Taking the COVID-19 temperature in emerging markets: A dipstick survey to draw early insights about impact on Livelihoods

It has now been 19 days since the WHO declared the COVID-19 crisis a pandemic on March 11. We publish this blog as several of the largest economies in the world are in the acceleration phase of the global epidemic. Many of us have now been sequestered in our homes for almost two weeks, while some countries are barely at the start of sheltering-in for the next weeks or months.

As the US stock market plummeted wiping out US$12 trillion in global market value, African stocks slid even further, losing more than 40% of their value, and global supply chains came to a standstill, we at BFA Global are asking what the direct impact is to the livelihoods of vulnerable populations during the pandemic. As a research and product innovation advisory firm for low-income people, one way we contribute is to generate data and insights to inform the best course of action for policymakers and the private and philanthropic sectors. With the virtual tools available to provide an immediate response, we provide an early, exploratory look into what is happening to livelihoods in emerging markets since the public health saga erupted and the economic crisis began to rapidly unfold.

Through an agile, rapid dipstick survey we concluded on March 27th (methodology described below), we share three early findings based on 1,521 respondents from Kenya, Nigeria, South Africa, Mexico, India, UK, and US, with the latter two countries for comparison with developed economies. Our objective is directional at this time, to surface focus areas that demonstrate the value of deeper exploration and that lend themselves to more rigorous analysis. Detailed analysis based on this survey can be found at the COVID-19 and Your Finances – BFA Global Worldwide Survey dashboard.

1. There is already a negative impact to income

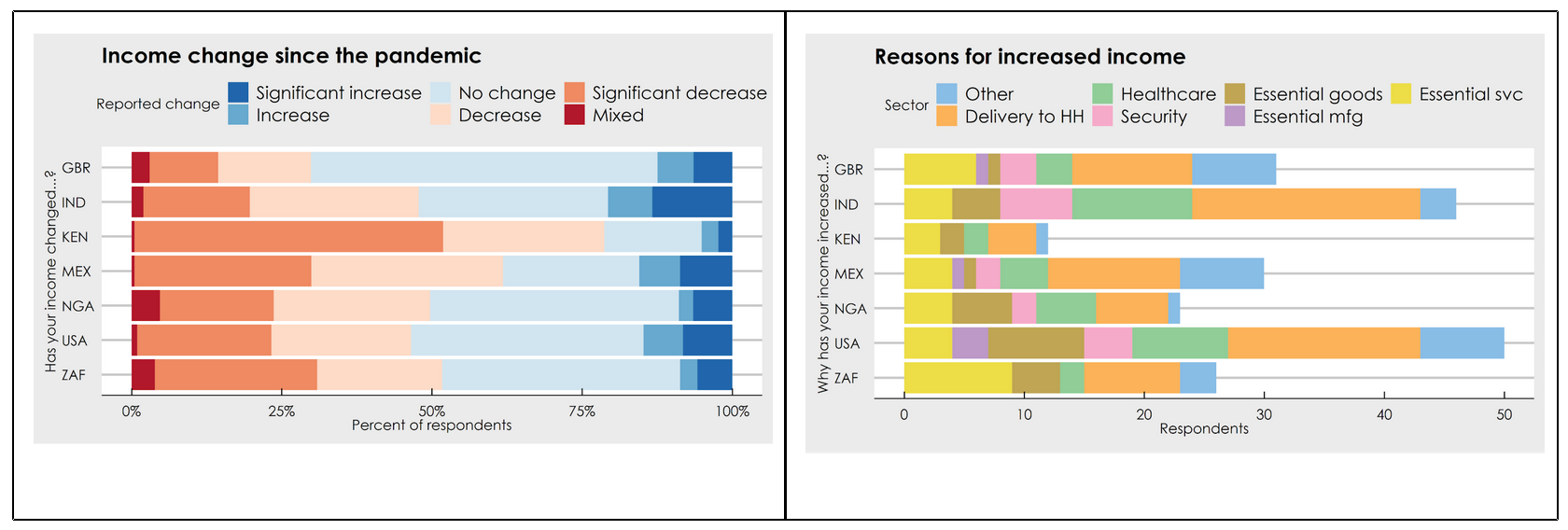

Low-income and lower-middle-income families are experiencing a decrease in income, and much more of a significant decrease in Kenya, Mexico, and South Africa. Twenty-six percent of respondents stopped working altogether and another 21% significantly reduced their earnings. Primary caregivers reported the highest rates of stopping work at 32%. In other markets such as the UK, US, and Nigeria, respondents’ incomes were less affected. For a smaller group of respondents as in India, US and Mexico, incomes have actually increased for 12% of respondents, though experiences vary dramatically across countries. In India, 12% report significant increases in income, versus just 2% in Kenya. The increase in incomes is partly attributable to higher demand for delivery to households or providing essential goods and services as would be expected under lock-down measures, as well as work in the healthcare sector.

