How Financial Health Is Transforming BFA Global’s Work in 2020

Genesis of Financial Health as a Concept

Financial health (FH) has become a core topic in the financial inclusion industry, and at BFA Global we believe it represents a lasting and meaningful change in how the industry sees itself affecting change. Financial health is both an organizing principle and a measurement framework for inclusive growth that goes beyond financial access for its own sake. Our work has always revolved around the “triple whammy” of low, unpredictable, and volatile income for the poor, particularly in low-income and middle-income countries.(1) Financial inclusion, as a policy and an industry, was meant to provide better services to people on the outskirts of the financial system, as compared to the patchwork of services they already use out of necessity: borrowing from informal moneylenders, joining savings clubs, buying necessities with store credit, holding assets that can be pawned or sold when money is tight, locking Christmas money away in a piggy bank, and even calling in debts from friends and family. (2) Financial health, as we see it, provides a coherent way to assess whether inclusion is delivering on that promise.

The financial services industry has championed various approaches to making the financial sector more inclusive. The first decade of this century belonged to microfinance, culminating in the UN declaring 2005 to be the Year of Microcredit, and the 2006 Nobel Prize for Peace going to Grameen Bank founder Dr. Muhammad Yunus. As alternative delivery channels emerged and mobile technology became ubiquitous, the focus shifted to financial inclusion, and associated efforts to extend savings, credit, insurance and payments solutions to the last mile. Between 2011 and 2017, 1.2 billion adults obtained an account offering such financial services, resulting in 69% coverage.

While the problem of access is by no means solved – 1.7 billion adults were still unbanked in 2017, and the gender gap was 9% – these rapid gains provide the context to explore how financial inclusion is empowering people to gain control over their financial lives, and make a meaningful dent in alleviating poverty. After all, we know that finance is merely a means and not an end, with the end being a higher standard of living, as defined by better food, health, education, or housing. It was in this backdrop that the concept of financial health was developed, providing a conceptual pitstop between access to appropriate financial services, and all the finer things in life those services were expected to afford.

Our Understanding of Financial Health

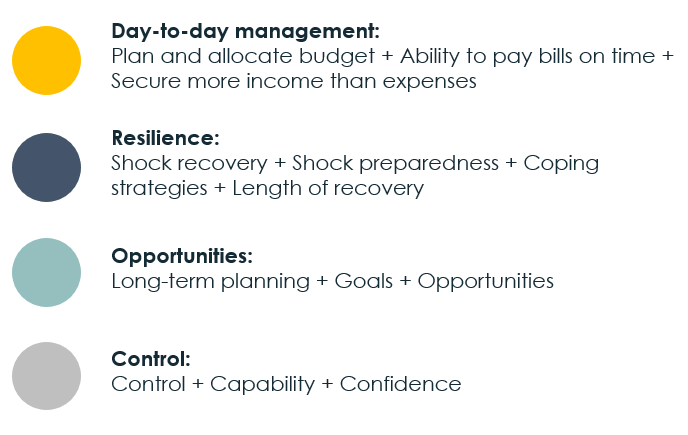

We consider a product or service as furthering the financial health of an individual if there is some combination of interlocking benefits along these four dimensions:

- Day-to-day management. Allows for the alignment of expected incomes and expenses.

- Resilience. Helps build a meaningful lump-sum as a hedge against shocks.

- Opportunities. Allows for the building of a meaningful lump-sum to take advantage of investment opportunities or pay for significant planned expenses.

- Control. Allows an individual to retain control while interacting with financial service providers.

The first three dimensions should come as no surprise – they are at the core of financial product design for the mass market, and have been the mainstay of seminal findings by Joanna Ledgerwood, Stuart Rutherford, Daryl Collins and other luminaries in the field.

We deliberately include the notion of “control” as the fourth dimension. We believe that the best way to make financial markets work for everyone is not to be prescriptive about supply-side interventions, but to offer one the widest possible suite of choices – along with the information necessary to make the choice that is most appropriate for them. Agency to make that choice is therefore key, as per the notion of “development as freedom” à la Amartya Sen. (3)

Each of these four dimensions have sub-topics (shown in Figure 1) requiring additional exploration; we defer that discussion to for another time.

Figure 1. Four dimensions of financial health, with sub-topics

Much of our thinking has benefitted from the pioneering work conducted by, and conversations with industry thought leaders such as the Financial Health Network, Innovations for Poverty Action, Center for Financial Inclusion at Accion, Metlife Foundation, FSD Kenya, Consumer Financial Protection Bureau, and Gallup.

