Post-COVID prognosis for gig workers in China: slow and steady improvement

While most economies in the world are still stumbling from the effects of the COVID-19 pandemic, it is reported that China, the second largest economy and the country where the pandemic started, has largely recovered. According to The Economist, China’s economy recovered to 90% of its pre-crisis level in May. According to Luohan Academy, the social science research institution backed by Alibaba, the economy had fully recovered by September based on their Pandemic Economy Tracker (PET) index.

Factories are fully operating, students are back to school, and restaurants are open without capacity limits. Everything seems back to normal – but, is this the case for all?

With the support of MetLife Foundation, BFA Global and the China Academy of Financial Inclusion conducted research to evaluate the state of economic recovery in China, particularly among gig workers, who represent one of the most vulnerable demographics due to lack of dependable incomes and benefits. We looked specifically at food delivery drivers, who represent one of the largest segments of gig workers, at 3 million people, to determine:

- Have delivery drivers been generally physically and financially better or worse off during the pandemic?

- How is their post-pandemic financial situation changing?

The team conducted three waves of surveys, illustrated in Table 1 below, to evaluate the post-pandemic financial situation of delivery drivers over time.

The physical and financial impact of the crisis on vulnerable drivers

At the height of the outbreak, Time Magazine released a feature on delivery drivers in China, titled These Delivery Drivers Are Risking Their Health to Keep China Running During the Coronavirus Epidemic, which indicated that this particularly vulnerable group of workers found themselves facing high physical risks as they worked overtime to keep the economy going. While demand for deliveries skyrocketed during the crisis, we sought to determine: what was the lasting impact on the physical and financial health of these drivers?

Our survey results show that more than 20% of the delivery drivers and those in their households faced significant adverse health effects due to the pandemic, and more than 40% of them faced some adverse health effects. As well, almost six months after the peak of pandemic in China, many are still in the process of recovering.

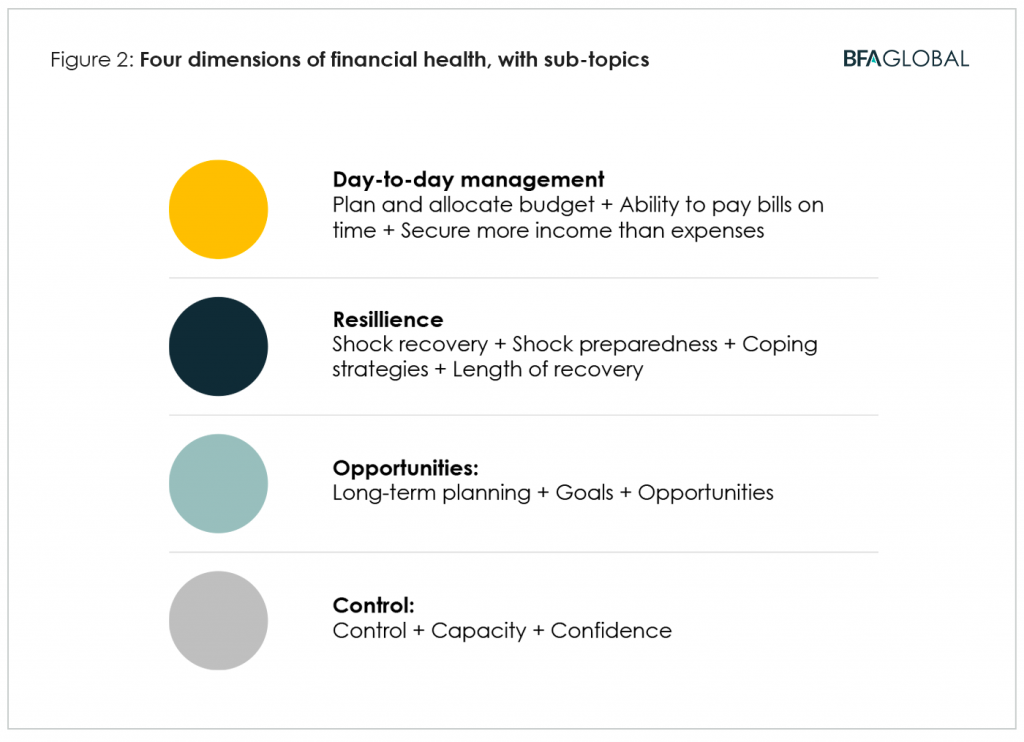

To evaluate the impact on the financial health of the drivers, we designed a survey using the four main dimensions of financial health (see Figure 1) to map the riders’ financial lives during and after the pandemic.