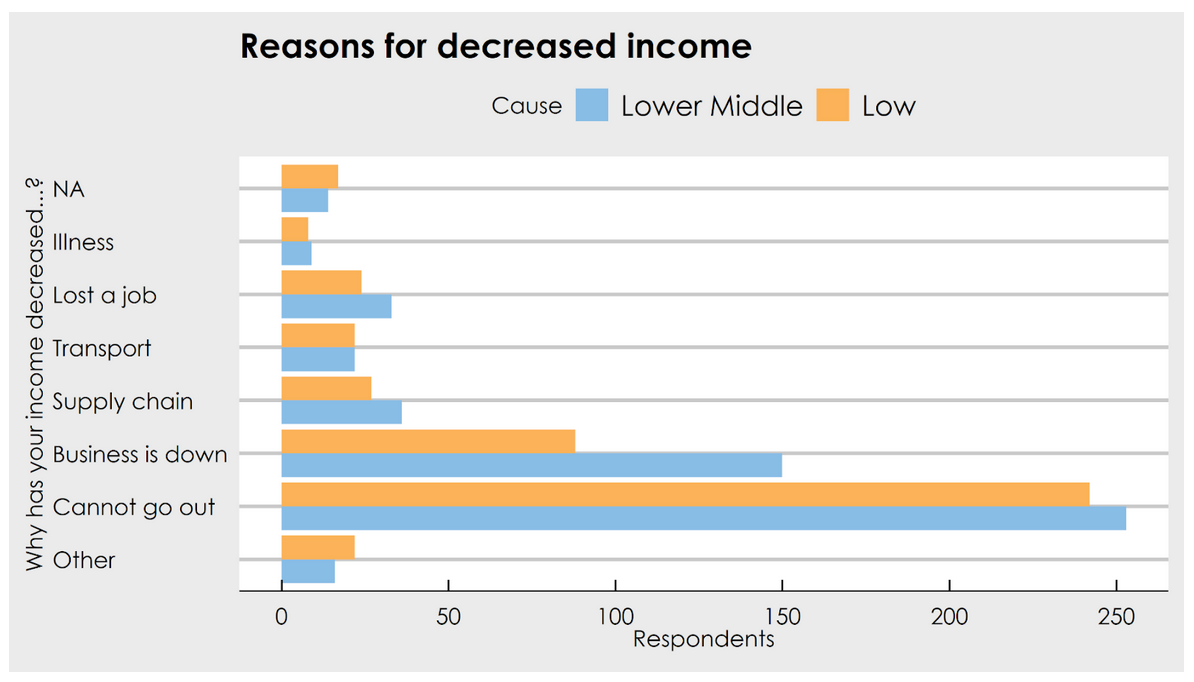

Worldwide, low-income and lower-middle-income workers are especially hard hit by social and physical distancing measures. The inability to go out to work is a global challenge for earning income, indicating the predominant in-person nature of work for this segment of the world population.

The downturn of business activity is also more acutely affecting lower-middle-income workers, who may be business owners or employed in formal enterprises, compared to low-income workers who are more likely to be in the informal sector. Business is down not because of logistics or supply chain issues, but because of weak demand. Significant disruptions have occurred for over half of businesses in Kenya and India – 33% of self-employed respondents have already closed businesses compared to the global average of about 25%. However, one surprising finding was attitudinal. Confidence remained high among the self-employed that they would recover partially or completely (66%) except for in the UK, where more than 25% said they did not know whether their business would recover from the shock.

