R²A Case Study: AML Data Infrastructure Prototype

The Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, or CNBV) requested a partnership to reengineer its data infrastructure to strengthen its anti-money laundering (AML) supervisory capacity and to accommodate a growing fintech sector. Currently, CNBV lacks an efficient means to extract insights from existing data since supervisors often must load appropriate data from compact discs and paper files.

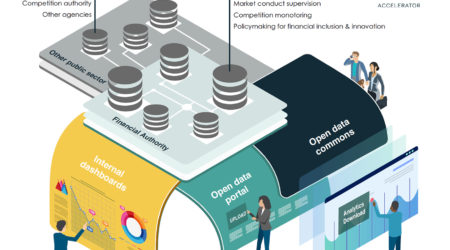

Partnering with R2A and Gestell, the CNBV created a prototype that:

- Allows financial institutions to submit information for AML compliance digitally and automatically to the CNBV.

- Increases the volume, granularity, and frequency – and improves the quality – of AML-related data submitted to the CNBV.

- Enables CNBV staff to import historical records into the central data storage platform.

- Enables CNBV staff to improve AML-related data validation and analysis, and generates customized reports for supervisory and policy development purposes.

By improving data quality and access and developing new tools for data visualization and analysis, the project supports CNBV’s efforts to effectively implement a risk-based AML supervisory approach that reduces compliance costs and promotes financial inclusion while ensuring financial integrity.