Impact on driver incomes, compared to pre-pandemic levels

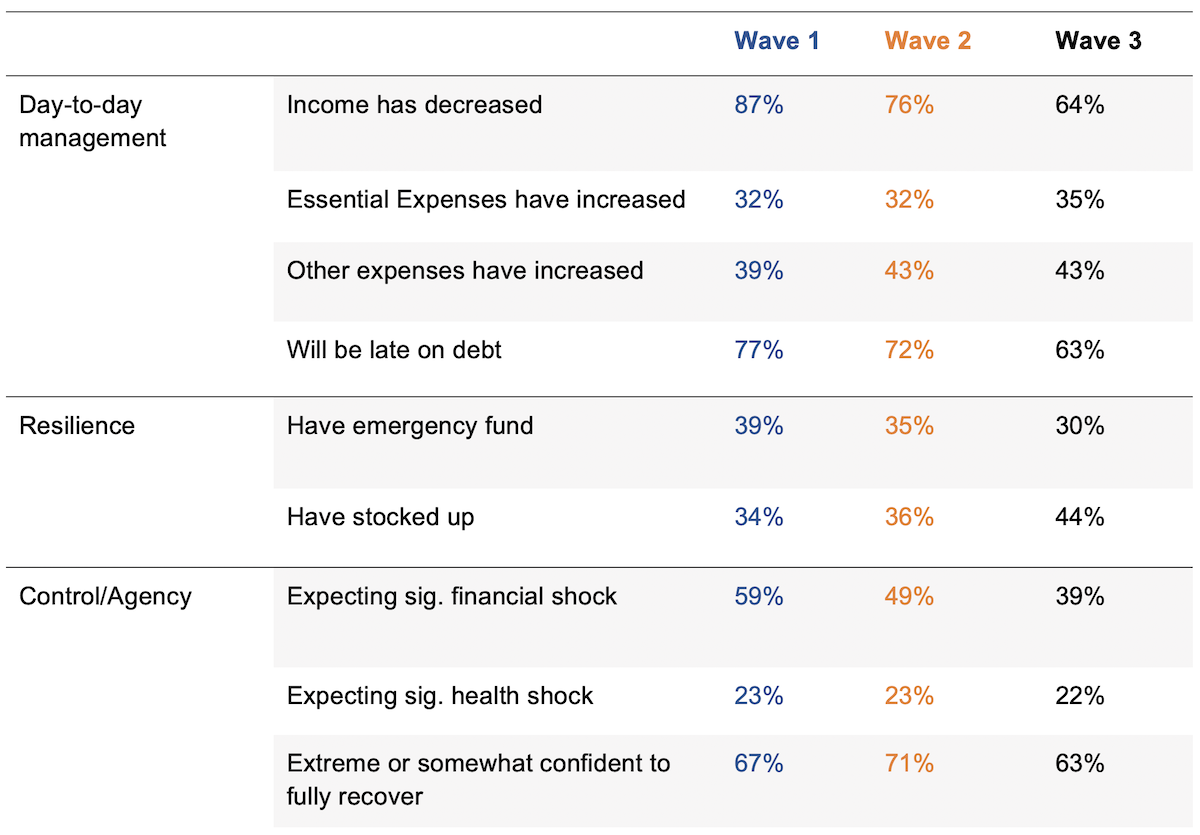

We found that drivers were hit harder by the pandemic than we assumed across all dimensions, and the recovery phase is supported by a relatively strong confidence. A high level result summary is listed in Table 3 below.

*Note that in our surveys, more than 80% of the respondents in the first wave said their income decreased, as shown in Table 3. This contradicts reports from Time Magazine and others which indicated increased demand. This may be the result of our survey sample. Most of our respondents work in food delivery, specifically for restaurants. During the lockdown, restaurants were closed, and there was no business for them. The increased demand for delivery services noted in other reports was related to delivery of groceries or household goods. Drivers in our sample who delivered household goods delivery indeed showed increased income.

Impact on day-to-day finances

Table 4: income changes

The reported income changes across the three waves show a promising trend. The percentage of respondents whose income had significantly decreased declined around 10% per month, from 48% in the first wave to 38% in the second wave, to 28% in the third wave. If this trend holds, we would assume that three months from now, most of the drivers will report no significant decrease in income compared to pre-pandemic levels.