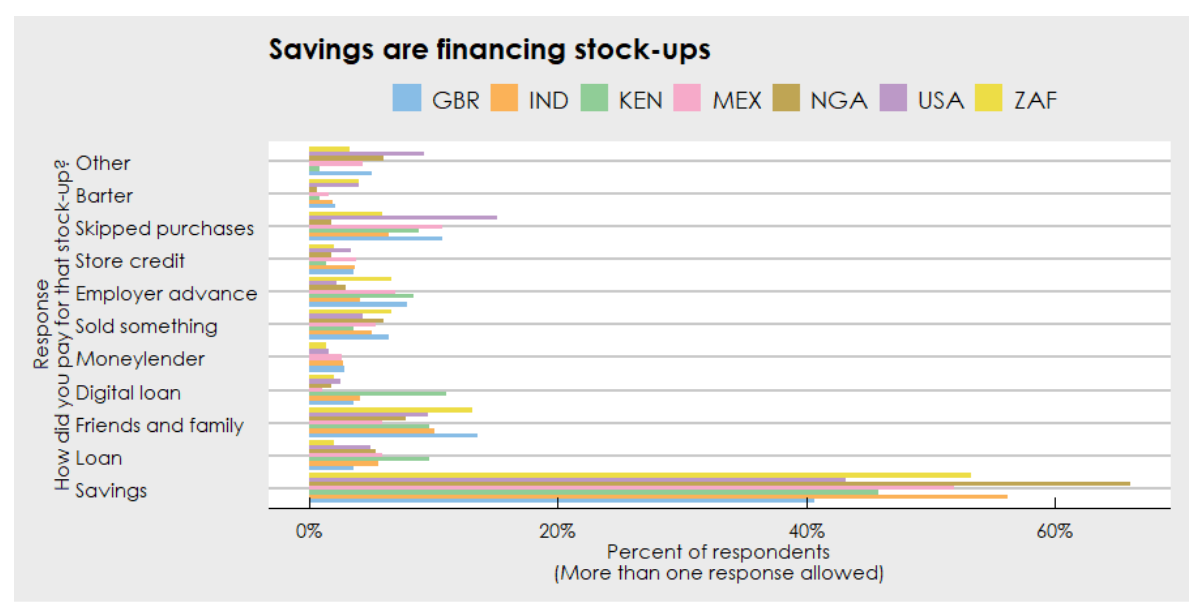

2. Savings are the main coping mechanism

In particular, we consistently see that households are drawing from savings to cope with their immediate expenses to stock up in preparation for uncertainty due to the pandemic. From our data, we saw that respondents’ stocks would last a week or more, for around 75% of respondents in all markets.

