Recovtech, by the Cambridge Centre for Alternative Finance (CCAF), is sponsored by the UK Foreign, Commonwealth and Development Office (FCDO) and implemented by BFA Global.

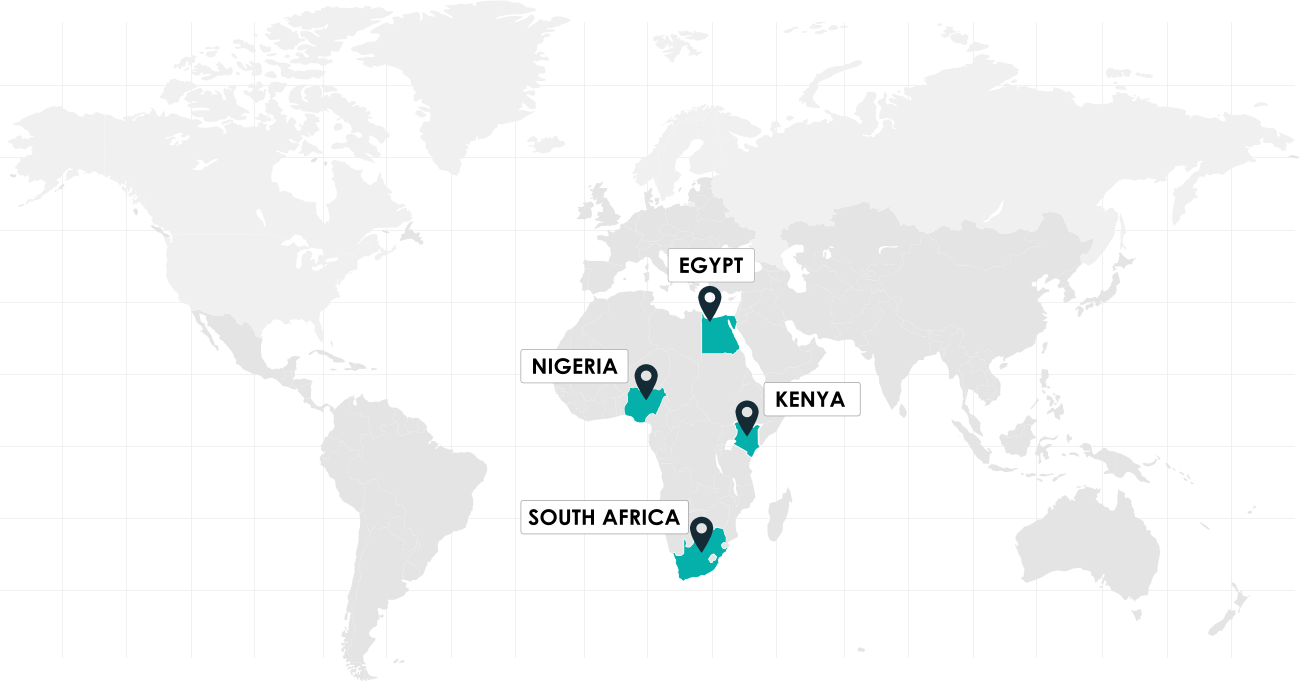

In order for fintech innovation to succeed, the regulatory environments in which startups operate need to be conducive to their growth. Recovtech (Recovery Technology) aims to bring regulators and fintech innovators together to discuss and prototype solutions for ways of enabling financial innovation by removing regulatory barriers for fintech companies in Kenya, Nigeria, South Africa and Egypt.

Recovtech will take place over a one-year period, during which the CCAF and BFA Global teams will conduct a scenario-based discussion, two cross-regional TechSprints and a Global Symposium that will bring together regulators, fintech innovators, investors and other stakeholders to present the leading solutions.

This aims to inform problem statements regulators will be confronted with, to guide key responses to COVID-19 recovery in each market.

TechSprints will enable fintech innovators and regulators to determine the role of fintech during and post-crisis, and discuss regulatory frameworks to best support innovation.

Outcomes from the scenarios exercise, as well as the best solutions resulting from TechSprints will be presented at a Global Symposium.

Recovtech will focus on three key markets in sub-Saharan Africa – Nigeria, Kenya and South Africa – and one market in MENA – Egypt – to help guide responses to the COVID-19 pandemic in the recovery phase.

Blog 1 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 2 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 3 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 4 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 5 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Blog 6 of the Recovtech series, this post written in partnership with members of the South Africa Recovtech team....

Would like to speak with us about how you or your organization could be interested in the Data Exchange or Financing Collaboration solutions? You can request a demo.