital commerce solutions across rural areas.

Similarly, in the fourth column, we list examples of adjacent companies from the Catalyst Fund Inclusive Fintech portfolio, beyond digital commerce, that can also benefit from partnerships with MMPs. These companies are working to improve consumer and MSE financial health via digital tools such as microsavings and investments, microinsurance, and mobile credit, all of which rely on a high volume of mobile money transactions and present a clear opportunity for MMPs to play a larger role.

The time is right for MMPs to enable the growth of digital commerce

MMPs’ reach and networks in emerging markets position them well to fill current gaps in the digital commerce ecosystem. Moreover, trends among MSEs, consumers, and MMPs themselves suggest that the market is ripe for integrating digital payments more deeply and more broadly.

MSEs are already adopting digital ways of marketing, but selling and logistics are largely manual. Research we conducted among retail MSEs in Ghana in 2020 indicates that social media is a powerful source of leads and new customers for MSEs, with only 7.5% not using social media for customer acquisition. This same research found that 85% of MSEs use WhatsApp, 63% Facebook, and 45% Instagram for business purposes. Even though they have a strong appetite for digital tools, these MSEs have found it difficult to adopt some newer commerce tools like digital storefronts and platforms. For example, even when a lead is generated via social media, the MSE completes the sale via phone call (89%) or WhatsApp (72%), which are the principal means for maintaining contact with customers.

Moving leads from social media to the phone is largely executed manually and is prone to delays and errors. As such, there is a massive opportunity to integrate sales and payment functionalities to these social media interactions, especially since most of these users already have mobile money accounts.

Beyond offering payments, MMPs also have existing digital infrastructure that can support MSE operations and logistics, in terms of inventory management, procurement (80% of MSEs we researched go to the physical market and 73% pay suppliers in cash), and fulfillment (84% of MSEs do not use app or online delivery services). Many MSEs report delivering themselves (or via their own delivery person) or using dispatch riders to fulfill orders, which is time-consuming, risky, and expensive. These functions are currently completed manually, but growing penetration and depth of use of smartphone penetration means that some of these “jobs” can be completed digitally or via agents.

As the primary point of service for digital financial services, the physical locations of agents and retail shops can be leveraged for a broader set of services, such as customer service, catalog shopping, and pickup and dropoff services for e-commerce fulfillment, addressing some of these pain points around delivery.

Consumers are increasingly savvy in using and knowing what they want from digital payments solutions. Even access to financial services remains an obstacle for 62% of businesses in Ghana; GSMA’s 2021 State of the Industry Report counted 1.2 billion registered mobile money accounts worldwide (up 13%), with 300 million monthly active accounts (up 17%). Unfortunately, very little of this mobile money usage reflects payments to small merchants, who remain in the cash economy.

There is an enormous opportunity to shift the vast quantities of small, informal transactions from cash to digital, if solutions are designed correctly. Particularly for low-income customers, digital commerce solutions must be reliable, valuable, accessible, and affordable (as found in our mixed-method research). Middle-layer solutions for digital commerce products, especially those that serve low-income populations, need to be designed in a way that is more customer-centric and brings real value to customers, accelerating digital adoption and avoiding a chicken-or-egg problem for MSEs and MMPs.

MMPs have direct channels to communicate, educate, and market to large swathes of the population via their existing relationships with (or in some cases ownership of) USSD, SMS, and data providers. Mobile money can enable better access to services for underserved populations as it moves beyond the initial success it saw via peer to peer payments and CICO. Today, the portfolio of services is continuing to expand to a more holistic offering, including credit, savings, and insurance, which are essential for commerce and can lead to improved livelihoods and resilience.

MMPs are expanding their models to embrace the ecosystem. Some MMPs have already started to venture into digital commerce, but most have not yet fully succeeded in developing deep digital ecosystems in specific verticals, such as branded, one-size-fits-all merchant apps, in-house. MMPs should also consider ecosystem plays that allow digital commerce companies to build on top of their platforms, thereby enabling new value propositions for consumers. For example, an API to integrate mobile money payments can enable digital startups to easily embed financial features into their customer experience. This would provide a reliable, seamless payment mechanism – this is invaluable in online commerce, where lack of trust and fear of fraud are barriers to use.

The time is right for MMPs to enable the growth of digital commerce, mitigating the known risks in their transactional MM models, completing the streamlined digital commerce flows for MSEs, and providing truly inclusive solutions that serve their mutual end-customers’ needs.

Big risks, big rewards

It was after Amazon came up with the outlandish idea of renting out its own computing infrastructure to other firms in 2006 that things really took off. The result—Amazon Web Services (AWS), now the world’s undisputed leader in cloud computing—has powered the firm on. – The Economist, July 2021

MMPs must future-proof their business models in order to stave off platform competitors in e-commerce like WhatsApp Pay, and to avoid stagnating as a business in the face of rapid fintech innovation. By learning from the successes and failures of superplatforms like Amazon and other platform models like Twitter and WePay, MMPs can embrace the ecosystem approach, unlocking revenue streams that dwarf the existing transactional business model.

Digitally-included users of these products and services will have continually higher minimal standards for these tools and will expect deeper vertical solutions to meet their needs, particularly where solutions built on superplatforms like Amazon, Alibaba, Google, and Facebook are setting the bar. MMPs can meet these needs by:

- Continuing to mature and excel at providing exactly the sorts of services that inclusive digital commerce platforms require (e.g. payments, but also Data-as-a-Service, Finance-as-a-Service, superapps and SDKs (Software Development Kits) for customer acquisition)

- Diversifying the value proposition of the agent network model and increasing the role of agents beyond that of CICO to include inclusive digital commerce (e.g. registration/payment points for cash-based users, pickup points for logistics)

Mobile money providers can refer to the Profitability 2.0: Ecosystem-driven business modelling and the future of mobile money margins report on building strategies for profitable digital products.