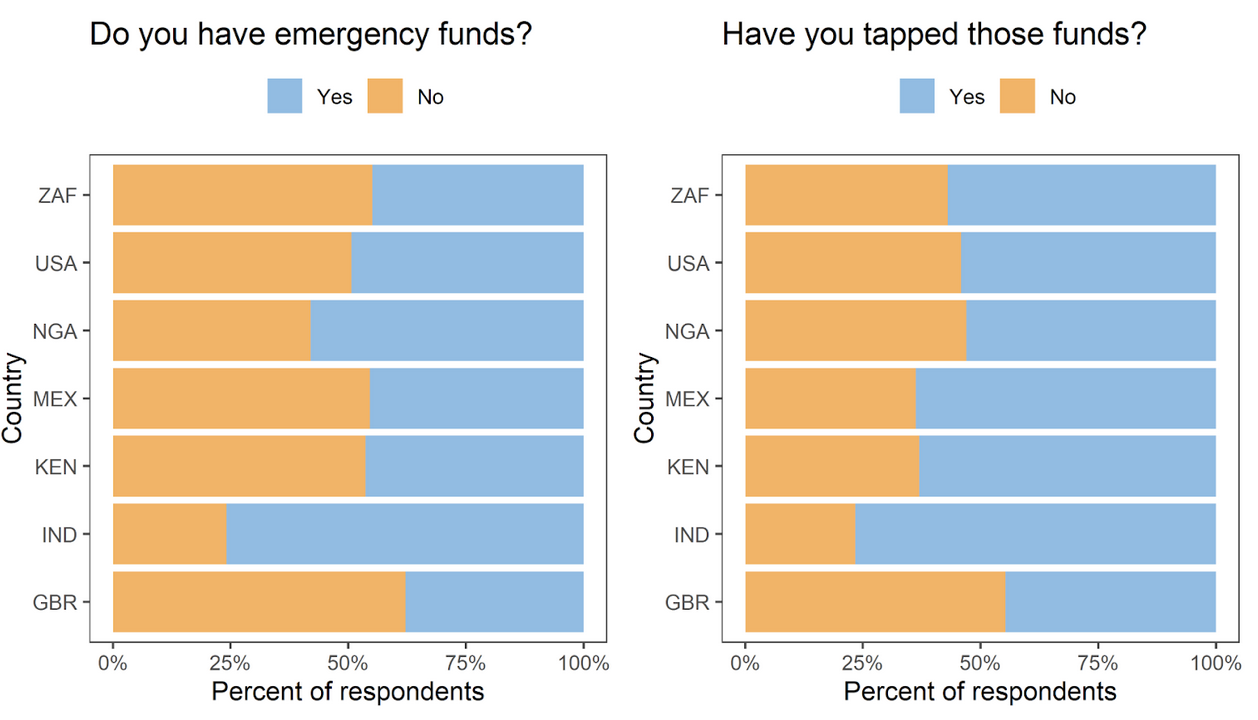

Indians, at 75%, were the most likely to have emergency funds compared to other respondents, and 75% of them had already dipped into their emergency funds. This data was collected the day after the prime minister made the announcement enforcing nationwide total lockdown to stay at home for the next 21 days.