In the third wave, we specifically asked about income recovery, as indicated in Figure 2. It has been almost six months since the peak of the pandemic in China (where recovery started on Feb 17, according to Luohan Academy’s PET), but only 23.75% of the drivers said their incomes were restored to or are now above pre-pandemic levels. The majority (54.85%) have seen their incomes recover since the height of the pandemic, though they remain lower than pre-pandemic levels. Based on this data, even when economic activity fully recovers, most people in this group will still need another six months to reach pre-pandemic income levels.

Figure 2: current income recovery levels

Impact on expenses

One third of respondents reported rising expenses for food, and more than 40% for other essentials.

Figure 3: changes in expenses

The dual impact of changes in income levels and expenses is shown in Figure 4. Almost one third (29%) of the riders in the first wave suffered the double whammy of lower income and increased expenses. This had decreased to 22% by the third wave, which indicates recovery. But again, at the current pace of recovery, it would take another six months for most in the group to recover from this impact.

We also noticed, however, that the impact of decreased income is more severe than that of increased expenses. In the third wave, almost one third of the riders reported the same or increased income compared to around 10% in the first wave.

Figure 4: net impact of changes in income and expenses

Impact on levels of debt and debt repayments

The need to repay debt during the pandemic put another layer of pressure on the majority of the drivers, as around 70% reported outstanding loans. As a coping strategy, more than 80% have already delayed loan repayments. Figure 5 shows that six months after the peak of the pandemic, half of delivery riders anticipate being unable to service their debt fully.

Figure 5: those anticipating late repayment of debt

Resilience to pandemic-induced economic shocks

Impact on emergency funds compared to pre-pandemic levels

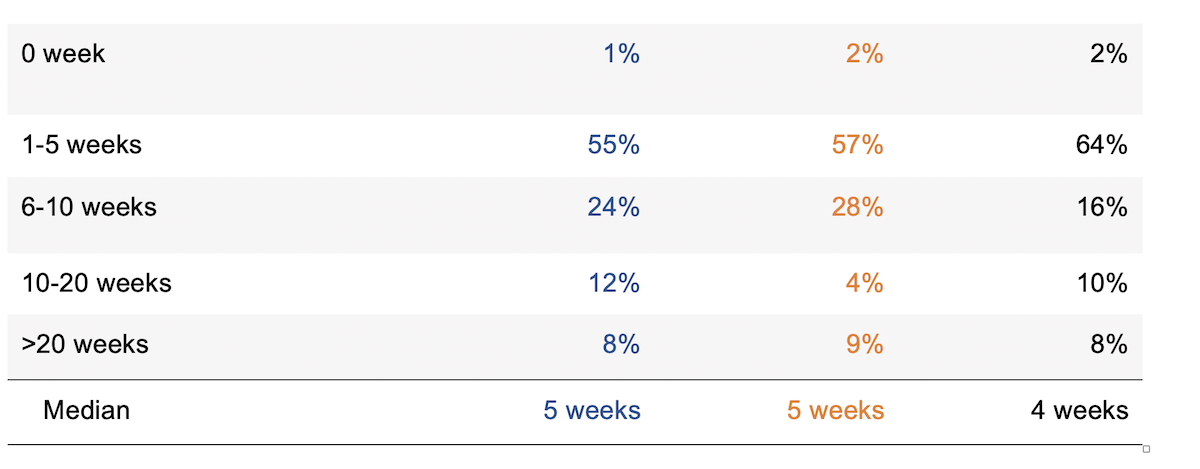

Financial preparedness before the pandemic had a tremendous benefit on daily lives during the crisis. Only one third of our survey respondents had emergency funds set aside before the pandemic, and of these, most (78%) have tapped into them. As shown in Table 5, emergency funds were limited to cover a median of up to five weeks of living costs (which decreased to a median of four weeks in the third wave). This diminished buffer means that this group would experience a more severe situation should the pandemic recur in China.

Access to insurance and public assistance

Due to the nature of their gig work, most delivery drivers lack access to benefits like insurance. Around 40% of the drivers did not have any form of insurance. Of those that did, one third made claims during the pandemic.

As well, public assistance hasn’t reached this segment. 40% of the respondents said they were not aware of any help, and another 35% said there was no one that would help them personally.