The Plan for 2020

Our focus on the benefits of using financial health as a lens comes from learnings from our projects across various geographies. Financial health has already been implemented as the assessment framework in the four-year OPTIX program (2015-2018). The project spanned four institutions across Bangladesh, Colombia, Mexico and Vietnam through 20 pathways (or interventions). OPTIX demonstrated improvement in participants’ wellbeing using the financial health framework. At scale, the programs reached 1.1 million customers, which included 800,000 active savers. Six financial tools were designed specifically to improve customers’ financial health. The Financial Advisory Services app is one such tool, which transformed the pitch for a term deposit account from one based on the draw of passive income on a lump-sum of money to one that mapped the amount and term to life goals, thereby making it more sticky.

We have developed solutions for financial services providers that synthesize multiple sources of data into insights about financial health. In-depth household interviews and financial diaries have long been the most valuable tools for understanding consumer wellbeing, but exciting new approaches are under development. We have developed analytics that characterize consumer behavior from banks’ internal data systems, using machine learning algorithms developed by our data scientists. These algorithms can synthesize patterns of behavior into meaningful insights about what customers do and what they might need.

We are currently developing software to expand financial providers’ access to those analytics, which will enhance their ability to make beneficial recommendations to customers. Imagine if the bank’s software could reframe customers’ savings balances as a “preparation for an economic shock,” as easily as it is used today to measure the bank’s capital adequacy or the depositor’s collateral for a loan. Our analytics support a customer-oriented perspective, rather than growth for its own sake.

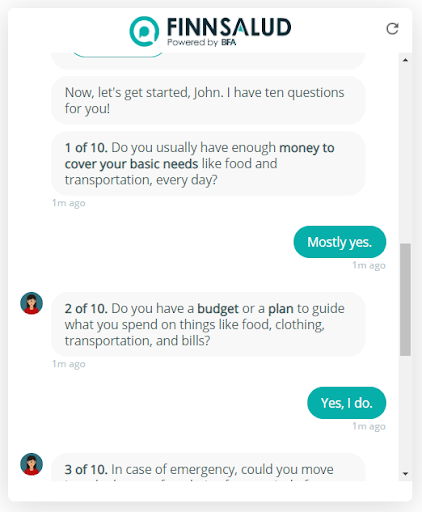

Figure 2. Frida the Financial Health Chatbot, deployed in Spanish and English in Mexico

Chatbots are another mechanism for collecting data, allowing for rapid assessment of financial health with low overhead (screenshot in Figure 2). These require some amount of setup, as the script has to be conversational enough to be engaging, and carefully tailored to the local context. In Kenya, we would want to ask about membership in chamas, while in Mexico, asking if individuals in distress could move in with a relative may be more appropriate. The responses are analyzed to provide the user with information relevant to their FH, and collated to draw inferences about a population of interest. Such bots require one to give up on some of the rigor that in-depth interviews afford us, but we have found the data to be sufficiently insightful to accept that tradeoff.

We will continue to implement financial health-related interventions across multiple projects this year to explore this topic across a range of themes. These include:

- How to best align customer priorities related to financial health with providers’ bottom-line considerations, thereby testing possible business cases for financial health (Mexico)

- How financial health can complement existing assessment tools that focus on poverty alleviation, and provide microfinance institutions (MFIs) a framework to track customer-centricity of financial products and services (Vietnam)

- How inclusive fintechs can achieve tighter product-market fit by focusing on their target segment’s financial health (India, Kenya, Mexico, Nigeria and South Africa)

- How workers in the emerging gig economy could benefit if superplatforms focus on their financial health (China)

Three of these projects are funded by the Metlife Foundation, and the fourth is jointly funded by the Foreign, Commonwealth and Development Office and JPMorgan Chase & Co.

We look forward to sharing our experiences as we implement these projects, and the lessons we learn along the way. Stay tuned!

References

1. Collins, D., Morduch, J., Rutherford, S., & Ruthven, O. (2009). Portfolios of the poor: How the world’s poor live on $2 a day. Princeton: Princeton University Press.

2.Rutherford, S. (2001). The Poor and Their Money. Oxford: Oxford University Press.

3. Sen, A. (2011). Development as Freedom. New York: Anchor Books.

Ashirul Amin, PhD is Managing Principal Consultant and Ben Mazzotta, PhD is Senior Social Science Researcher at BFA Global. They are responsible for leading the development and implementation of financial health initiatives across all projects at the firm.