Financial Inclusion on Business Runways (FIBR)

Year Started:

2016

Year Ended:

2019

Key Partners/Clients:

Mastercard Foundation

Area of Work:

Digital Financial Services, Inclusive Fintech, Livelihoods and Microenterprise, PAYGo and Essential Services

Countries:

Tanzania, Kenya, Ghana, Uganda

The Financial Inclusion on Business Runways (FIBR) Project, a partnership between BFA Global and Mastercard Foundation in Africa, was created with the vision to digitize the informal economy through micro and small enterprises (MSEs) using smartphones. The new data could then enable access to essential financial services such as credit, loans, savings and insurance for underserved populations by partnering with financial institutions.

By harnessing MSEs, FIBR aimed to identify the advantages and experiences of new partnerships between fintech companies and traditional banks (linkages). Against the promise of increasing smartphone penetration, decreasing cost of data, and widespread mobile money adoption, our hypothesis championed accelerating digitization to overcome the MSE finance gap. We learned that creating incentives for financial linkages were much more complicated and limited in achievement. At the same time, the rise of platforms and global focus on SDGs were changing the panorama in which FIBR viewed impact.

By reframing digital and financial inclusion through platforms, FIBR developed two fundamental insights that are relevant to financial inclusion and livelihoods:

FIBR developed an extensive body of research and insights in PAYGo solar and water as they related to digital and financial inclusion, particularly in digital transformation and payment flexibility. Two main takeaways include:

1. Customers value payment flexibility. Offering flexible financing implies turning rigid payment structures into ones that match income, is tied to tangible assets, is bundled with customer benefits, and gives customers more control.

2. PAYGo companies have shown that payment flexibility can be done successfully, but also require strong operational knowhow, business alignment, trust with customers, and extensive training to educate field staff and customers. Machine learning can be particularly effective at predictive repayment behaviors for which more tailored churn interventions can be created at the optimal servicing cost threshold.

FIBR was employed as an R&D project, designed to build demonstration cases. It was not intended to reach scale but rather to test and explore pathways to scale in the next generation. As the program concluded, FIBR solutions reached over 6,000 individuals, with over 70% represented by micro and small enterprises, and young adults, ultimately disbursing over 6,000 loans through FIBR-designed solutions valued at over US$345,000.

FIBR was managed by BFA with the support of Mastercard Foundation. The program launched in Accra, Ghana on February 25, 2016 and concluded in December 31st, 2019.

The Gig is Up is a three-part podcast series discussing the global gig economy covering everything from the disruption...

With knowledge comes power. Artificial intelligence (AI) is a powerful way to harness data into knowledge and into action....

This second report by CGAP and FIBR seeks to understand the value that customers derived from PAYGo solar and...

This white paper considers the likely effects of an important new phenomenon that may accelerate the “pull” factor of digital...

To “ensure availability and sustainable management of water and sanitation for all (SDG 6),” water service providers need to...

How do you design and pilot a credit solution for small merchants? This new case study from FIBR shares...

This briefing note examines four key industry challenges from a financial inclusion perspective that serve as the foundation for...

Agent networks are a backbone for the delivery of financial services. While the report refers specifically to the management...

Originally posted on the World Economic Forum website, February 19, 2019 Around the world, the new technologies behind digital...

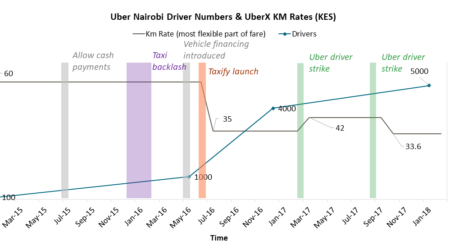

Are Reputational Ratings Favorable for Drivers? As platform-mediated livelihoods grow around the world, many are contemplating how to ensure...

How can digital and financial inclusion at the last mile, change lives and improve livelihoods? The Financial Inclusion on...

How can digital and financial inclusion at the last mile, change lives and improve livelihoods? The Financial Inclusion on...

How can digital and financial inclusion at the last mile, change lives and improve livelihoods? The Financial Inclusion on...

Small merchants need to create and maintain trust with customers to sell online, but they could use more help...

Superplatforms & Small Merchants Series #2 Meet Agnes, Moses, & Anita Traditional, “informal” retailers dominate the commercial landscape in...

Tips for Communicating with and Helping Agents Through a Messaging Service Agents serve as the face of PAYGo and...

Micro-consulting to Provide MSMEs with Practical Advice Micro and small retailers (referred to as small merchants here) play a...

Understanding the Financial Health of Small Shops in Africa Juma*, a small shop owner in Nairobi’s Kibera slum, is...

MSMEs Have Different Financing Needs in Four Discrete Stages Small shops or “dukas” account for 80 percent of employment...

Certain Behaviors Can Help Providers Unmask a Business’ Readiness for Financing We previously explored the life cycle of a...

Running a Small Shop is a Tough Job When I was growing up, the corner store was a convenient...

An Immersive Experience with Informal Retailers in Africa Produced and Developed by: Abi Steinberg, Videographer and Director: Adam Wisema...

The Rise of a New Asset Class Alternative lenders in East Africa are connecting underbanked consumers with affordable, asset-backed...

A Prepayment Model to Achieve the Sustainable Development Goal of Providing Water as Household-Level Service You’ve probably heard about...

There has been a lot of work exploring why some pay-as-you-go (PAYGo) solar customers stop paying after they are...

Just five years ago new entrants to the PAYGo market had to be vertically integrated: under one roof, they...

Technology-enabled pay-as-you-go (PAYGo) has unlocked millions of loans in the off-grid solar sector, and the model is already being...

Pay-as-you-go (PAYGo or PAYG) is emerging as a solution that addresses both end-customer affordability and provides sufficient margins...

Co-written by Elizabeth Davidson If you are one of the 73 percent of Ugandans who is not connected to...

Digitization Helped PEG Africa Increase Efficiency, Data Visibility and Agent Satisfaction Digitizing operations for PAYGo 2.0 providers seems like...

In just eight years over three million PAYGo solar systems have been sold, and over $1B has been...

The Case for AI for Financial Services in Africa Artificial Intelligence to Augment Ability A PAYGo provider no longer...

Hype. Dangerous. Automation. Elon Musk. Uncontrollable. This is what usually comes to mind when people think of artificial intelligence...

Customer churn is a major headache for most companies and threatens to put the brakes on the red-hot growth...

Last summer, we published a post that described how ZOLA Electric uses Machine Learning (ML) to predict which of...

Four Lessons for Training Computer Vision Models Artificial Intelligence (AI) technologies offer many opportunities to augment and extend business...

The FIBR (Financial Inclusion on Business Runways) project is an action research project of BFA Global (in partnership with...

Digital products and channels are generating exponentially more data each day. Enhancing user research with data analysis has become...

During the past years, the U.S., the UK and China have seen an explosion of what has come to...

In this case study, we examine an alternative lending platform that connects impact and institutional debt investors with alternative...

This briefing note examines four key industry challenges from a financial inclusion perspective that serve as the foundation for...