These results demonstrate why delivery drivers remain a vulnerable group, as they have fewer useful tools on which to rely for recovery from the effects of a financial shock. They are not fully covered by social welfare networks, and few have commercial insurance. In most cases, they have only their own emergency funds to rely on, where these exist.

Driver perceptions of financial well-being

During the recovery phase, perceptions may matter as much as realities. Positive perceptions guide people’s positive behavior, such as working harder and making long-term investments in themselves in order to achieve higher income and financial opportunities. We would expect rising income to be associated with the perception of financial well-being; and indeed, from June to August, the percentage of drivers who reported that the pandemic has had a significant/disruptive adverse effect on their financial well-being also declined 10% per month, which is indicated in Figure 7.

Figure 7: adverse effects on financial well-being

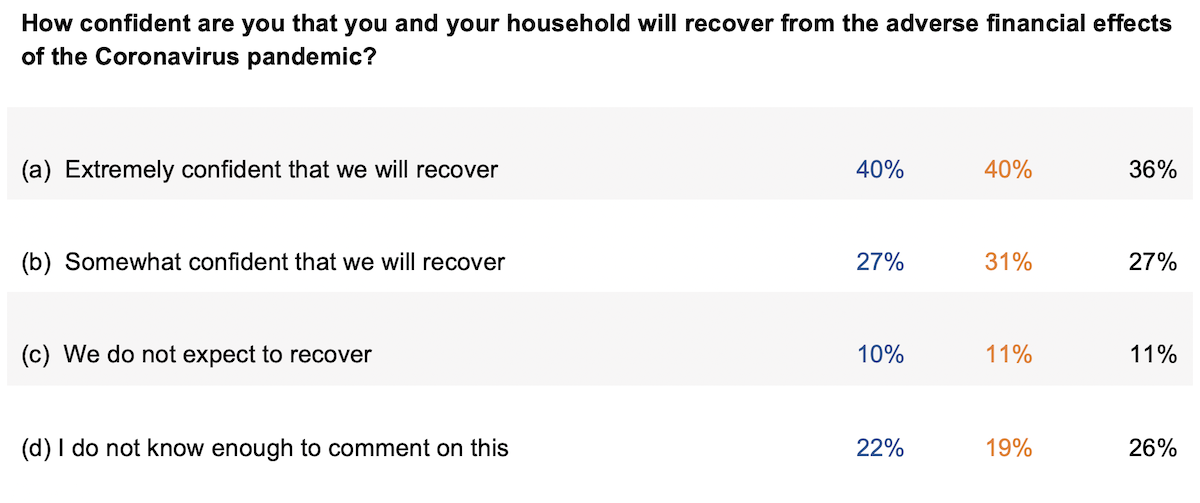

The percentage of riders who report feeling extremely confident about their recovery prospects, however, is in fact decreasing; it slides by 4% from 40% in the first and second waves to 36% in the third wave, as shown in Table 6. It would be great if the riders think they are right on the initial assessment on the recovery so that the perception holds. However, if we look at the other side of the coin, riders’ perceptions didn’t change, even with rising income, which would indicate that they are relatively inflexible to the circumstances.

Table 6: drivers’ confidence in their ability to recover

Conclusion

According to the research results, we see that the surveyed delivery drivers were hit both financially and physically by the pandemic. Six months after the peak of the pandemic in China, they are still in the process of recovery. Applying the financial health framework to the drivers, we see that:

- Drivers’ day-to-day management has improved. Fewer drivers have had incomes reduced during the 3 months’ research period, and more have had incomes unchanged or increased. Another 3 months are needed to see no reported significant decrease in income levels.

- Resilience of the drivers has taken a hit. Most of them have less than 5 weeks’ cushion to rely on. Fewer have more than 6 weeks’ emergency funds available. And the majority of them wouldn’t receive welfare support. Insurance coverage is low among the group. In the future, we hope to see more support from policy makers and the private sector.

- There are fewer drivers reporting adverse financial affects from the pandemic. The confidence level remains the same.

Delivery drivers in China are one of the most vulnerable segments, and recovery from the pandemic needs systematic support. The project will continue to focus on the financial health of this group. We hope that these results help to draw more attention to this vulnerable group in China today. In the future, we hope to see more support from policy makers and more financial offers from the private sector targeted toward this segment.