3. Fragile reserves on hand to keep coping

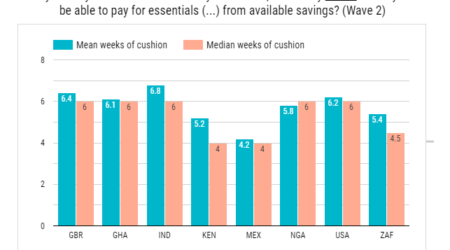

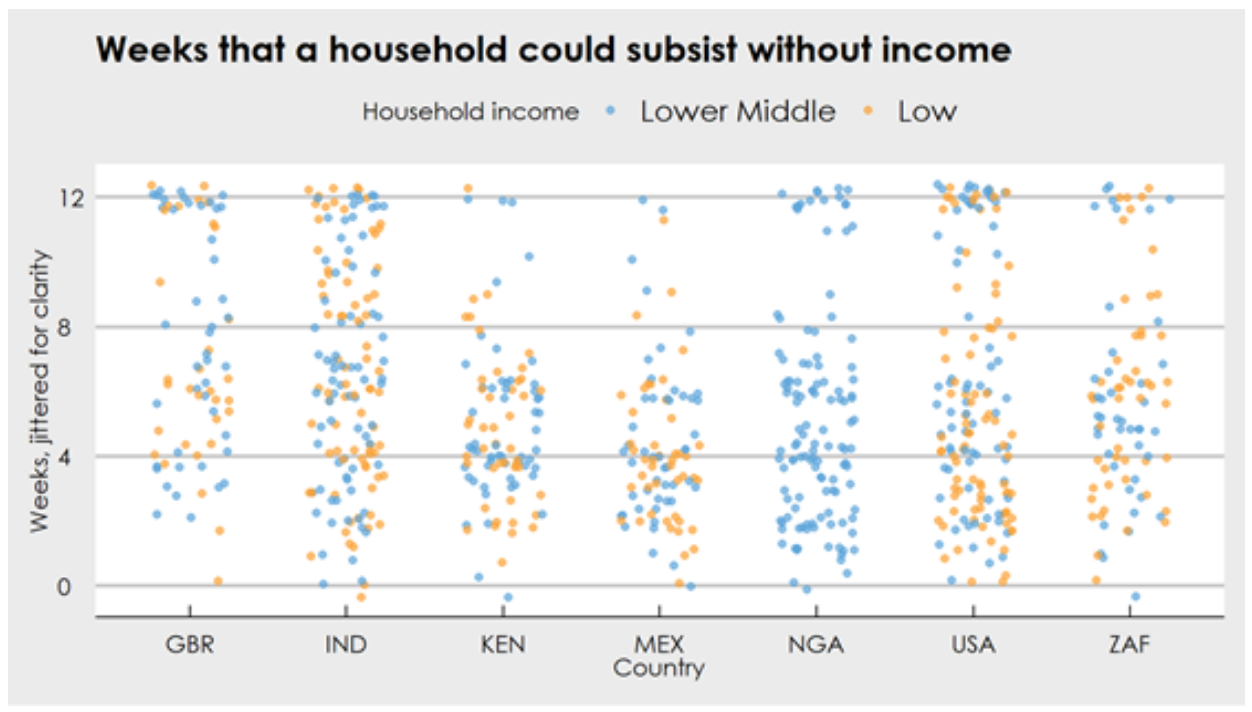

Households could subsist between four to eight weeks without income. Financial health characteristics such as having savings to cope against shocks demonstrate how vulnerable these households are. Mexicans are among the most vulnerable with an average of four weeks of reserves, and the British are the least vulnerable with almost eight weeks of funds on hand. A significant minority in several countries, including the United States, has far less than one month of funds on hand and will need to borrow to make ends meet. The pandemic measures may exceed two months in some instances. China took nearly three months to begin relaxing the most stringent measures of its stay-at-home policy.

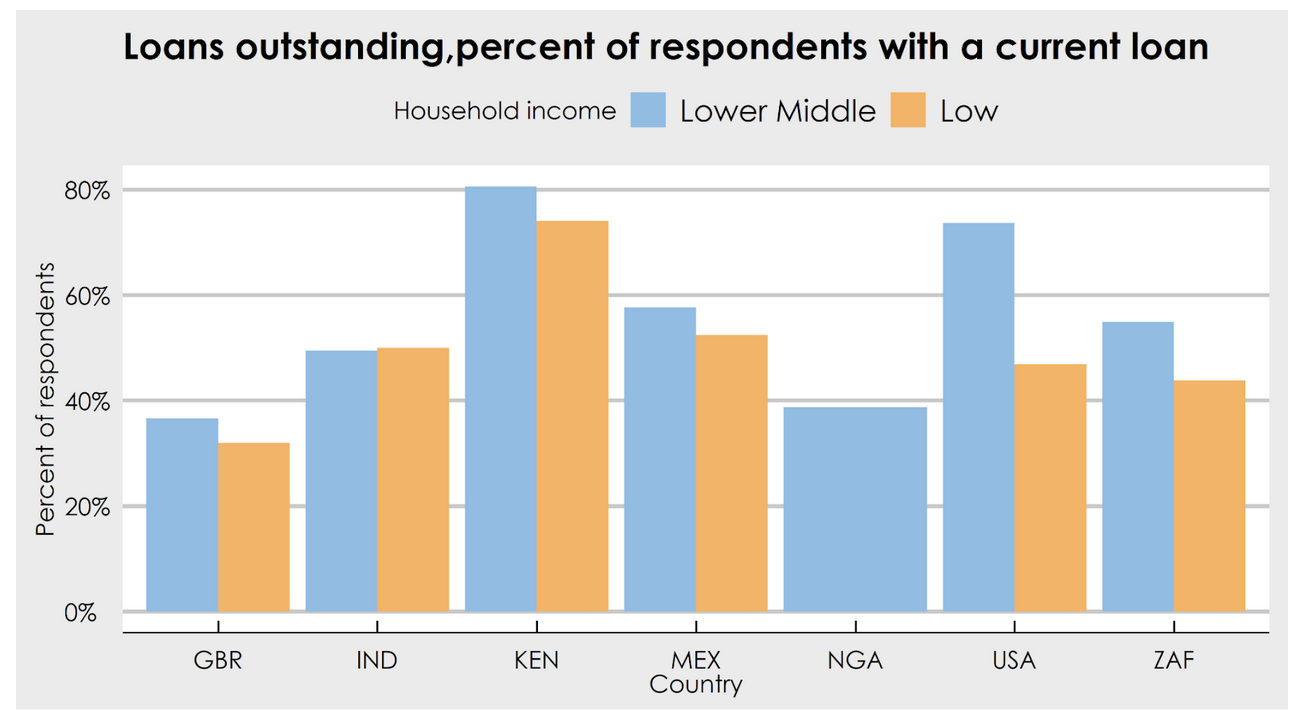

Without income-generating work, these respondents would quickly find themselves unable to cover household needs in the short-term, let alone pay back existing debt. Late repayments are also forecasted to rise significantly this year in all markets. Respondents in Kenya, followed by Mexico and India, stand out as the highest groups of debt holders in both the low- and lower-middle-income categories as do the lower-middle-income respondents in the US and South Africa.

