Your finances and the Coronavirus pandemic: Dipstick surveys

Our social science researchers and data scientists set out to capture real-time snapshots of how Covid-19 is affecting health and wellbeing at the level of households, small businesses, workers, and consumers. On March 25, we surveyed over 1,400 respondents in 7 countries (India, Kenya, Mexico, Nigeria, South Africa, United Kingdom, and the United States) to record how people at the bottom of the pyramid are dealing with this unprecedented emergency.

We have preliminary insights that begin to illustrate the challenges that the pandemic poses for financial health and the solutions people have devised to the crisis. Key questions we sought to answer were:

- What is the biggest challenge for the respondents right now?

- What is the current situation of households and small businesses?

- What financial instruments are people using to manage the crisis?

- Will people continue to be able to work and earn a living?

- How has spending changed? Can people afford to stock up on necessities?

- Is the burden of care for dependents affecting work or household finances?

- How long can people get by under these conditions? When will things return to normal?

- Do people feel that the crisis is most likely to affect their health, finance, or community?

The policy implications of these questions are broad and timely. They can inform recommendations about how to provide low-income populations with emergency funds; how to address personal and business debt problems that will ripple out from the crisis; whether markets continue to have sufficient demand to function during the crisis; how the digital economy can support households; and how to support micro- and small enterprises grappling with unprecedented financial and logistical challenges. We can also study the specific issues of greatest concern to special groups, such as youth, caregivers, women, and gig workers.

This survey used a methodology optimized for rapid insights, using a sample from a recruited panel of respondents through SurveyMonkey Audience rather than a random sample from a national population. Inference is limited to the respondents in our survey sample, consequently. Technical readers should refer to the section on methodology at the bottom of the page.

Key questions

Each survey contained 50 questions that revisited and expanded on themes initially introduced in our Financial Diaries research study, which began in 2012 in India and South Africa. That study centered on a year-long household survey that examined financial management in poor households. In light of the Covid-19 pandemic, we wanted to go back to this sample to see what has changed, if anything, in this exceptional global moment.

This is a sample of the questions we asked:

- Have you had to tap into emergency funds as a result of the Coronavirus pandemic?

- How did you get the money to stock up on essentials for the Coronavirus pandemic?

- How has caring for others affected your ability to earn a living?

- Overall, do you think the Coronavirus will adversely affect the financial well-being of your family?

- How confident are you that you and your household will recover from the adverse financial effects of the pandemic?

- What is the single most important reason that your business income has increased?

- What is the single most important reason that your business income has decreased?

- Do you have funds on hand to continue your business or production operations if revenue fell by half or more?

Preliminary findings

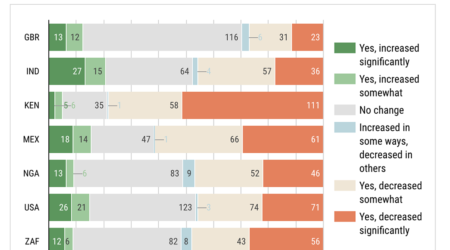

Low-income populations in our focus countries are already experiencing a decrease in income. More then half of respondents in Kenya report a “significant” or “very significant” decrease. Those whose incomes have increased are servicing crucial sectors such as healthcare and delivery of food and other household necessities. Incomes are only increasing for a small minority of respondents, fewer than one in five respondents across the whole survey. Households are using a mix of different financial instruments, including digital lending and mobile money, to meet their specific needs.

Quarantine measures are causing collateral damage. Respondents in our survey because people cannot go out to work. They voice this concern, not as a layoff or a lost job, but that their economic activities are interrupted nonetheless. In our lower-middle income bracket, the decline in demand (“business is down”) is also hurting incomes.

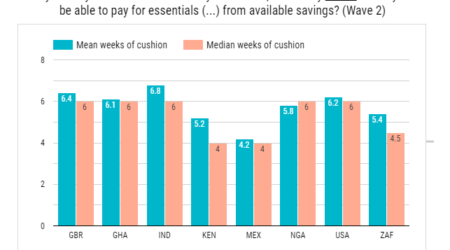

Emergency funds have already been tapped at this early stage of the crisis. Respondents in some countries are more likely than others to have funds set aside for emergencies, notably some three-quarters of Indian respondents report having some savings for emergencies. Yet the same proportion already reports they have begun to draw on those savings, and half of those who have not report that they will soon need to do so.

Next steps

These surveys are guiding our work to address the crisis proactively. As the crisis unfolds, we are supporting decision-makers and innovators who are working to mitigate the costs of the pandemic. These surveys inform our work financial health, innovation, livelihoods, and the digital economy. We will produce in-depth analyses for our focus countries periodically over the coming weeks and months. Our research team is preparing future waves of the survey that can track trends over time in certain key indicators, while also allowing us to drill down into issues with the greatest relevance for policy.

Methodology

This survey was completed between March 25, 2020, and March 27, 2020. We obtained a random sample from the SurveyMonkey Audience panel. The sample included seven countries and two household income brackets per country. We targeted low-income and lower-middle-income respondents, balanced for age and gender in line with national estimates. In Nigeria, targeting was based on education rather than age and income because of availability. We accepted only respondents with secondary education or less in Nigeria, which is correlated with income but not as well as we would have liked. In Mexico and Kenya, age balance was not available for the lowest-income bracket, so only the lower-middle-income bracket was balanced for age. SurveyMonkey Audience recruits participants by making small charitable donations on behalf of the respondent, rather than paying them directly for their time. Respondents receive invitations to participate by email and then complete surveys in a web browser. This tells us that they are already over the digital divide to some extent, and possibly not typical of national low-income populations. The upper limit of household income in the lowest bracket was (by country) INR150,000 per annum for India, ZAR1,400 per month for South Africa, KSH12,000 per month in Kenya, MXN3,750 per month in Mexico, USD 25 000 per annum in the United States, and GBP10,000 per annum in the United Kingdom.

Finally, we would like to thank our colleagues at MetLife Foundation for all their support towards our global work in financial health. Any opinions expressed here are solely BFA Global’s and do not express the views or opinions of others.