Implications for policy and funding

BFA Global has already seen that timely survey results can have power when policymakers are struggling to find the right answers. We are currently supporting the China Academy of Financial Inclusion (CAFI) in a project to improve the financial health of app delivery workers. The results of their first survey, which took place at the height of the crisis in China and showed that most microenterprises were facing funding challenges, were picked up by the press and have attracted queries from government and policymakers. On Tuesday, March 31st, we are hosting a webinar to present CAFI’s research and additional insights about BFA Global’s ongoing survey about the impact of the COVID-19 pandemic.

This research shows that even in countries where the pandemic is in the early stages, the economic effects are widespread and substantial. While these are not fully digested recommendations, it does make us start to think about whether governments and funders could consider interventions aimed at ensuring:

- That households have money to be able to buy food through the duration of the social distancing requirements, starting immediately. Households are already drawing down on their savings, foregoing purchases and starting to pull down on their credit limits. Digital distribution of money and food vouchers is absolutely critical in many countries where low-income people do not shop in supermarkets but instead buy food and household goods at their local corner stores.

- That the most vulnerable populations are getting the aid they need. For example, if we are able to determine that particular groups, such as women or youths are draining their savings or losing their incomes faster than others, then governments, donors, and financial institutions can also more specifically target women or youths to offset their losses, such as individual government transfers rather than household-level support.

- That financial institutions are able to serve customers through the crisis and to be on hand to prime the pump to get the economy going again in the recovery period. It may be hard to restart the economy if customers don’t have ready cash, and sellers and providers can’t re-stock. Banks need to be in a position to weather the inevitable increase in non-performing loans, and then start lending again to get the economy going.

- That governments provide the right monetary and fiscal policies that most directly impact low-income workers and businesses and support them in the eventual recovery phase.

Methodology

This survey was completed between March 25, 2020, and March 27, 2020. The survey questions are built on BFA Global’s financial health framework will soon be provided as an open-source resource in English and Spanish. We encourage other researchers to use these questions to standardize results and increase sharing.

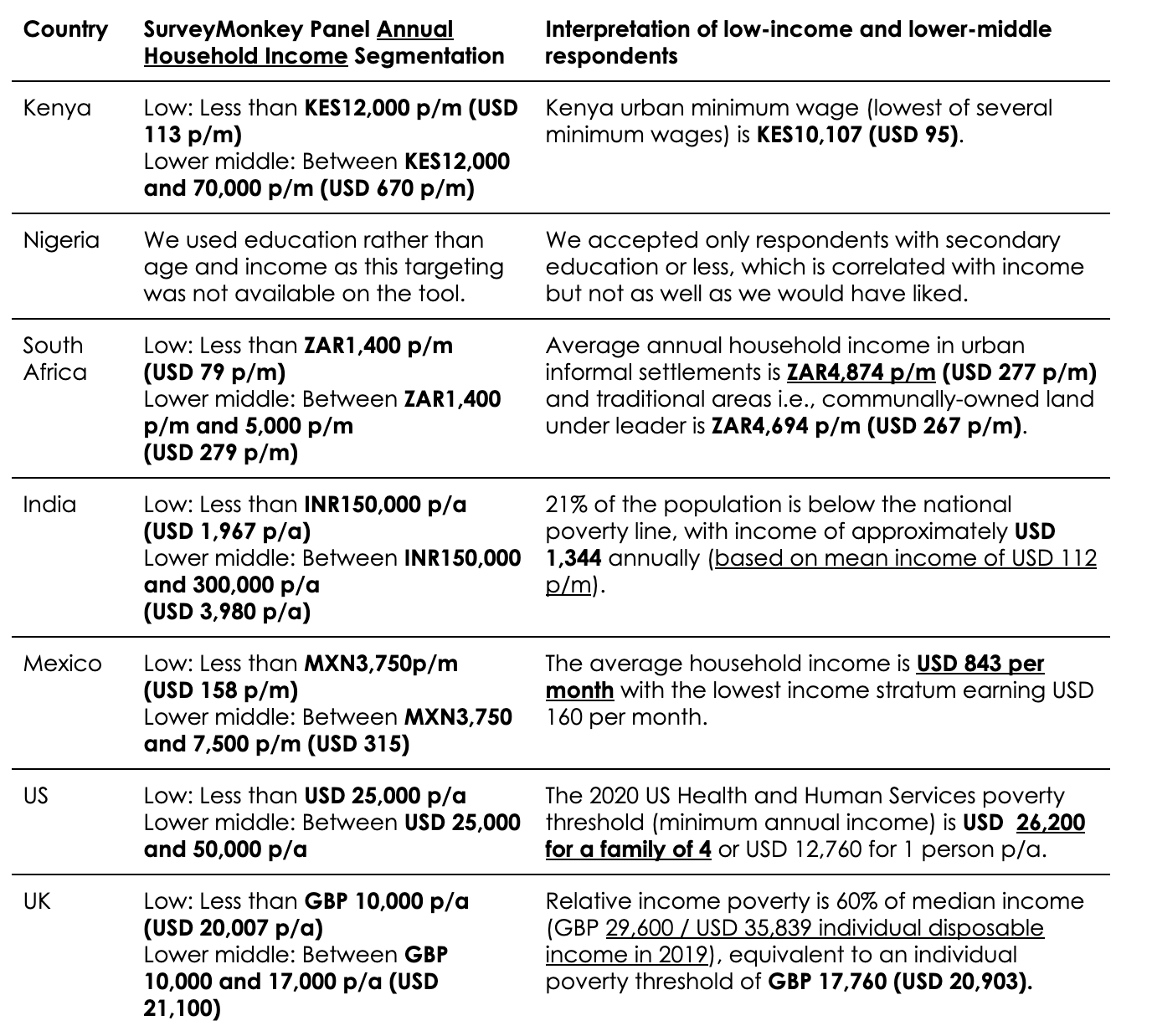

We used SurveyMonkey’s Audience tool, which covers over 100 countries allowing for wider geographic coverage and comparative insights through a recruited panel of respondents rather than a random sample from a national population. Therefore, inference is limited to the respondents in our survey sample and not representative of the population.

The random sample included seven countries and two household income brackets per country where possible. We targeted low-income and lower-middle-income respondents, balanced for age and gender in line with national estimates. Age balancing was not available for Mexico and Kenya for the lowest-income bracket, so only the lower-middle-income bracket was balanced for age. The panel allows income segmentation for which we could assemble a panel of low-income respondents that are represented through the tool’s characterization of income.

SurveyMonkey Audience recruits participants by making small charitable donations on behalf of the respondent, rather than paying them directly for their time. Respondents receive invitations to participate by email and then complete surveys in a web browser. This tells us that they are already over the digital divide to some extent, and possibly not typical of national low-income populations. However, we still found that the lowest-income segments available through the tool would fit our definition of low-income respondents (see income segmentation table below).

Way forward

These three findings are just some of the immediately evident top-level, cross-country insights we see coming out of our initial data analysis that we are conducting as this blog gets published. By going deeper into the data and deeper into each country’s experience, we hope to identify and share more findings about how households, workers and businesses are dealing with the crisis, managing their finances, how financially healthy they are, and what the impact to micro and small business is. Read about Mexico (in Spanish) in the first country-level post from our survey series.

In addition to conducting the rapid dipstick survey, our intention is to follow up with a more robust telephone survey, which would be more representative of the national population. As the situation is now, there may be limited capacity to deploy a telephone survey if the countries are under lockdown because their call centers will be closed – we have already encountered this in Kenya, for example. Covering largely the same ground as the rapid dipstick survey, the telephone survey would be prepared in more depth to validate the survey questions and approach.

Each day, as we look at the global leaderboard, just hoping that widespread lock-down measures have decelerated the contagion in our cities and towns, just hoping that we will start to see the curves flattening out, it is imperative to get as fresh information as possible to capture the reality on the ground. It does not cease to be startling how quickly the pandemic unfolds or how drastically measures are put into place, resulting in very different lives and economies from one day to the next. With this agile approach, we hope we are able to better focus our collective efforts and ensure low-income populations are supported enough, and that we are swift in mitigating against the negative impact of the crisis. Below are three suggested next steps for you:

- Follow our insights from the ongoing dipstick survey by visiting our COVID-19 survey page and read about our Mexico analysis (in Spanish).

- Visit the BFA Global public dashboard “COVID-19 and Your Finances – BFA Global Worldwide Survey.”

- Contact us to support our efforts in building an evidence base and generating insights to improve our chances for meaningful and lasting interventions in this critical moment.

Finally, we would like to thank our colleagues at MetLife Foundation for all their support towards our global work in financial health. Any opinions expressed here are solely BFA Global’s and do not express the views or opinions of others.